Times are tough for businesses in the UK at the moment. The high inflation environment continues to increase costs, and is also impacting company revenues as consumers have less disposable income to spend. Plus, increasing interest rates mean that borrowing costs have increased dramatically following a period of historically low levels.

In 2020 we analysed how a possible wave of post-Covid insolvencies could impact the PPF. Thankfully, across 2021 and 2022 this turned out to be much less severe than we predicted, but it is now clear that the continuing challenges in the economy are creating tipping points for many companies.

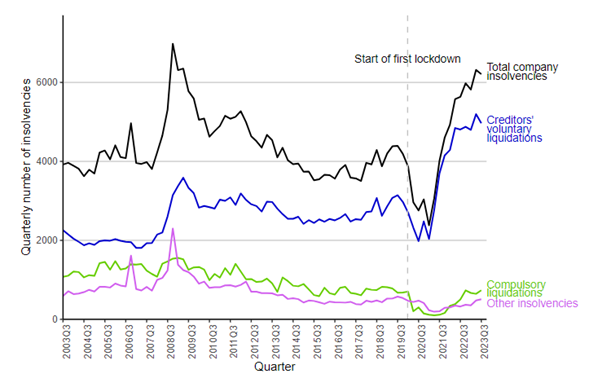

There has been a lot in the media on this over the last few weeks. Last week, latest figures from the Insolvency Service made lead news on the BBC. The figures highlighted that it’s predicted that the number of companies going bust this year could reach levels not seen since 2009 in the aftermath of the global financial crisis.

Source: Commentary - Company Insolvency Statistics July to September 2023 - GOV.UK (www.gov.uk)

On 2 November 2023 the Bank of England’s Monetary Policy committee decided to maintain UK base rates at 5.25%, but this remains at historically high levels (in recent memory anyway!) and many financial commentators are expecting interest rates to remain “higher-for-longer”. This means that the prospect of cheap debt returning anytime soon to provide companies with any respite appears unlikely.

In our covenant work for pension schemes we have seen these macroeconomic impacts bear out in practice on a growing number of organisations, in particular those sponsors that just about managed during the Covid period, perhaps taking on lots of debt at rock bottom rates and then hoping that better days were coming.

Although every situation is different, and in some unfortunate cases insolvency will be inevitable, the more time that trustees have to make contingency plans the better the potential outcomes for scheme members. We’ve set out below our 3 practical steps which give schemes the best prospects of protecting themselves through these difficult times.

Governance

Information is key and it is really important for trustees to have transparency and strong lines of communication with sponsors regarding financial data and upcoming events. Documenting what information trustees will receive from sponsors, and when it will be provided, within formal Information Sharing Protocols will help to get everyone on the same page.

Monitoring

The trustees and their covenant advisers should use the information they receive to understand when pinch-points could occur which may impact upon their position, for example when cash flow forecasts project minimum headroom on borrowing facilities or when borrowing facilities are due to be renewed. By considering the timeline of possible events in tandem with planned milestones on a scheme’s journey plan and / or trustee leverage points (eg powers under a scheme’s trust deed and rules, any contingent mechanisms that may have previously been agreed), strategies can be formulated to put the trustees in the strongest possible negotiating positions.

Early engagement

Whilst being aware that businesses in distress will need to manage multiple stakeholder interests, trustees need to be proactive in raising their concerns with sponsors and how they propose that the scheme is protected, otherwise pensioners could be an afterthought. Trustees should think about what non-cash support is available, for example charges over assets, or perhaps there is a parent company that can offer a guarantee.

Companies may be willing to provide additional security for the scheme where they weren’t before to maintain cash in the business (to help with ideas here, we have set out lots of practical thoughts in our recent Contingent Funding Handbook.)

Early engagement can also provide time to consider innovative options such as superfunds or capital-backed journey plans, although these will likely only be available to well-funded schemes. Finally, we have also found that engagement with The Pensions Regulator and the Pension Protection Fund at an early stage can be really helpful to ensure that trustee concerns are taken seriously.

Our overriding message is that preparation is key during periods of volatility and distress. Trustees and sponsors need the right advice to ensure that they have the right plans in place for when times turn tough. LCP’s Covenant & Financial Analysis team have the right expertise and can help you plan for uncertainty.