Building a strategy for long-term run-off

Failure to prepare is preparing to fail as they say – for trustees of UK pension schemes preparation, planning and strategy are the watchwords for 2021. The recently passed Pensions Act 2021 has reinforced the need (and indeed made it a legal requirement) for UK pension scheme trustees and sponsors to agree and document a long-term funding and investment strategy to deliver benefits to members.

In my view, the ultimate long-term aim (or “endgame”) for many UK pension schemes is likely to be transactional; with an insurer buy-out being the gold standard. But this isn’t the aim for all schemes. For some schemes the endgame will be running the scheme to the end of its life (or close to it, when the running costs are no longer justified). Ideally, I expect these schemes will aim to do this in a way that means the scheme is unlikely to need to call on the sponsor for further help – their goal is a truly self-sufficient “run-off” portfolio.

For some this might mean “investing like an insurer”, by which I mean buying assets (often mostly corporate bonds) which are expected to “match” future liability payments. For insurers this is a strategy supported and driven by the requirements of Solvency II regulations, which strongly incentivise insurers to buy up large amounts of longer-dated corporate bonds in order to cash flow match their liabilities. As discussed in my blog here I’m sceptical of the real life economic benefits of cash flow matching very long-dated liabilities in the way an insurer may have to do, unless the assets we can use to do it are offering very good value for money.

So what does the ideal run-off portfolio look like in current market conditions? Well, no doubt it depends on a scheme’s own circumstances, but my starting point for a scheme that’s targeting run-off is to:

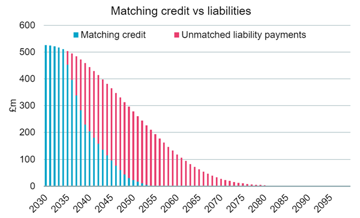

- Use credit assets to match shorter-dated liabilities, where both asset and liability cash flows are more certain. Match less at longer horizons but allow flexibility to buy long-dated matching assets when risk/return assessments are more attractive. The chart below illustrates my thinking: the blue distributions from matching credit are expected to cover all of the benefit payments required on a 5 year horizon, but I’m using much less “matching” for longer dated liabilities, unless compelling assets are available.

- Invest in a wide range of short-dated credit on a rolling basis, to diversify risks. See my previous blog for more detail on the benefits of holding a rolling portfolio of shorter dated credit alongside longer dated credit. While our matching credit portfolio is likely to be focused on Sterling investments (minimising currency hedging needs) I see benefits in investing the shorter-dated credit portfolio in a more flexible, diversified and global mandate. I would also allow scope to use high grade structured credit like asset backed securities where this offers better value.

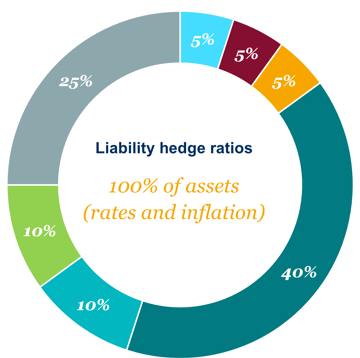

- Hedge interest rate and inflation risks since we don’t expect to be paid a significant or reliable premium for taking these risks. This means we will need to hold enough collateral (mostly gilts and cash) to support our hedge, and will need to generate enough return elsewhere in the portfolio to make sure we still expect to generate the returns needed with a high degree of likelihood.

- Hold a (small) diversified portfolio of assets we expect to generate higher returns. This may include equities, real assets and some illiquid credit assets (noting that most liquidity requirements are expected to be comfortably covered by the credit and hedging portfolios described above). These relatively small holdings in more risky assets diversify well against the other risks in the portfolio and provide extra returns to act as a buffer against any emerging risks (eg longevity). My personal view is that it’s worth mitigating exposures to climate change risks and as a result I’d favour a low carbon approach in the equity portfolio.

- Allow a degree of unhedged currency risk. Allowing some degree of unhedged overseas currency risk is a healthy diversifier within the portfolio as well as reducing hedging costs.

- Bear in mind hedging longevity risk may not always be the answer. Hedging longevity risk may not offer good value-for-money in reducing total risk. If a scheme is holding the assets suggested above, longevity risk is likely to serve more as a diversifier than a significant contributor to total risk and as a result I wouldn’t expect hedging longevity risk to lead to a material reduction in overall risk. However, I would expect (even with prices at record lows) the annual cost of hedging longevity risk to be a relatively significant “drag” on expected asset returns in the current (low yield) market environment.

I have set out an illustrative strategy incorporating these ideas below.

| Portfolio | |

| Low carbon global equities | 5% |

| Real assets | 5% |

| Private credit | 5% |

| Investment grade matching credit | 40% |

| Asset-backed securities | 10% |

| Short duration rolling credit | 10% |

| Dynamic LDI | 25% |

This is my high-level view of the best way to build a successful strategy for long-term run-off. For schemes that have a clear goal to secure liabilities with an insurer we would typically recommend slightly different approach (though there are many similarities in the two portfolios), see Tom Farrell’s blog here for more details.