Building financial confidence in the UK: building better financial futures

Pensions & benefits DC member engagement and communication Financial wellbeing Personal finance

In today’s financial landscape, building financial confidence is more crucial than ever. The ability to manage personal finances effectively can significantly impact our overall wellbeing.

Understanding financial confidence

Financial confidence isn’t just about having a robust bank balance. It encompasses several key aspects including:

- Self-efficacy: Believing in your ability to make sound financial decisions.

- Self-assurance: Trusting yourself to act on those decisions.

- Self-determination: Having the willpower to take control of your financial future.

Our latest research, Employee wellbeing: building better financial futures, explores how these elements collectively contribute to a person’s financial wellbeing, influencing your ability to manage money, plan for the future, and handle financial setbacks.

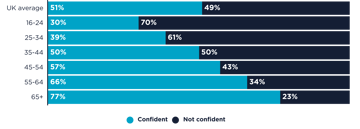

With almost half (49%) of employees stating they don’t feel confident dealing with their everyday money, low financial confidence can have far-reaching consequences. It can lead to poor financial decisions, increased stress, and a reduced quality of life. Conversely, high financial confidence can empower individuals to make informed choices, reduce anxiety, and improve overall wellbeing.

Employee financial confidence by generation:

Strategies to build financial confidence

- Financial education / knowledge building: Providing accessible and practical financial education can equip employees with the knowledge they need to make informed decisions. This includes understanding budgeting, debt management, credit scores and investment basics.

- Support systems: Encouraging open conversations about money can help break the taboo around financial discussions. Initiatives like Talk Money Week aim to foster a culture where people feel comfortable seeking advice and sharing their financial concerns

- Digital tools: Using technology, tools and resources can help individuals track their spending, set financial goals, and monitor their progress. Apps and online platforms can provide personalised guidance, advice and support.

- Employer initiatives: Employers can play a pivotal role by offering financial wellbeing programs. These can include workshops, one-on-one financial coaching, and access to financial products that support protection, long-term savings and investment.

Conclusion

Enhancing financial confidence in the UK is not just about individual empowerment; it’s about creating a society where everyone has the tools and support they need to achieve their own financial wellbeing. By focusing on knowledge building, support, and trust, we can help more people feel confident in their financial decisions and secure in their financial future.

We need employers to embrace communication and to normalise financial conversations in the workplace and pension awareness week is a great place to start.