Is it time for your scheme to buy into an alternative endgame?

Pensions & benefits Endgame strategy and journey planning Pension risk transfer Corporate strategy DB pensions

Most DB pension schemes in the UK have followed a well-trodden path in the last couple of decades: close to accrual, seek funding to operate on a low-risk basis, and ultimately hand over liabilities to a life insurer when affordable (with or without additional contributions from the scheme sponsor) – in order to extinguish liabilities and free sponsors of financial uncertainty.

However, whilst targeting a buy-out may be the right approach for many schemes, in my opinion trustees and indeed sponsors should always be aware of and consider the alternatives – could these options better serve your objectives and lead to better outcomes for scheme members and other stakeholders?

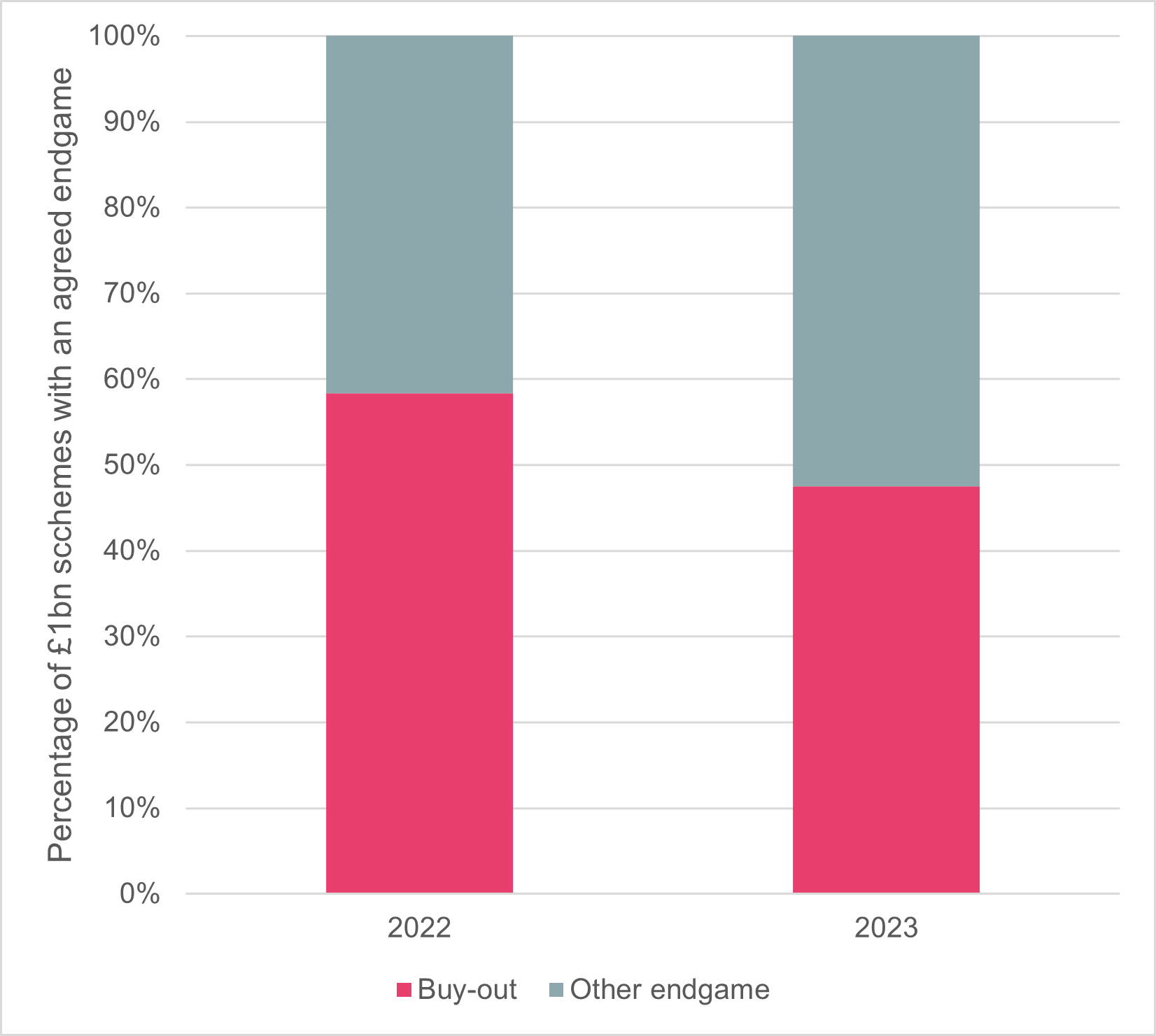

Source: Survey data for Chart your own course 2022 and 2023

As the only way to fully settle liabilities, buy-out has long been thought of as the ultimate endgame for many schemes. However, my personal view is that the choice of endgame shouldn’t be taken as read. The chart above is based on survey data collected for our annual DB pensions survey publications which shows of the schemes surveyed with over £1bn of assets and a selected endgame, only around 50% of them have that endgame set as buy-out, with the rest choosing to run schemes on.

The inevitable questions arise: why are some schemes choosing not to buy-out in the face of attractive pricing and improved funding levels? Should other schemes be following their lead and reconsidering their own strategies?

Why not buy-out asap?

It’s worth saying up front that in my opinion fully insuring in the near term will remain the best outcome for many schemes – particularly those with covenant uncertainty, or smaller schemes without the economies of scale needed to efficiently continue as a standalone scheme. However, this won’t be true for all schemes. There are a number of reasons why it may be appropriate to delay fully insuring and/or buying out, including:

Value for money for deferred pensioners

Whilst a transaction may appear affordable, it may not represent value for money in respect of deferred members of the scheme. Schemes with significant numbers of members who are yet to retire will be paying a premium to insure the long-term nature of their liabilities. Waiting for more of those members to retire is likely to be more-cost effective, thereby resulting in lower funding being required or greater potential for a surplus to be built up, freeing up funds that may be better used elsewhere – see below.

Greater potential for benefit improvements

Buying out a scheme typically removes any future discretion available to trustees and sponsors, and therefore removes any future potential for upside to members. Running a scheme on for a period beyond the point at which a transaction first becomes affordable could lead to the generation of surplus that can be used to offer additional increases, or other improvements to members’ benefits.

Member options

Any surplus built up could be used to provide enhancements to insurers’ standard member option terms. Running a scheme on could also enable schemes to expand their offering to members. Members may appreciate options for bridging pensions or pension increase exchanges on retirement. Whilst some insurers can facilitate these options, schemes generally need to put them in place at the point of buy-in. Further to this, schemes may also be able to provide or retain existing paid-for financial advice to members that may not be readily available following a buy-out.

Sponsor upside

The premium paid in an insurance transaction will reflect the cost of the high reserves that insurers are required to hold against the risk they are taking on. Particularly where there is good covenant visibility, and they are comfortable running risk over the longer-term, sponsors may prefer solutions that enable them to retain this potential for upside. This may allow the sponsor some additional options: to use DB surplus to fund DC contributions; to improve DB members’ benefits; or to return any residual surplus generated (albeit taxed) if buy-out does become the right option in the future.

Illiquid assets

Entering into full insurance as soon as possible could lead to schemes having to accept significant haircuts on any illiquid assets they hold, or otherwise negotiate complicated deferred premium structures to accommodate them. Delaying a transaction can gives schemes the time to realise illiquids at market value, with the proceeds potentially being put to good use as described above.

Of course, the extent to which it will be appropriate to take into account the above will depend on the scheme’s specific circumstances, covenant support and rule requirements.

These aren’t new ideas, but the fundamental shift in buy-out funding levels seen over the last twelve months (coupled with high inflation putting pressure on discretionary increases and the cost of living) has led to renewed thinking in this area.

Powering possibility in pensions

I’ve set out some reasons for why schemes might not want to fully insure or buy-out in the near term, but the Chancellor’s Mansion House speech on 10 July 2023 also adds another dimension to this, including considerations that might lead to deferring buy-out over the longer term.

The Chancellor announced Government consultations on various proposals that may encourage greater pension scheme investment in longer-term assets. This includes LCP’s Powering Possibility in Pensions policy idea, under which we propose creating a new “opt in” system for well-funded DB schemes, with two key changes:

- PPF cover increased to 100% of member benefits, building on the proven success of the PPF approach

- Ability to extract surpluses on an ongoing basis (with suitable protections) to fund improved DC savings, invest in UK plc and boost DB member benefits

We proposed this idea as the current regime offers very little reason to not buy-out once affordable; we believe these proposals would provide greater optionality for those schemes where it may be appropriate to run-on, invest for long-term growth, provide protection for Trustees and members, and offer increased flexibility to give sponsors access to any resulting upside. A potential big win for members, trustees, sponsors, and UK plc.

Ultimately any change in pensions policy will depend on the outcomes of the consultation process and the Government’s objectives - it will take time to implement. However, the existence of such an appetite for change could be a key part of decision making for endgame strategies and not taking any irrevocable decisions over the short term.

Other endgame options are also gathering pace

Following the Mansion House speech, the DWP also reaffirmed the Government’s intention to establish a commercially viable superfund regime. In the right circumstances, we believe superfunds will provide a potentially valuable option.

We are also seeing increasing innovation in capital-backed solutions – where third parties provide schemes with capital to reduce risk and support a scheme’s journey to their chosen endgame in exchange for a share of potential excess investment returns.

In all cases it’s worth taking the time to understand the different options available and what could work best for your scheme. The right answer isn’t always to follow the well-trodden path and it isn’t always necessary to get there as fast as you can.

Keep options open through your strategic journey plan

At LCP we know that journey planning needs to be dynamic and your plan should allow you to steer your scheme effectively through the ever-changing pensions landscape. For many schemes this may mean keeping your options open and considering those alternative routes that may not have previously been viable. Our LCP GEARS framework to journey planning helps schemes achieve this.

Subscribe to our thinking

Get relevant insights, leading perspectives and event invitations delivered right to your inbox.

Get started to select your preferences.