Emerging market debt is borrowing by either emerging markets governments or companies. Compared with its developed market equivalent, EMD is perceived as riskier and therefore typically offers higher prospective returns.

Investing in emerging market debt can be likened to walking a rope-bridge. From the bridge, investors can experience truly spectacular views of the canyon; an experience that surpasses traversing a mundane, concrete overpass. However, the investor must navigate a somewhat unsettled contraption whose suspension and integrity depends on multiple factors.

Thankfully, safety equipment can be worn to materially reduce the dangers of walking across the bridge. Investors should seek a well-diversified portfolio to avoid overexposure to idiosyncratic risks. Helpfully, the sub-asset classes within EMD have different characteristics, offering this diversification, and so we generally prefer a blended approach for most investors.

Last year, the bridge’s integrity suffered, and emerging market debt struggled. A blended portfolio1 would have declined by around 14% in USD terms. In particular, hard currency assets suffered as the rate hiking cycle pursued by the US Fed and other central banks strengthened the US dollar and increased borrowing costs for emerging markets. This year EMD has rebounded strongly, outperforming some broad developed market indices.

Thus far throughout 2023, market participants have taken in a more satisfying view from the rope-bridge – its suspension has swayed, but generally felt reassuringly stable.

So, looking forward across the near term, how attractive is EMD?

Macroeconomic tailwinds are plentiful

Emerging markets are, perhaps, currently enjoying a higher level of macro certainty than their developed markets peers.

Despite softening growth expectations in China, global growth is expected to be overwhelmingly driven by emerging economies this year; the IMF expects emerging economies to grow by 4.0%, with advanced economies projected to grow by just 1.2%. EMD sentiment is highly growth and performance sensitive, and inflows are likely to increase if 2023 plays out as expected.

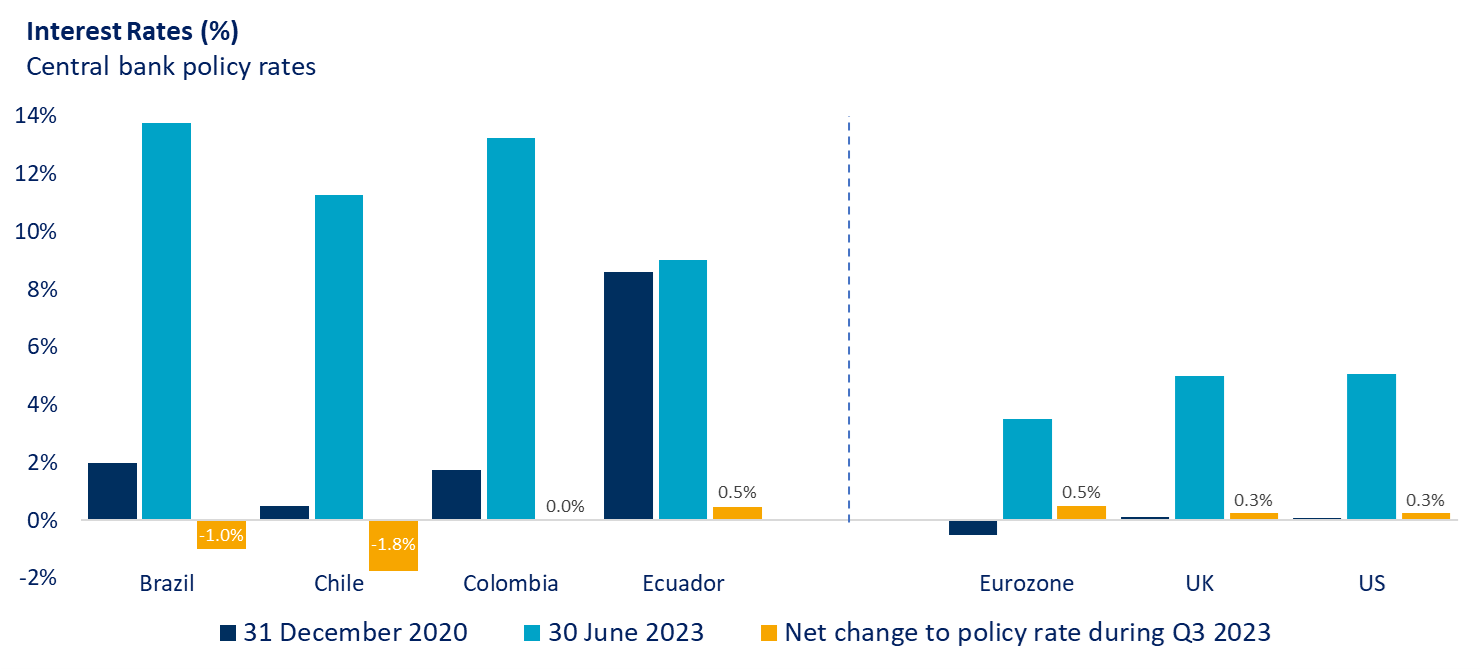

Furthermore, in an effort to curb inflationary pressures, emerging market central banks have been hiking interest rates for an extended period of time. In many cases inflation has been less sticky in emerging economies, resulting in relatively high real interest rates. EM central banks now find themselves able to cut rates ahead of their developed markets counterparts.

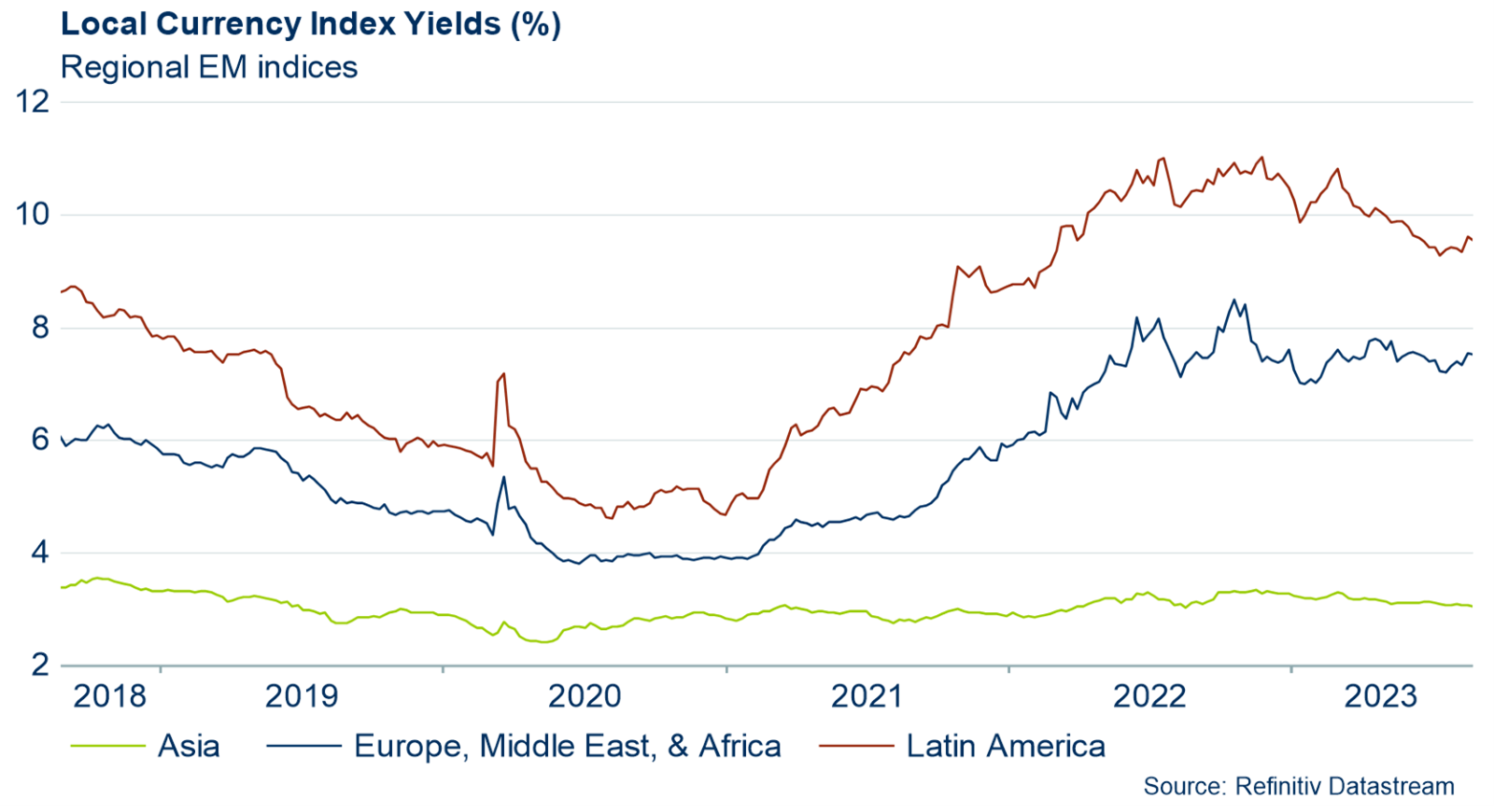

Local currency bonds have been interesting, with currencies undervalued

Whilst hard currency bonds have sat under the black cloud of see-sawing expectations around US recession and policy direction, local currency bonds stand to benefit from EM central banks’ imminent monetary policy descent. Local currency assets are enjoying high starting nominal and real yields, and the disinflation story is likely to inspire inflows into long duration local currency debt as yields compress over the near term. Furthermore, market technicals are positive: EMD fund flows have been negative year to date (goodbye “tourist” money), while supply is forecasted to remain muted for the rest of the year.

As well as potential in their own currency, local bonds offer additional returns through currency moves. US dollar strength was a headline throughout much of last year and, whilst this has dissipated somewhat, it would be difficult to argue that the dollar now looks cheap. Relative to most emerging market currencies, USD has persisted far above long-term levels. The prospect of rate cuts being introduced by the Fed in the near term suggests that there is plenty of opportunity for a softening dollar.

Focus: Latin America

Of the group of countries that significantly hiked rates early and are now able to cut them, many are Latin American. Macro and idiosyncratic conditions appear to suggest that Latin American local currency sovereign bond prices exhibit asymmetry to the upside.

Source: Central banks

Local currency Brazilian sovereigns offer some of the most attractive real rates in the market. Whilst Chile was the first major emerging market country to cut rates, by 100bps in July, Brazil closely followed with a 50bps cut in August. Future cuts are expected to persist across the region. The disinflation trend is well underway in Brazil, and data suggests economic growth is slowing. Relative to GDP, Brazil’s primary deficit is expected to be modest this year and in 2024.

The local currency sovereign issuance of Argentina also offers attractive valuations and an opportunity for high carry. However, the recent October elections did not result in the (relatively) more market-friendly outcome many had expected.

Evaluation: risks and our preference

One concern is liquidity. In June, the US government agreed a deal to roll over the debt ceiling and resume ‘normal’ Treasury issuance. The resulting effect is one of quantitative tightening, which is likely to incur at a lag, so it is possible that risk assets (including EMD) may sustain downward pressure later this year. Furthermore, it is worth remembering that the balance sheets of the Fed, ECB, and BOJ are already being forcefully scaled down. This is more concerning with valuations no longer screaming value.

Another risk is that inflation stickiness across emerging markets surpasses expectations, thus derailing monetary policy expansion. Should this be coupled with slower-than-expected growth, the fundamental case for local currency would lose its strength – the integrity of the rope-bridge would suddenly appear compromised. However, the current market environment suggests that EM countries are ahead of the curve with respect to taming inflation. Disinflation trends and starting yields are compelling, particularly in some Latin American countries. For an investor, a primary benefit of investing in EMD is the opportunity to diversify across macro and idiosyncratic factors that differ from those driving returns other parts of their growth fixed income portfolio.

We continue to advocate for a more unconstrained approach to EMD investment, which blends together a diversified set of assets (hard and local currency) that can be rotated dynamically over time. We recommend all investors consider EMD as part of their strategic asset allocation. Please speak with our credit experts if you would like to learn more.

[1] Consisting of 50% local currency sovereign assets, 25% hard currency sovereign assets, and 25% hard currency corporate debt.

This should not be relied upon for detailed advice or taken as an authoritative statement of the law. If you would like any assistance or further information, please contact the partner who normally advises you.