Home Energy Management in Europe: a rapidly evolving market with a growing potential

Energy transition Energy research Residential research

The European Home Energy Management (HEM) market has been quite slow to develop in the last decade, only reaching around 300k installations to date. But this is going to change.

By 2023, we expect the market to reach 2.3M units installed

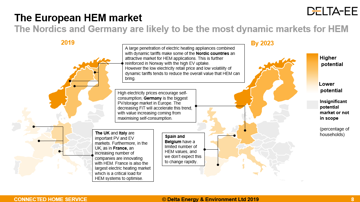

While the overall HEM European market will grow, the highest potential for growth will continue to be in the Nordics in terms of relative penetration and Germany in terms of absolute numbers. France, the UK and Italy will remain behind even though we predict their HEM markets sizes will increase faster. With its high penetration of solar PV, one may have expected Belgium (and to a lesser extent the Netherlands) to be an interesting market, but its net metering system is clearly a barrier to HEM. Finally, Spain, and its interesting geography for sun power, could have been better placed, but there is a lack of incentives for customers to install and self-consume solar PV.

The HEM growth is closely related to three drivers:

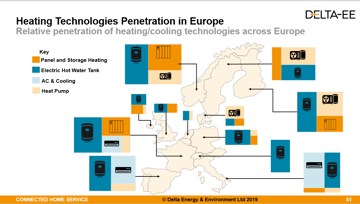

1. The penetration of large electrical loads in households in Europe

In the Nordics, the important uptake of heat pumps (up to 32% of households equipped) used with dynamic tariffs leads to a lot of opportunities for HEM solutions. Germany, which has the largest potential for HEM after the Nordics, is the biggest solar PV and storage market: 3M of German households are equipped with PV and more than 4% of them are connected to a battery. Countries with future important potential for HEM exhibit similar trends: for example, France represents the largest electric heating penetration of Europe, and 38% of Italian households are equipped with an air conditioning and/or cooling system.

Countries with large EV and chargepoints (CPs) markets, such as the UK and Norway, will see increasing HEM penetration in the next years. This is further driven by the increasing implementation of connected CP, controllable by third parties.

2. The evolving regulatory framework

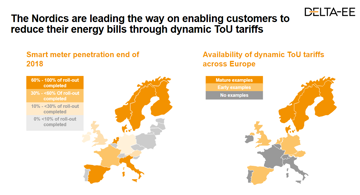

Regulatory frameworks also shape the attractiveness of each European country for HEM. Some countries, such as the UK and France, are currently achieving their smart meters rollouts. Italy is now at around 50% of second-generation smart meters. The granularity of energy data now collectable will enhance the precision of HEM solutions, as is already the case in the Nordics.

In most countries, the previous feed-in-tariffs for solar PV are slowly disappearing, leaving customers no other choice than self-consuming their free electricity. It means solutions like HEM, which can optimise self-consumption, will be on higher demand over time.

Similarly, the opening of the flexibility market to residential loads in some countries is likely to drive further HEM values such as the support of the distribution network. This is for example the case in the UK, France and the Nordics.

3. Technological and business innovations

Technological and business innovations have further pushed the development of some products and commodities accessible to HEM.

For example, we are already seeing multiple examples of companies offering dynamic time-of-use tariffs coupled with either heat pumps or EVs. The customer proposition is, “we keep your comfort, but we optimise the timing of consumption to give you the lowest electricity bill”.

The development of connected home technologies, and connectivity in general in the energy industry, is also clearly helping companies innovate around HEM. Some even specialise in just the software behind HEM, allowing others such as energy suppliers or manufacturers to provide HEM services without having to develop everything from scratch.

The HEM market is rapidly evolving leading to increased activity and competition. More than 50 specialised companies operate across Europe, boosting the visibility of HEM solutions and the interest of various channels that could be offering HEM to customers. The Nordics, and especially Norway, are leading the way in term of future HEM potential but we expect Germany, France, Italy and the UK to represent also a large part of the European HEM installed base by 2023. Even though the market is very niche today, we do believe there is a strong potential for HEM to capture a growing range of the values mentioned above. The market will grow, for sure. The real question is how fast?