Residential solar PV subscription portfolios – an attractive investment opportunity?

This content is AI generated, click here to find out more about Transpose™.

For terms of use click here.

Dina Darshini and John Parnis-England discuss how each stakeholder in the fast growing “Solar-as-a-Service” market can benefit from increasing collaboration between market players and financial institutions.

The European residential solar photovoltaic (PV) market exploded last year, growing 78% between 2021 and 2022 in terms of annual installations. But what has particularly caught our eye is the rapid traction being gained with Solar-as-a-Service contracts (growing by 196% between 2021 and 2022). Solar-as-a-Service models involve households paying a recurring fee for access to rooftop solar-generated electricity rather than buying the solar system outright. In other words, Solar-as-a-Service models, such as leasing and power purchase agreements, involve third-party ownership. Crucial to its value proposition is that customers are relieved of the upfront cost barrier1 and get to pay smaller, more affordable payments over an extended period.

Why would solar PV providers offer Solar-as-a-Service?

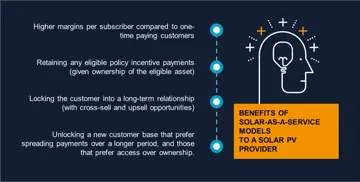

The ‘traditional’ model of a solar PV provider simply installing solar systems for one-off payments is a simple business proposition, but is relatively low margin (as it stands) and does not capitalise on the range of opportunities that exist in this market.

The European residential solar PV provider market is also competitive and highly fragmented. So, how are market players trying to stand out from the crowd? Address the upfront cost barrier, optimise energy cost reduction, offer peace of mind, and be a one stop-shop is the route that some are taking.

Specifically with the Solar-as-a-Service model, solar PV providers take on the ownership of the solar PV system, and shift the technical, policy, and financial risk away from the customer and onto itself. This allows the solar PV provider to appeal to a wider customer base (i.e. acquire more customers), which in turn drives volumes and allows for scaling up, which in turn is beneficial to customers (if costs come down as a result).

Adopting a Solar-as-a-Service model attracts a higher margin, and provides a revenue stream for years to come (across the 10-25 year customer contract), plus other benefits.

However, the Solar-as-a-Service model is not without risks

For example, solar PV providers that aggressively take on a high amount of debt (from lenders) to finance the solar PV systems upfront are essentially betting on acquiring sufficient subscribing customers to (at the very least) keep up with debt repayments2.

A combination of high customer acquisition costs (in what is a competitive market), interest expenses and the relatively high costs of purchasing solar PV equipment from manufacturers means that many of these solar-as-a-service companies remain loss making, and it can take several years for a solar PV provider to see profitable operations.

Solar PV providers will also have to think very carefully about the financing structure (e.g. debt financing ratio) best suited for their growth ambitions and solar finance proposition. Holding long leases and debt, and managing them to maturity – makes Solar-as-Service companies akin to a bank, even if financial risk is isolated via a special purpose vehicle (SPV).

Should Solar PV providers leave financing to the experts?

Providing direct financing solutions to customers can be a challenge for many Solar PV providers (and creates high levels of financial risk), and partnering with a bank or financial institution can be an effective way to allow for each stakeholder to focus on areas in which they have a comparative advantage.

This could take the form of finding a partner bank willing to offer solar loans. In this scenario, the solar PV provider merely acts as a credit broker, with the loan typically formalised between a partner bank and the solar customer directly. And the solar systems remain off-balance sheet for the solar PV provider.

Solar-as-a-Service businesses start to have a much lower risk profile as residential solar grid parity3 comes in, as the regulatory environment both at an EU-level and at country-level improve, and we enter the “mainstream market” stage of technology adoption. And with that, banks and investors alike are starting to see the residential solar PV space as a major opportunity.

Recurring-revenue solar businesses (with stable, predictable income flows expected over a long period) appeal to financiers looking to position solar PV as a bond-style investment.

Solar-as-a-service companies could for example:

- Sell the debt, once established, to actual banks.

- Bundle solar leases into green securities for selling on money markets, appealing to ESG (Environmental, Social and Governance)-minded investors.

- Sell on the SPV to entities like pension funds where it could possibly be viewed as a stable ESG asset.

The result? A solar PV provider with lower leverage and financial risk, creating the freedom to take on new debt and build up a ‘new’ portfolio of subscription customers, with a target to repeat the process at the desired level of scale.

Is the financial market in Europe ready to consider residential solar subscription portfolios in mainstream investment portfolios?

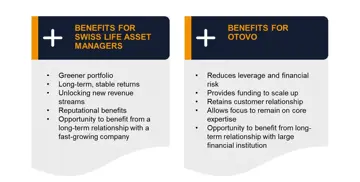

We’re optimistic that it is. And recent news from Otovo, a fast-growing solar PV company, is a recent example of this.

Founded in 2016, Otovo is a solar PV and battery marketplace company connecting residential customers and vetted installers. It has rapidly expanded and currently operates in 13 European countries. For the many reasons we outlined earlier, Otovo is scaling up its subscription (leasing) model, targeting it to be ~50% of overall sales in 2023 compared to <30% in 2022.

A key feature of a Solar-as-a-Service business is that you need to design a financing solution to meet the upfront costs, and Otovo uses the popular choice of an SPV to facilitate its funding through traditional capital markets. Otovo’s SPV is called European Distribution Energy Assets Holding AS (EDEA), which it owns 100% of the equity of (it previously held a minority share).

In October 2023, Otovo announced that it had entered into a share purchase agreement with Forte PV S.à.r.l (part of a collective investment scheme managed by Swiss Life Asset Managers) for the sale of its Norwegian and Swedish subscription portfolios.

The transaction involves the sale of 100% of the shares held by EDEA in its Norwegian and Swedish subsidiaries European Distributed Energy Assets AS (“EDEA NO”) and European Distributed Energy Assets AB (“EDEA SE”). The portfolio size includes ~1,600 contracts with Swedish and Norwegian homeowners, which have had solar PV systems installed over the last 3 years. Additionally, all new lease contracts originated in Sweden and Norway between close of transaction and December 2024 will be sold at the same terms (expected to be around 3,000 – 3,500 residential solar projects).

Otovo will continue operating the solar PV assets on behalf of Swiss Life Asset Managers, through a service & maintenance and customer service agreement. Hence, from the customer’s point of view, things will seem no different.

But on Otovo’s side, this deal has enabled Otovo to improve its liquidity, reduce its financial risk, and continue to accelerate its growth across Europe. It also gains a financial partner to execute similar transactions with in the future.

For the wider market, this deal can serve as inspiration to similar providers aiming to monetise their subscription assets.

Why is the Otovo-Swiss Life Asset Managers deal noteworthy?

Because it signals that investors are starting to see beyond traditional renewable energy investments. And that residential solar subscription portfolios are starting to be viewed as an attractive investment.

For a long time, when we discussed with our clients from the banking and investment community – a key concern they’ve had with the residential energy segment is “scale”. But this Otovo-Swiss Life Asset Managers deal shows that investors do have appetite in the fast-growing residential low carbon tech markets.

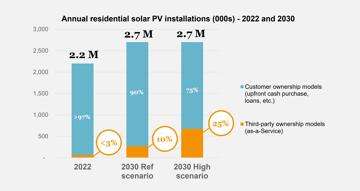

We also believe the Solar-as-a-Service model will gain a lot more traction here in Europe. We expect that by 2030, almost 10% of home solar customers per year will procure their solar PV systems via third-party ownership models.

Source: LCP Delta, 2023 – Outlook for Solar-as-a-Service in Europe

Providing finance to credit-scored homeowners to buy solar PV can be considered relatively low risk. Unlike a subscription to an entertainment device or a non-essential premium item, homeowners always need affordable electricity. And if monthly Solar-as-a-Service repayments are cheaper than the prevailing utility rate, a solar lease becomes an easy financial choice for homeowners. The USA experience is that default levels are low and can be factored in predictably into debt calculations. Sunrun, the leading solar lease company in USA, claim to only have a loss rate of ~1% from their on-going subscription contracts4.

There is also the wider trend of market players like Otovo expanding their product portfolio (e.g. offering a range of energy assets including solar PV, battery, electric vehicle chargepoint, heat pump, etc.). This means future subscription portfolios morph from solar portfolios to low carbon tech portfolios – allowing a higher-level of diversification.

The pairing of energy solutions and finance will be important for accelerating the energy transition

Whether it is banks providing green finance (e.g. solar loans and green mortgages) directly to customers; or low carbon tech businesses raising funds via equity or debt financing; or Solar-as-a-Service subscription portfolios finding a place in the financial market… finance is available.

Low carbon tech providers aiming to attract the right financial partners should emphasise their potential for scalable partnerships and present investment opportunities that match investors’ expected returns with associated risks.

At LCP Delta’s New Energy Summit 2023, Dina chaired the panel session on “Accelerating the transition to Net Zero Homes”, while John chaired the panel session on Green Finance. Across both panels, it was clear – that finance will be one of the top enablers of the energy transition for residential customers.

1 A solar PV system could typically set a household back €7,000 to €20,000 depending on the system size.

2 As debt repayment obligations are contractual, they must (usually) be paid whether a company has had a good sales month or not. Solar PV solution providers typically look towards debt financing when they are confident about their revenue and profit forecasts, and hence the company will be able to pay back the contractual debt repayments plus interest.

3 The tipping point when rooftop solar power costs less than or equal to buying electricity from the grid. Reaching grid parity is considered to be the point at which an energy source becomes a contender for widespread development without subsidies or government support.

4 Losses include uncollected recurring billings months after invoice date, write downs and appeasement credits.