Should the Covid-19 pandemic change your view on the value offered by a pensioner buy-in?

We have heard both trustees and sponsors question whether they should enter into a pensioner buy-in this year given the potential of increased deaths as a result of Covid-19 reducing their liabilities in future.

In this blog we set out why, in our view, it is current economic conditions rather than mortality rates that are the key driver of whether a pensioner buy-in is an attractive investment. In current market conditions pensioner buy-ins are offering pension schemes very attractively priced opportunities to de-risk.

Based on our internal insurer pricing model, which is calibrated against pricing achieved on buy-ins and buy-outs which LCP has transacted over recent weeks, we estimate that a typical scheme has achieved pricing around 3%-5% (or more in some cases) lower (relative to gilt values) than was available in January or February based on an unchanged view for future mortality rates.

Furthermore, in general, insurers and reinsurers are currently making no allowance for mortality rates being higher in 2021 and beyond and are probably unlikely to do so until evidence emerges to support doing so, which is likely to be many months away, if at all. So, while schemes may have made a small financial gain to date if they have experienced higher than average deaths over the past few months, we are currently not expecting material further gains to be made by delaying buy-ins or buy-outs.

Mortality impact

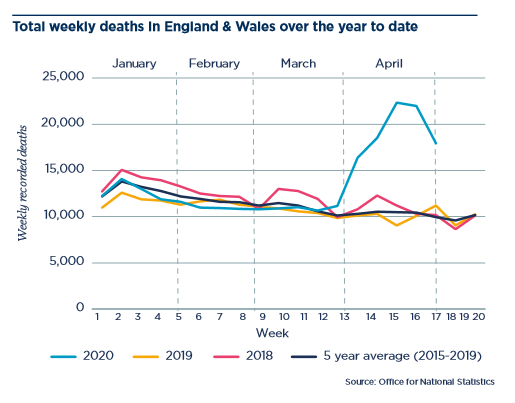

Based on data released by the ONS up to 15 May, there were 56,000 more deaths registered so far this year in England & Wales compared to the same point in 2019, with the vast majority of those occurring since late March. This is shown in the chart below. In an average year we would expect around 500,000 deaths.

Looking at this dramatic increase in the number of deaths, you might expect there to be a corresponding material reduction in pension scheme liabilities. However, this is not necessarily the case.

In Chris Tavener’s blog, he considered that the liabilities of a typical pension scheme might reduce by just 0.25% if the number of deaths over 2020 at all ages was 20% higher than an average year. This would represent 100,000 additional deaths occurring in England & Wales, compared to 56,000 for the year to 15 May.

If we were to apply this example to a typical pensioner population (ie 20% higher deaths than an average year) it would be expected to reduce the pensioner liability by only around 0.5%.

In both cases this impact seems very low. Why is this? Well this is probably best explained by some simple maths.

Let’s say we have an example pensioner population with an annual payroll of £10m. During a typical year, and assuming no new retirees, you might expect that payroll to reduce to £9.75m (i.e a reduction of around 2.5%) due to deaths, ignoring new dependants. If instead deaths were 20% higher than expected the reduction in the payroll would be £300,000 giving a reduced payroll of £9.70m. So even with 20% higher deaths this year the payroll has only reduced by an extra £50,000 or 0.5% more than expected. Resulting in a corresponding 0.5% reduction to the value of your pensioner liabilities compared to what you expected.

If the increased level of mortality rates apply into future years rather than just 2020 (e.g if an effective vaccine is not developed and other mitigation approaches are not effective) then the reduction in liabilities will be higher although, as you can see, it would take several years of sustained excess mortality for more material reductions to come through.

Economic impact

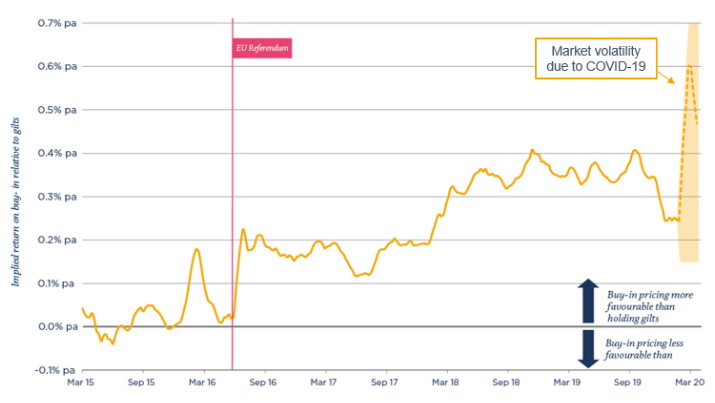

As well as an impact on mortality rates Covid-19 has also caused considerable market disruption over the last few months which has led to some of the most attractive pensioner buy-in pricing seen in recent years. This has been driven mainly by falls in the price of UK and US corporate bonds, as life insurers who invest in credit and similar debt-like investments have been able to pass on the lower cost of investments through significantly reduced pricing.

Our analysis is shown in the chart below which plots typical pensioner buy-in pricing over time expressed as an implied return compared to the yield available from holding gilts. The shaded area highlights the range of the impact of recent market movements on this metric for the different insurers in the market. For some insurers there was little change in their pricing. However, for those insurers that use credit investments there were some significant price improvements (depending on their appetite and views on the default risk in the underlying investments).

Pricing has fallen back a little since March but insurers have become more confident over the future outlook and so pricing continues to be attractive with the implied return still some 0.2% pa higher than in February which is a price reduction for a typical pensioner population of around 3%.

Conclusion

For schemes that are able to move quickly, buy-in pricing continues to look highly attractive compared to historic levels driven by movements in investment markets.

There may be other reasons than Covid-19 that mean now is not an opportune time to de-risk, for example due to falls in the overall funding or illiquidity in your asset portfolio, however holding out for a potential price reduction due to an expectation of higher future mortality rates is unlikely to save you nearly as much as the price reductions being offered by insurers due to the current economic factors.