Steer your journey dynamically

Pensions & benefits DB investment consulting Strategic journey planning DB pensions

We recently published LCP Gears – our Strategic Journey Planning Framework which sets out how we at LCP help our clients to achieve a successful journey to their ultimate goals, capturing opportunities and managing risks effectively on the way.

In this blog series we look at each step in turn, and what it means in practice. Here we cover step 5: Steer your journey dynamically and in a joined-up way.

Even with the best laid journey plan, it’s likely that you will experience some bumps along the road. Some of these could be headwinds, delaying or changing your path to your ultimate objective. Some could prove to be tailwinds that accelerate your journey, but these are not without their own risks.

So what can you do prepare for these bumps before they materialise?

Monitoring your plan

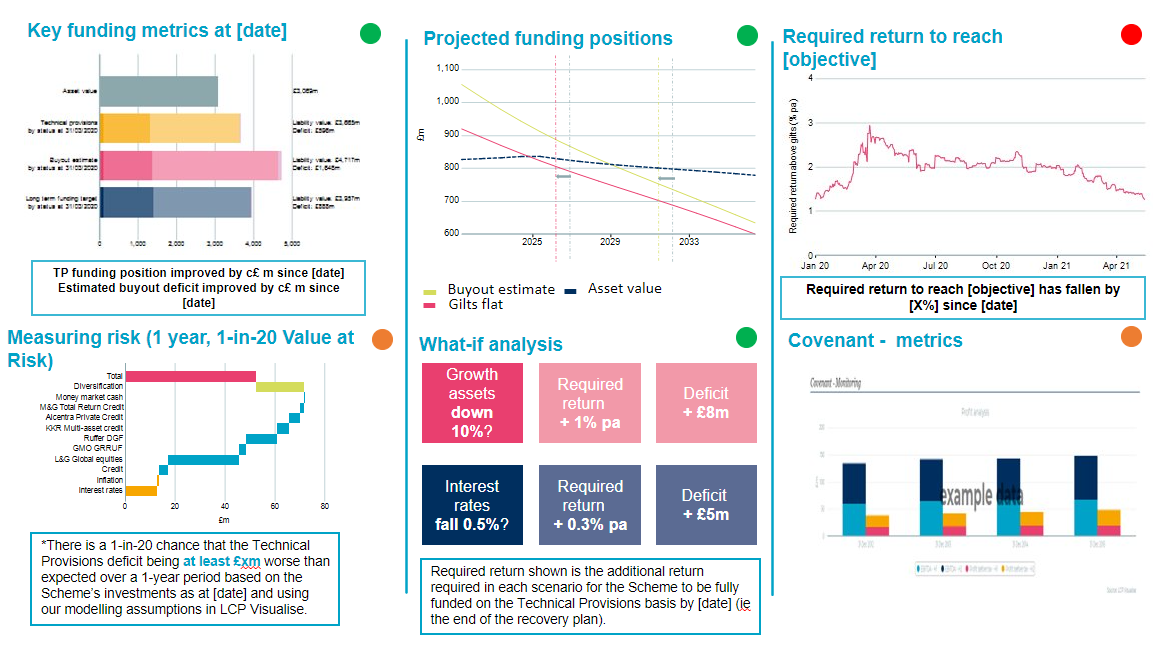

Visualise allows you to monitor progress against a range of metrics on a daily basis and set triggers depending on what is most important to you. This could include monitoring your scheme’s funding level, required returns, and/or market metrics such as gilt yields. When this monitoring is combined with a clear framework of pre-agreed actions to take, you can respond quickly to opportunities and take action to lock in a favourable position. We can also help you to track covenant metrics and understand how member experience impacts your scheme’s position.

While this sounds like a lot to be keeping an eye on, with the tools and technology now available, all this information this can be filtered down and presented in a single strategic dashboard to be reviewed on a regular basis – we’ve helped lots of clients with this. Because each scheme has unique circumstances, each dashboard is unique too. An example for one client is shown below:

Taking things a step further, for some of our clients we’ve helped put in place Advance – an integrated online dashboard for DB schemes, summarising key metrics for schemes across actuarial, investment, administration, covenant and secretarial.

However you choose to monitor progress against your journey plan, the important thing is that you combine it with pre-agreed actions for how you will get back on track or evolve your plan as things change.

Evolving the journey plan

It’s important to have contingency plans in place to enable you to react to decisively to adverse events, such as a deterioration in sponsor covenant or lower than expected investment returns. One or more contingent funding solutions such as contingent contributions, security over assets or group guarantees, can be an important element of this planning. For more details on the range of solutions available and to read about how we have already helped our clients in this area, see our handbook for more detail.

Contingency plans don’t only need to address downside risks, we also believe that it is good practice to set up automatic actions within your investment strategy – for example, rebalancing your scheme’s strategic allocation to within agreed tolerance levels, or agreeing a liquidity waterfall (a combination of highly liquid money-market and investment grade credit funds) to meet LDI collateral calls. This latter structure can be decided up front and then implemented automatically with the right manager arrangements - through recent LDI market volatility, we have seen how an automated process could be the difference between maintaining or losing hedging.

Tailwinds and overfunding

In recent months, many schemes have had a big helping hand towards their ultimate objective thanks to the significant rise in gilt yields.

Whilst that’s good news, rapid and unexpected funding improvements can have consequences for scheme sponsors, including the risk of trapped surplus. This occurs when the ultimate cost of buying out and winding up a scheme is less than the assets it holds, and any refund of those excess funds to the sponsor will typically be subject to a considerable tax charge (this charge is currently 35%, which is far more than the tax relief the sponsor will have received when paying into the scheme).

This can make sponsors reluctant to pay further contributions to their pension schemes, particularly if the sponsor happens also to be facing challenging economic conditions, such that paying pension contributions may not be a priority. At the same time, trustees may still be keen for support to make the scheme’s journey plan even more secure, or achievable within a shorter timeframe.

Sponsors and trustees with schemes closing in on their ultimate objective can head off these concerns in advance by using an escrow. This can be a win-win solution for sponsors and trustees; the scheme gets the extra security of funds being available if they are needed, and if they are not the sponsor gets the comfort that they will be returned promptly and without the tax penalty. Another benefit of escrows is that their terms can be tailored to individual situations.

LCP have launched our Streamlined Escrow service, designed to provide certainty on fees and keep the set-up and ongoing processes as efficient as possible, making escrows more accessible to sponsors and trustees of schemes of all sizes.

In conclusion

Having a strategic journey plan in place is an important first step in reaching your ultimate objective, but it’s important to both monitor progress against your plan and to have contingencies in place:

- monitoring will help you to identify any roadblocks or tailwinds that arise along the way;

- contingent funding solutions can be a win-win for different stakeholders, and can help smooth the bumps in the road; and

- combining the two will help you act quickly and decisively, and may even lead to you achieving your ultimate objective sooner than planned.

Other blogs in the LCP GEARS series:

G - Is governance a part of your journey plan?

E - Have you established your ultimate objective and timescales?

A - Analyse what could change your journey

R - Refine the steps you plan to take