SunPower – an isolated casualty? Or is the wider residential solar industry in trouble?

Energy transition Investment Residential research Solar & battery research

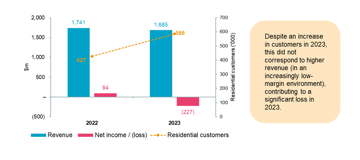

In August 2024, SunPower Corp., one of the largest and most well-known solar companies filed for bankruptcy. Along with Sunrun and Sunnova, it is a Top 3 solar installer in USA. SunPower had 586,250 residential customers as of Dec. 31, 2023. Founded in 1985, SunPower spun off its manufacturing business in 2020 to focus on its installation arm as rooftop solar demand surged. But even this scale-up success could not overcome its liquidity challenges in the face of lower-than-expected revenue and the high interest rate environment – which led to a breach of banking covenants.

Figure 1: SunPower’s trading summary (2022 and 2023), from continuing operations

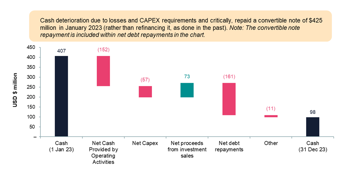

Figure 2: SunPower’s cash flow summary (2023)

But SunPower was not the first casualty. In February 2024, Sunworks, a public-listed USA solar company filed for bankruptcy.

In June 2024, Titan Solar Power (Titan) shut down its operations across 40 USA States. Titan, a Top 10 solar installer by market share in the USA, had grown nationally, mainly through its dealer program. Titan stated that it had helped over 100,000 households go solar. Its network of dealers focused on door-to-door sales (receiving commission per project) and Titan focused on installations. However, while this approach allowed each party to focus on its core strengths, this also led to a lack of customer service and to Titan foregoing the on-going customer relationship. Faced with a string of consumer complaints and lawsuits, it failed to find a buyer in 2024 and filed for bankruptcy.

It’s important to contextualise SunPower, Sunworks, and Titan’s troubles within the wider solar market environment. In a previous blog, we discussed how the share prices of major residential solar market players took a beating last year. By Q4 2023, even the most bullish of solar advocates had to concede that demand for residential solar installations across USA and Europe had begun to decline.

Across the Atlantic, over in Spain, SolarProfit, a national solar installer, announced a redundancy plan for 90% of its workforce and eventually filed for bankruptcy in Q2 2024.

Then there’s Holaluz - hailed as a market disruptor to watch. As part of its “Rooftop Revolution”, green electricity supplier Holaluz offers customers energy management / supply in exchange for a monthly fixed fee (guaranteed to be 70%+ lower than their previous energy bill) upon installation of solar PV with them (+battery, EV charger). However, in 2024, a cash-strapped Holaluz is battling through liquidity problems and has also had to lay-off installers.

Like the abovementioned companies, there are many more – small to large, public-listed and private – solar businesses in USA and Europe that have struggled in 2024.

What’s going on? Why are so many solar businesses crumbling?

Let’s start with Europe:

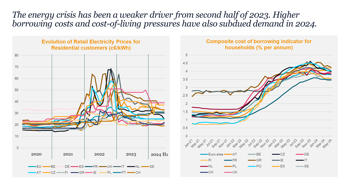

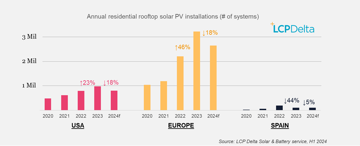

2020 – 2023: Demand exploded for residential rooftop solar PV systems following record high retail energy prices (linked to the 2021/22 energy crisis and the release of pent-up demand post-pandemic). Households rushed to buy solar systems as a hedge against higher and more volatile grid electricity prices. Subsidies and green economic recovery plans further stimulated the market, as did a rush in applications pre-subsidy schemes ending. Supply chain disruptions and labour shortages held the market back from further growth.

2024: Both revenues and solar financing structures have come under pressure, arising from:

- lower wholesale electricity prices impacting the rationale for consumers to install solar panels;

- cost of living pressures impacting the ability to pay-out initial outlays;

- policy initiative scale-backs; and

- higher costs of borrowing (impacting both solar funding models and the level of disposable income that consumers have) – as shown in Figure 3.

Figure 3: Trends in the average retail electricity prices and the composite cost of borrowing for households in Europe

In Spain:

This decline happened a year earlier (ie in 2023), with around half the installations achieved compared to the prior year. This was mainly due to easing concerns over electricity prices, cost-of-living pressures, damaged reputation of access to subsidies (average waiting time for subsidies to reach households post-installation is 1+ year) and the exhaustion of the grant allowance pot (from EU-sourced funds).

Figure 4: Annual residential rooftop solar PV installations per market

In USA:

2023: The annual residential solar market grew by 23%, but there was a slowdown in installations the second half of the year. The overall annual growth was largely driven by a surge in customer demand in California to take advantage of more favourable net metering rules before switching to NEM 3.0 in April 2023. The increase in demand in California offset lower demand in other states due to high interest rates.

2024: We expect an 18% decline in annual residential solar installations – largely influenced by the decline in California (which represents ~35% of the total USA solar market), and interest rates remaining high.

Despite the issues we have identified, our outlook for both the European and USA market remains positive

Arguably, 2022 and 2023 were unique years in Europe’s solar deployment which were propelled by the energy crisis. Hence, the real comparison should be between year 2021 and 2024 – a remarkable 122% increase in annual installations.

We expect market recovery out to 2030, owing to customer fear of further retail energy price hikes and price volatility, falling solar equipment costs, increased electrification of the home and transport, (limited) policy incentives, regulatory requirements, market player push and greater availability of financing business models. Post-2030, all newbuild homes in EU-27 will be mandated to install solar panels.

We will be monitoring market dynamics through SOLARbase, our solar & battery market data platform, revising our 2024 forecasts accordingly in the second half of the year.

For our view on trends and how solar businesses have responded to the phenomenal solar market growth and recent downturn - see our Part 2 blog.

This publication is intended as a subjective analysis piece for information and general thought-generation purposes only. It does not constitute advice (professional, financial or otherwise) and may not be relied upon by the reader for investment decisions. The information contained herein is based upon publicly available information and we accept no responsibility for its accuracy or completeness.