The hidden challenge of upgrading incumbents’ energy retailers IT platforms

Energy transition Energy research New energy business models Flexibility research Technology

Launching new tariffs, offering explicit flexibility propositions, and giving customers access to advanced energy insights are just some of the growing expectations for incumbent energy retailers. However, one critical question often goes unasked is: Are they technically capable of meeting these expectations?

Can they bill these new, more complex tariffs? Can they provide third-party aggregators with the data needed to monetise demand-side flexibility? Can they launch new smart energy propositions quickly enough to remain competitive with the more agile disrupters?

Unfortunately, for many incumbent energy retailers, the answers to these questions are often no. Or at least, not quickly enough for them to be able to keep up with the rapid pace of the energy transition.

The root of the problem lies in the IT systems that incumbents use to manage billing and customer interactions. Mostly overlooked so far, these systems are a key piece of the energy transition puzzle.

What are Retail IT platforms?

Think of the Retail IT Platform as the engine of an energy retailer. This digital architecture handles daily business processes, primarily managing the cashflows from the sale of energy to customers.

Core capabilities performed within the Retail IT Platform include:

- Billing: invoicing customers based on meter readings, managing financial flows, tracking payments, accounts receivable and debt management, as well as linking with external payment methods.

- Customer management: end-to-end tracking of the customer from account setup to account closure, including storage of key customer data and contracts, and cross-channel tracking of interactions from onboarding onwards.

- Market messaging: communication with other stakeholders of the electricity market about customers, including managing customer transfers between retailers, and managing metering data with Distribution System Operators (DSOs).

What do incumbents’ Retail IT Platforms look like?

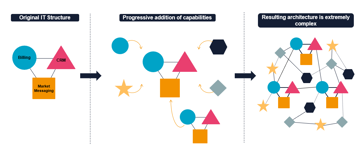

Although the evolution of each company’s Retail IT Platform is unique, it can, in many cases, be summarised as follows:

At first, incumbents started using an Enterprise Resource Planning (ERP) platform, like SAP or Oracle, to manage the billing of their customers, to which they added a Customer Relationship Management (CRM) software like Salesforce and a market messaging middleware. The software was most often installed on-premises and relied on batch-processing, making updates expensive, cumbersome and therefore infrequent. In this initial architecture, end-customers were seen as nothing more than meter points, and the goal of the platform was solely to manage cashflows and the sale of kilowatt-hour (kWh).

Then, as the role of the incumbents evolved, they started adding capabilities on an ad-hoc basis to the previous software. Their IT structure got progressively more complex, with data layers being added to legacy software that weren’t designed to allow for seamless integration. This often resulted in poor data management and data sprawl, making any update complex and lengthy due to the risk of cascading failures.

Most incumbents currently have these sprawling Retail IT Platforms, and it is increasingly proving to be a challenge for them. First of all, the complex architecture and poor data management can result in inaccurate billing and poor customer service. In fact, there are numerous examples of incumbent energy retailers getting fined for customer service failures directly attributable to their Retail IT Platforms. For example, Scottish Power received a million customer complaints after implementing a new SAP system, resulting in a £18m fine in 2016.

Second, if incumbents are already struggling to do the core of their job correctly – selling energy to customers – how do we expect them to evolve with the energy transition? Introducing new tariffs, providing smart meter data disaggregation or integrating with the ecosystem of third-party applications needed as part of the VPP (Virtual Power Plant) value chain require:

- A streamlined digital architecture in which modules can function independently and communicate through well-defined interfaces and protocols – usually APIs.

- The ability to collect and process large amounts of data while keeping the cost to compute low.

- A flexible development approach and the ability to do ongoing improvements to the platform outside of major updates.

With their current Retail IT Platform, incumbents take years to launch new propositions, need to go through complex and risky updates of their systems every few years, and might already struggle to bill export tariffs, let alone dynamic or type-of-use tariffs. Overall, this is presenting an increasing threat to their competitiveness in front of disruptive energy retailers who can do more, more quickly.

Incumbents will have to re-platform to remain competitive

The residential energy transition is requiring incumbents to shift from account management towards customer engagement. If they want to be able to join in, incumbents will ultimately have to streamline their Retail IT system by re-platforming to a Retail IT Platform that is cloud-based, processes data in real-time, is modular and built around a strong API structure.

Re-platforming is undoubtedly complex. E.ON, for example, took 27 months to migrate 8.7 million accounts from 11 separate platforms onto Kraken. Similarly, British Gas began migrating its 7 million UK customers to its new ENSEK platform in 2021, and the process is ongoing.

For this very reason, incumbents have been avoiding to re-platform as they perceive the risks and costs to be too high. However, with the rapid changes of the energy sector, the risks of NOT re-platforming might have now become higher.

We strongly urge incumbents to view their Retail IT Platforms as a critical barrier to competitiveness in the residential energy transition. Additionally, those working with incumbents should not assume these companies can easily meet new technical demands, whether launching a new tariff or providing better APIs to third-party partners.

Unlock deeper insights on LCP Delta's subscription portal

Check out our portalSubscribe to our thinking

Get relevant insights, leading perspectives and event invitations delivered right to your inbox.

Get started to select your preferences.