The world has changed, has your portfolio?

Of course, we all know a lot has changed over the last decade or two. Not least in markets and asset classes. But have we really internalised these changes? Have we properly built them into the design of portfolios and investment propositions that we offer to individual savers? Perhaps not.

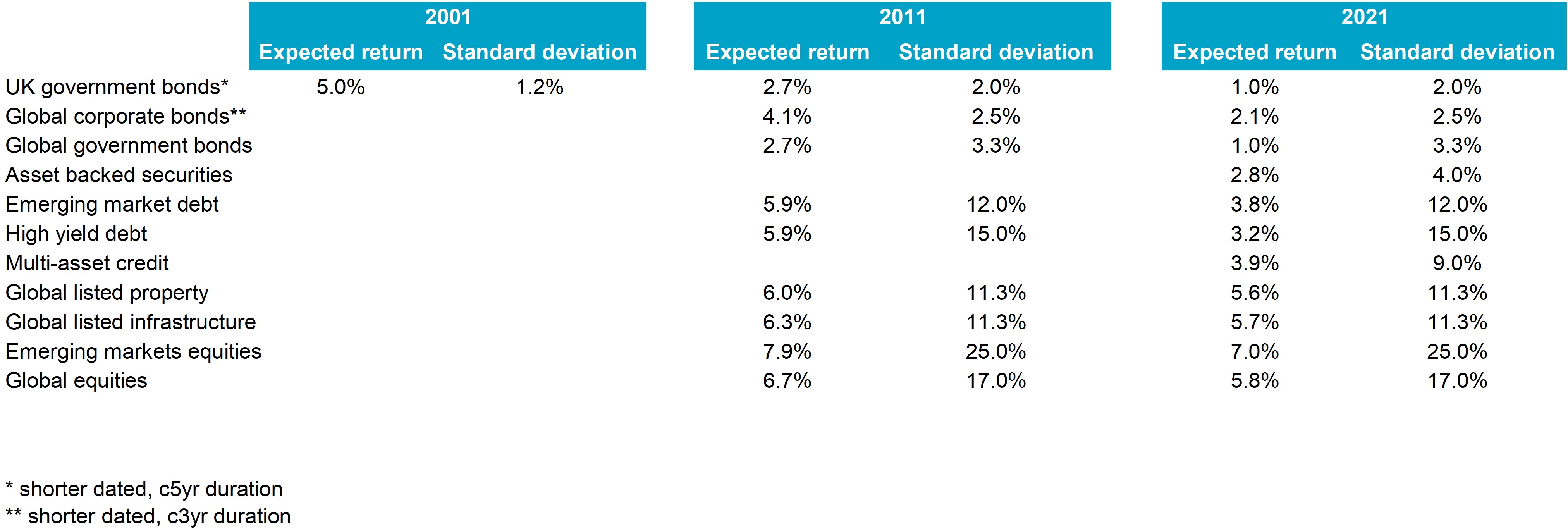

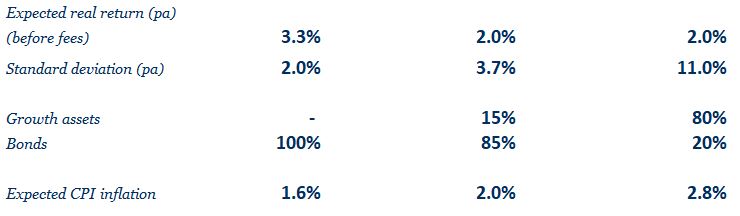

What we find here is that the asset allocation you need to achieve a set level of return above inflation (here we look at 2% per annum (“pa”) above inflation, both before and after the deduction of fees) has changed radically over the last 20 years. Today you need quite an “adventurous” portfolio to deliver this level of return (even more so after fees). Back in the “good old days”, a gilt portfolio could have got you there and more. But has the industry adapted to this? We think often not. Many propositions still offered today are expected to deliver less-than-desirable outcomes (in real terms and after the deduction of fees).

Two decades ago, you could get reasonable returns by investing in a relatively low-risk bond strategy such as a combination of government and corporate bonds. You could have yielded a 3.3% pa return above inflation by solely investing in UK government bonds (10 year gilts).

However, the current economic landscape paints a completely different picture for investors. Macroeconomic events such as the Financial Crisis of 2007-08 and the more recent Covid-19 Pandemic have driven interest rates down to historic lows, meaning lower-risk bond strategies can no longer deliver the level of returns seen in 2001.

Today, you have to invest in a far riskier strategy to have any chance of seeing your investments grow at this rate. This typically means you will need to invest a higher proportion in growth assets such as equities, property & infrastructure assets and high-yield bonds. As you can see in Chart 1, to target a 2% pa return above inflation (before the deduction of fees) today, we estimate that you would need to invest 80% of your portfolio in growth assets. And to think, back in 2001, one could have easily matched these returns by simply depositing their money in a high street bank!

Chart 1 – To target a 2% pa return above inflation (before the deduction of fees) today, we estimate that you would need to invest 80% of your portfolio in growth assets.

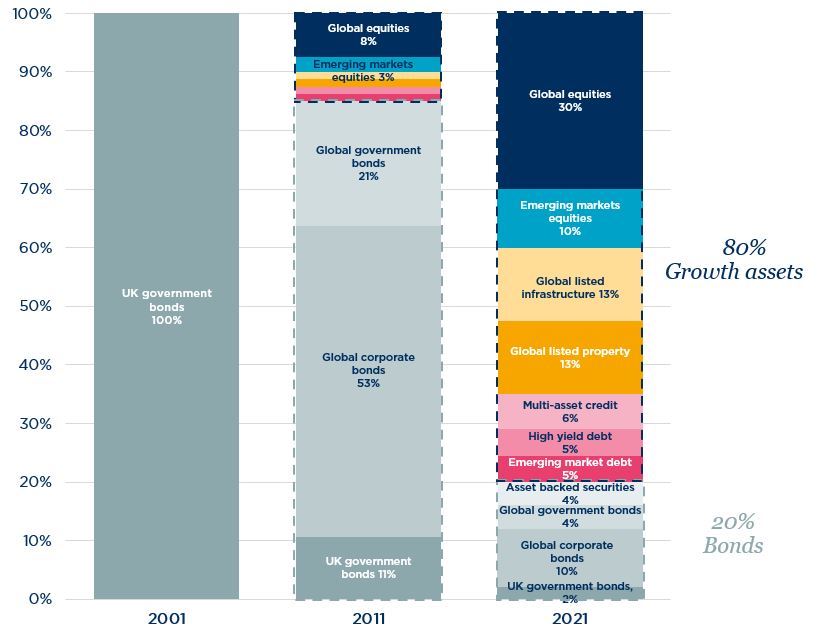

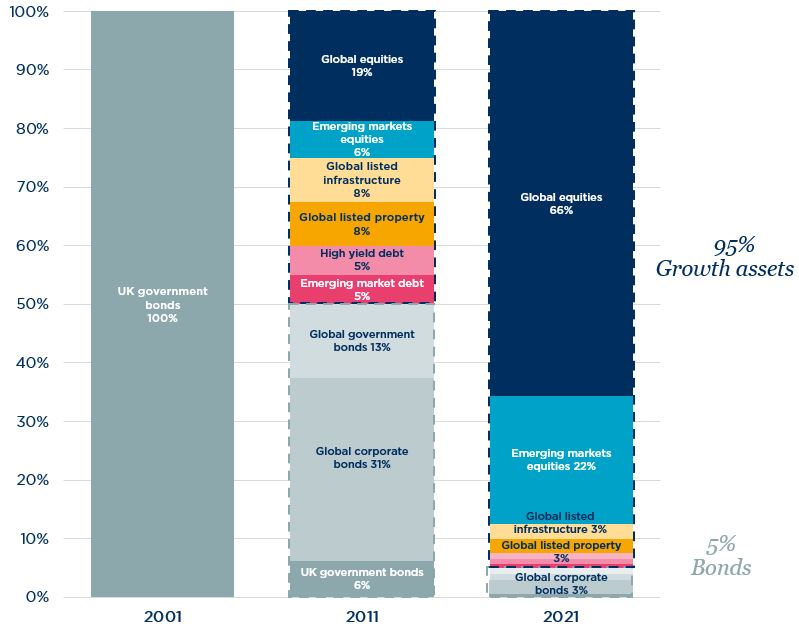

Think this is bad? It’s even harder to stomach once you allow for the typical costs of investing, such as advisory and management fees. We have made a deduction of 1% pa which might include asset management, platform and advisory costs. Some investors pay far more for this. For more information on fund manager fees watch out for our LCP Fee Survey in February.

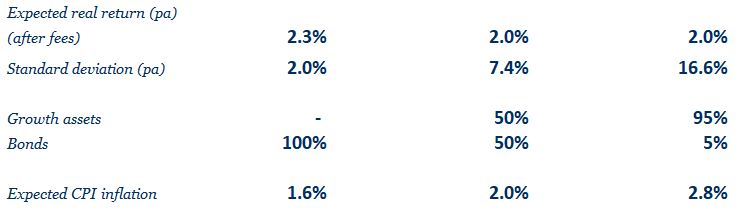

In 2001, the government bond portfolio would have yielded a real return of around 2.3% after the deduction of fees. Today, however, to target a 2% pa real return, we estimate that you would need to invest 95% of your portfolio in riskier growth assets.

Chart 2 – To target a 2% pa return above inflation (after the deduction of fees) today, we estimate that you would need to invest 95% of your portfolio in growth assets.

These charts show a potentially alarming, but important-to-know progression towards higher-risk, more complex strategies, for even lower reward. As shown, this effect is amplified further when you take fees into account.

For example, you might have invested into a balanced portfolio, investing say 60% in growth assets and 40% in bonds (this classic “60/40” portfolio has been a very common asset allocation strategy). A decade ago this portfolio would have been expected to earn healthy returns above inflation but these days this combination might barely grow faster than inflation after fees. We are seeing examples of asset managers amending performance targets on balanced funds to no-longer reference returns over inflation.

Why is this?

As I mentioned earlier, the key reason for this is the relentless decline of interest rates. Just before the 2007-08 Financial Crisis, interest rates were around 5%. With the objective of stimulating the economy, the Bank of England reduced interest rates to 0.5% in under a year. Since then, rates have hovered between 0 and 1%, the direct impact of low-interest rates is that future returns on bonds are reduced, but this impacts all investments in some way as the risk-free rate is a fundamental starting point in assessing expected returns of all asset classes including equities.

Other factors are also at play here, including the dilemma of disappearing dividends and increasing inflation, but the conclusion is the same: in the current market environment, you need to make your investments work harder to try to get out as much growth as you can within your risk tolerance and constraints.

All this is based on LCP’s central assumptions for future long-term returns, which are based on historical market data and our own judgements. Other participants such as large asset managers also produce their own expected returns, which will differ, but this broad conclusion usually remains the same.

How do you do this?

1. Get more out of your bonds portfolio

Allocating to asset classes such as asset-backed securities, shorter-dated corporate bonds and emerging market debt could refresh your bonds portfolio to capture additional returns beyond what you can now get from a traditional gilts portfolio.

2. Diversify and ensure you invest in efficient portfolios

Gone are the days when UK investors were limited to the UK stock market and government bonds. Global assets are now easily investible at reasonable costs giving you options to invest in assets in the US, Japan, Europe, China, Indonesia, Brazil and more across a vast range of sectors … in a low return world we recommend you make the most of these options including specifically

- investing bonds and equities globally, as opposed to just the UK;

- growth credit, such as high-yield debt and global multi-asset credit;

- emerging market equities and debt; and

- global real assets such as infrastructure and property.

Get in touch with our experts if you would like to hear more about how to bring all these asset classes together to create efficient risk-graded portfolios

3. Invest for as long as you can

If you’re investing in growth assets, you need to keep those investments in the market for as long as possible so they have time to recover from a potential market downturn. The pandemic has led to many ‘accidental savers’, and this fortunate group could benefit from investing these savings in a long-term strategy for their future.

On top of this, now that auto-enrolment is well established for employees, there are millions more individuals with long-term savings pots who should be thinking carefully about how they plan to invest those savings. If you are early in your career for example, It might well be very reasonable for you to embrace investing the majority of your savings in growth assets.

4. Minimise your fees – think about where to use active management

Individual savers tend to be hit by layer-upon-layer of fees – you may have adviser fees, platform fees and underlying manager fees, all eating away at your investments. Consultancy the Lang Cat found that average advised costs could be as high as 12.18% per year. Many investors are now migrating towards passively managed funds in areas of the market which historically have shown little evidence of managers consistently outperforming the wider index (such as developed equities). This not only lowers reliance on manager skill, but also significantly reduces management fees.

However, we do advocate active management in some “inefficient” markets, such as emerging markets.

There’s no indication that this dilemma of having to take more risk to deliver the level of returns seen in the early 2000s will reverse any time soon. Financial advisers should be ensuring their clients’ portfolios are optimised to help them achieve their objectives, as it’s simply not as easy as it was 20 years ago. The steps above are a great starting point, but for more tailored advice specific to your own requirements, feel free to contact our private wealth experts at LCP.

Our risk and return assumptions: