Time for solar asset-backed securities to shine in Europe

Energy transition Investment Energy research Solar & battery research

In this blog, Dina Darshini and John Parnis-England discuss the role solar asset-backed securities can play in driving residential solar PV deployment in Europe.

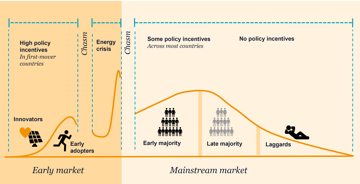

We are on the cusp of crossing “the second chasm” in the residential solar PV technology adoption curve here in Europe (see Fig. 1). The theory follows that as a technology is deployed more widely, the needs and customer profiles shift. ‘Innovators’ and ‘early adopters’ may be willing to pay cash for solar PV systems because they are enthusiastic about the technology, affluent, and/or eco-conscious. But the ‘early majority’ will need more convincing. As generous government support schemes wane out, a post-subsidy world requires market players to incorporate other elements into their solar PV value proposition like “x% savings on electric bills” or “zero upfront cost, care-free packages”.

Figure 1: Customer profiles per market stage in the technology adoption curve

We expect that over the course of this next two decades, solar loans, leases, PPAs, and green mortgages will grow in popularity in Europe.

Put simply, if you create a marketplace whereby financing solutions are widely available and easily accessible for mainstream consumers, one of the most significant barriers (ie high upfront cost) is removed and adoption will be accelerated.

What are solar asset-backed securities (ABS)?

Solar ABS are securities that are collateralised, secured by pools of consumer receivables (consisting of solar loans, leases, or PPA contracts). The basic premise involves packaging cash-flow generating assets together into one securitised product (rated as “investment grade” by rating agencies) and selling them on to institutional investors.

An example scenario:

A solar PV provider (“Originator”) finances the purchase of solar PV systems upfront and provides 20-year leases to households. The Originator also creates a special purpose vehicle (SPV) that can bundle thousands of leases. The SPV (“Issuer”) then issues new debt securities based on the cash flows from the selected solar leases. Investors buy the solar ABS and receive periodic returns. The capital that the Originator / Issuer receives can then be used to finance more solar projects.

This process is repeated, increasing liquidity for the market, and ultimately reducing the cost of capital for solar end-customers (households).

A key benefit of an SPV is that it can continue to operate regardless of whether the Originator remains solvent or not. As such, a lender is exposed only to the risks associated with the solar contracts in the SPV, rather than the financial risk of the Originator’s whole business. Using this approach, debt costs can be lowered when compared to traditional financing methods.

The benefits of solar ABS to solar PV providers include:

- Low risk ABS portfolios can reduce cost of capital (which can be used to pay off more expensive debt, as well as fund future growth at more attractive rates).

- Diversification of capital sources (for example, equity in an SPV can be sold to raise cash).

- It enables assets to be moved off the Originator’s standalone balance sheet, which can improve its financial ratios (eg debt to equity ratio), which can be attractive to investors and creditors.

The European vs. USA solar-ABS market

Despite Europe being ahead in terms of residential solar deployment, the USA solar market is no stranger to solar-ABS. It’s been a decade since the first solar securitisation in USA. From 2013 – 2022, the USA boasted an aggregate solar-ABS issuance volume of over $20 billion across offerings of different sizes, tenors, and ratings.

So, what’s the deal with Europe?

Scale is key when creating a viable securities marketplace, and the European residential solar PV provider market is very fragmented, with only a few market players having individual market shares above 1% (in terms of annual installations). This means that there aren’t enough mid-to-large sized pools of homogenous solar loans, leases, or PPA contracts for an Originator / Issuer to sell-off. This, amongst other factors, could promote further market consolidation.

But as Europe’s solar market booms and market players race to scale, so too has Europe inaugurated its first solar securitisation deals. In mid-2022 and early 2023, contracts originated by Perfecta Energia (a Spanish solar PV provider) and Enpal (German solar PV provider) respectively formed the basis of Europe’s first two solar ABS warehousing facilities. Perfecta Energia launched a €133.5 million securitisation fund. Enpal raised €365 million debt commitments for its ABS facility, which it is using to finance more than 12,500 new solar projects.

But wait… why does all this ‘securities talk’ sound so familiar?

For the average person outside the Finance industry, the term ‘securitisation’ might mostly be associated with the subprime mortgage bubble burst in 2008 (which led to a global financial crisis). But the truth is securitisation also revolutionised mortgage finance and accelerated home ownership, by converting individual mortgages into tradeable securities, increasing liquidity across the market.

Luckily for the solar market, solar ABS looks like a safer investment, as the end-customers of these loans, leases, and PPAs tend to be eco-conscientious households with high credit scores. However, it is worth noting that ‘Early Adopters’ tend to be more affluent, and it is possible that the credit quality will reduce as the market enters more mainstream consumers.

What could boost the European solar-ABS market?

- Better quality data, rigorous analysis, and accurate forecasting: This will help investors better understand key risks such as customer default rates, contract renegotiation risks, volatility in future electricity prices, policy risks, technology performance risks and more. These factors are critical to the economic value proposition of long-term fixed-fee solar leases and PPAs. The more clarity on such risks, the more comfortable credit rating agencies and investors will be, which should facilitate a reduced cost of capital and promote higher transaction volumes.

- Standardisation of contracts: This enables large enough asset pools of similar quality solar contacts.

- Pooling of cash-flow generating assets: We expect there to be greater market consolidation and heightened investment flows supercharging the growth of some solar PV providers over the next 7 years. A less fragmented providers market will help build up large enough portfolios. However, in the nearer-term, an interim solution could be combining contracts originated by various Originators.

Like in the USA, we believe solar-ABS does have a role in spurring the residential solar market here in Europe. It is an attractive consideration for investors with ESG investment mandates wanting to get exposure to a new class of debt instrument. Win for the investor, win for the solar PV provider, win for solar households able to access affordable financing options and be on their energy-transition journey, and win for the environment.