How we helped a Lloyd's syndicate client to successfully boost their yield and reduce their investment fees significantly

Investment Insurance consulting Performance monitoring Investment strategy Technology

John and Greg helped us to achieve a great result – by helping us reset our investment strategy; boosting the yield of our investments; achieving a significant reduction on our fees; and working closely with ourselves to transition the portfolio to the new investment manager. They used interactive technology and insurance market insights to help our Board and Exec make good decisions quickly.

LCP client

Our client was invested entirely in short-dated corporate bonds and cash. They were mindful that market conditions had changed significantly over recent years, and carried out a review to ensure their investments were well-positioned for the future.

We helped them to enhance their investment strategy in three simple steps:

Step 1: Using market-leading technology to enhance their bond portfolio, in an intelligent way

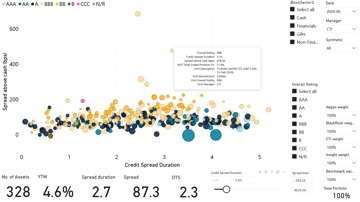

We used innovative look-through tools to clearly show the key characteristics of each of our client’s investments, at an individual security level. This included the duration, yield, credit spread, credit rating, ESG rating, instrument type, sector, region and currency of each security.

This interactive analysis revealed some rich insights that had been masked by summary statistics, and quickly gave our client confidence to make changes to their investment guidelines, to materially boost yield in a risk-controlled way.

For this client, we complemented our look-through analysis with peer benchmarking on other Lloyd’s syndicates, and we used interactive polling technology to survey the views of our client’s key investment stakeholders. We also worked closely with their finance team to ensure the shape of the bond portfolio was an appropriate fit for the shape of the claims liabilities.

Look-through portfolio analysis

This image is for illustration purposes only.

Step 2: Using competitive tension – and LCP’s scale – to achieve excellent terms from the investment manager

Once our client had agreed the desired characteristics for their bond portfolio, we approached a number of investment managers that we knew would be well-placed to deliver the client’s specific objectives. Our work on the initial step ensured we were clear on what the client wanted, which meant each investment manager’s proposal really hit the mark, and we received very high quality submissions.

Competitive tension between the investment managers throughout the selection process allowed us to achieve excellent terms – reducing our client’s fees by more than half and achieving a better service, which is much more tailored to the client’s specific requirements.

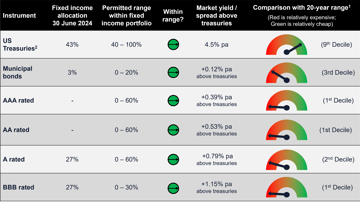

Step 3: Ensuring the investments are dynamic, so they remain well-positioned in the future

Whilst our client had a clear view on the bonds they wanted to hold immediately after the review, we know that market conditions will change in future. Some parts of the market will become more attractive over time, and the outlook for other assets will worsen.

We helped our client to get on the front foot with this, by designing a monitoring dashboard with clear parameters for reviewing their bond portfolio in future. This has given our client confidence they will identify opportunities and risks early – and are well-placed to act quickly if needed.

Asset allocation and market pricing: Your government bonds and corporate bonds

This image is for illustration purposes only.

Please get in touch with our insurance investment specialists to ensure your assets are well-positioned for the future.