2022 another strong year for UK pension risk transfer as the market gears up for a sharp acceleration over 2023-2025

Pensions & benefits Pension risk transfer Risk

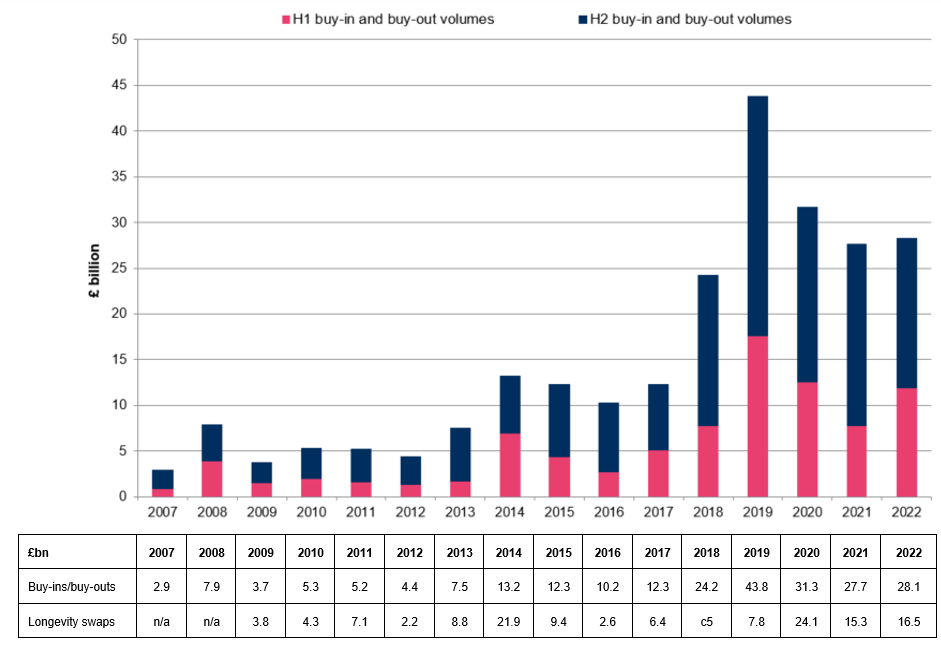

Analysis of insurers’ 2022 results by Lane Clark & Peacock (LCP) shows that the UK pension risk transfer market finished strongly in 2022 to reach £44.7bn across buy-ins, buy-outs and longevity swaps, despite the dampening effect on volumes of dramatic increases in gilt yields in the second half of the year. This compares to £43.9bn in 2021 and makes 2022 the third-highest year on record (behind 2019 and 2020). LCP is predicting a surge in demand to drive record-breaking volumes over 2023-2025.

For buy-ins/outs in isolation, volumes reached £28.1bn in 2022 (2021: £27.7bn), with £16.1bn of transactions completed in the second half of the year (H2 2021: £19.9bn).

LCP’s analysis is based on the insurers’ final reported results for 2022, including Rothesay’s results released today. Full data is set out at the end of the release, but key findings include:

- For the first time, six insurers secured a 10% plus market share, up from five in 2021, four in 2020 and three in 2019. These six were Legal and General (L&G), Standard Life, Aviva, Pension Insurance Corporation (PIC), Rothesay and Just, together writing 96% of 2022 buy-in/out volumes.

- L&G wrote the highest buy-in/out volumes with £7.2bn (26% market share), transacting the two largest deals of the year – two buy-ins totalling £4.3bn with the British Steel Pension Scheme.

- Behind L&G – Standard Life, Aviva and PIC all wrote over £4bn, with Rothesay on £3.4bn. Just grew its market share, increasing volumes by nearly 50% to £2.8bn and writing its largest transactions yet.

- Dramatic increases in gilt yields over 2022, coupled with improved insurer pricing, saw buy-out funding levels improve for many UK schemes, with LCP estimating that nearly 1 in 5 were fully funded on buy-outs. This has led to an acceleration in market activity which we expect to drive record-breaking volumes over 2023-2025. Last month saw the largest ever buy-in/out in the UK, a £6.5bn full buy-in by RSA’s pension schemes with PIC, with LCP acting as lead transaction adviser to RSA and its parent, Intact.

- Another consequence of improved funding was that pensioner-only buy-ins, historically the most popular route for schemes to de-risk, comprised only a quarter of volumes in 2022, down from c70% five years ago. Canada Life entered the market for non-pensioners last year, meaning all eight insurers are now writing full scheme transactions. In conjunction with schemes maintaining higher LDI collateral levels following the LDI crisis, we expect full scheme transactions to predominate in 2023.

- Six longevity swaps were announced by UK schemes in 2022 totalling £16.5bn (FY 2021: five longevity swaps totalling £15.3bn). The largest longevity swap was £7bn between Barclays Bank UK Retirement Fund and Prudential Insurance Company of America. Four of these were follow-on transactions extending existing longevity swaps, and the UBS longevity hedge covered the scheme’s older (60+) deferred pensioners.

- With a strong focus on improved buy-out funding levels, alternative de-risking solutions had a relatively muted year. L&G wrote three Assured Payment Policy (APP) transactions, totalling under £100m, and there were no DB superfund transfers.

Charlie Finch, Partner at LCP, commented: “2022 was a strong year for UK pension risk transfer with the third highest volumes on record despite higher gilt yields and the market volatility following the LDI crisis. We are currently seeing a surge in demand for buy-ins/outs following dramatic improvements in buy-out funding levels last year, and we expect this to drive record-breaking volumes over 2023-2025. We anticipate growth in larger £1bn plus buy-ins this year as larger schemes assess buy-in options following the RSA schemes’ record-breaking £6.5bn buy-in with PIC last month, for which LCP was delighted to act as lead transaction adviser to RSA and its parent, Intact.

“In response to these shifts in market dynamics, we have been innovating how we prepare and take schemes to market. We were proud to develop solutions that allowed transactions to proceed in challenging conditions following the LDI crisis. Innovation will be key as the market adapts to higher activity and volume levels, whilst ensuring it can continue to serve schemes of all types and sizes.”

Ruth Ward, Principal at LCP, commented: “2022 was a vibrant, competitive market with an unprecedented six insurers securing a 10% plus market share. It’s welcome news that all market participants are now able to transact with non-pensioner members, aligning with the continuing shift from pensioner-only to full scheme transactions.

“This provides a competitive backdrop as we enter a new busier phase for the market that will test operational capacity at insurers and make it harder to secure quotation capacity from them, with some insurers declining two out of three deals. To thrive in this environment, more than ever, schemes must undertake focussed preparation guided by an experienced de-risking adviser if they want to beat the insurer triage and secure competitive buy-in/out quotations.”

Further information on how to beat the insurer triage can be found in LCP’s recent blog.

Buy-in/buy-out volumes in the UK by insurer:

|

Insurer |

H1 2022 (£bn) |

H2 2022 (£bn) |

Total 2022 (£bn) |

2022 share |

Total 2021 (£bn) |

2021 share (rank) |

|

1. Legal & General |

3.7 |

3.5 |

7.2 |

26% |

5.3 |

19% (3) |

|

2. Standard Life |

1.6 |

3.2 |

4.8 |

17% |

5.5 |

20% (2) |

|

3. Aviva |

1.9 |

2.6 |

4.4 |

16% |

6.2 |

22% (1) |

|

4. PIC |

2.4 |

1.7 |

4.1 |

15% |

4.7 |

17% (4) |

|

5. Rothesay |

1.0 |

2.4 |

3.4 |

12% |

3.0 |

11% (5) |

|

6. Just |

0.6 |

2.2 |

2.8 |

10% |

1.9 |

7% (6) |

|

7. Scottish Widows |

0.4 |

0.5 |

1.0 |

3% |

0.1 |

0% (8) |

|

8. Canada Life |

0.3 |

0.0 |

0.3 |

1% |

1.0 |

4% (7) |

|

Total |

12.0 |

16.1 |

28.1 |

100% |

27.7 |

100% |

Source: Insurance company data. Only buy-ins and buy-outs with a UK pension scheme are included. The data, therefore, excludes the APP transactions by L&G (£925m in 2021 and £93m in 2022) and overseas transactions for L&G. Just’s volumes reflect gross premiums before allowance for any liabilities being reinsured by external partners. Note the totals may not sum due to rounding.

The chart and table below set out the volume of buy-ins and buy-outs each year since 2007.

Named buy-in/ buy-outs over £100m in 2022/23:

|

Company / scheme |

Size (£m) |

Insurer |

Type of transaction |

Date |

|

Heathrow |

370 |

L&G |

Pensioner buy-in |

Jan-22 |

|

Nationwide |

170 |

Canada Life |

Pensioner buy-in |

Jan-22 |

|

Church of England |

160 |

Aviva |

Pensioner buy-in |

Feb-22 |

|

Newell Rubbermaid |

230 |

L&G |

Full buy-in |

Feb-22 |

|

Findel Group |

160 |

Standard Life |

Full buy-in |

Mar-22 |

|

House of Fraser |

600 |

PIC |

PPF+ buy-out |

May-22 |

|

British Steel |

2,260 |

L&G |

Pensioner buy-in |

May-22 |

|

De La Rue |

320 |

Scottish Widows |

Pensioner buy-in |

May-22 |

|

TI Group |

640 |

Rothesay |

Full buy-in |

Jun-22 |

|

Aviva |

800 |

Aviva |

Deferred and pensioner buy-in |

Jun-22 |

|

Whitbread Group |

670 |

Standard Life |

Pensioner buy-in |

Jun-22 |

|

Sappi |

150 |

Standard Life |

Full buy-in |

Jun-22 |

|

Barloworld |

480 |

Just |

Full buy-in |

Jul-22 |

|

EDS |

1,130 |

PIC |

Full buy-in |

Jul-22 |

|

WH Smith |

1,100 |

Standard Life |

Full buy-in |

Aug-22 |

|

Cobham |

530 |

Standard Life |

Full buy-in |

Aug-22 |

|

Yell |

370 |

PIC |

Full buy-in |

Sep-22 |

|

Interserve |

440 |

Aviva |

PPF+ buy-out |

Oct-22 |

|

British American Tobacco |

200 |

PIC |

Full buy-in |

Oct-22 |

|

Spirent |

140 |

PIC |

Full buy-in |

Oct-22 |

|

Agfa |

180 |

Standard Life |

Full buy-in |

Nov-22 |

|

TT Group |

400 |

L&G |

Full buy-in |

Nov-22 |

|

Tioxide |

430 |

L&G |

Full buy-in |

Nov-22 |

|

Tomkins |

140 |

PIC |

Full buy-in |

Nov-22 |

|

Coats |

350 |

Aviva |

Pensioner buy-in |

Dec-22 |

|

British Steel |

2,060 |

L&G |

Deferred and pensioner buy-in |

Dec-22 |

|

Pearl Group |

560 |

Standard Life |

Full buy-in |

Dec-22 |

|

Co-operative Bank |

1,200 |

Rothesay |

Full buy-in |

Dec-22 |

|

Brit Insurance |

110 |

Just |

Full buy-in |

Dec-22 |

|

Morrisons |

760 |

Rothesay |

Full buy-in |

Dec-22 |

|

IMI |

180 |

PIC |

Full buy-in |

Dec-22 |

|

Amey |

390 |

PIC |

Full buy-in |

Dec-22 |

|

Arcadia |

850 |

Aviva |

Full buy-in |

Jan-23 |

|

RSA Group |

6,500 |

PIC |

Full buy-in |

Feb-23 |

|

GKN Group |

510 |

Just |

Full buy-in |

Mar-23 |

Source: Insurance company data for 2022. Public announcements for 2023. Excludes deals where scheme name is not disclosed.

Longevity swaps in 2022/23:

|

Company/ Scheme |

Size £m |

Structure |

Intermediary |

Reinsurer (where disclosed) |

Date |

|

Lloyds Bank |

5,500 |

Fully intermediated |

Scottish Widows |

SCOR |

Feb-22 |

|

UBS |

500 |

Pass-through |

Zurich |

Canada Life |

Jul-22 |

|

Undisclosed |

800 |

Pass-through |

Zurich |

Prudential Insurance Company of America |

Jul-22 |

|

Undisclosed |

1,000 |

Pass-through |

Zurich |

Partner Re |

Nov-22 |

|

Balfour Beatty |

1,700 |

Pass-through |

Zurich |

SCOR |

Nov-22 |

|

Barclays |

7,000 |

Captive Insurer |

Captive |

Prudential Insurance Company of America |

Dec-22 |

Previous transaction data can be found in the appendix to LCP’s De-risking Report 2022, “Insurance enters a new phase: a skyrocketing market” available at: LCP transaction data 2022 (dynamics.com).

Link to the full report here: LCP pensions de-risking report 2022 (dynamics.com)