“Government set to write to hundreds of thousands of ‘mothers missing millions’ - but not everyone will get a letter” – Steve Webb

Pensions & benefits Personal finance

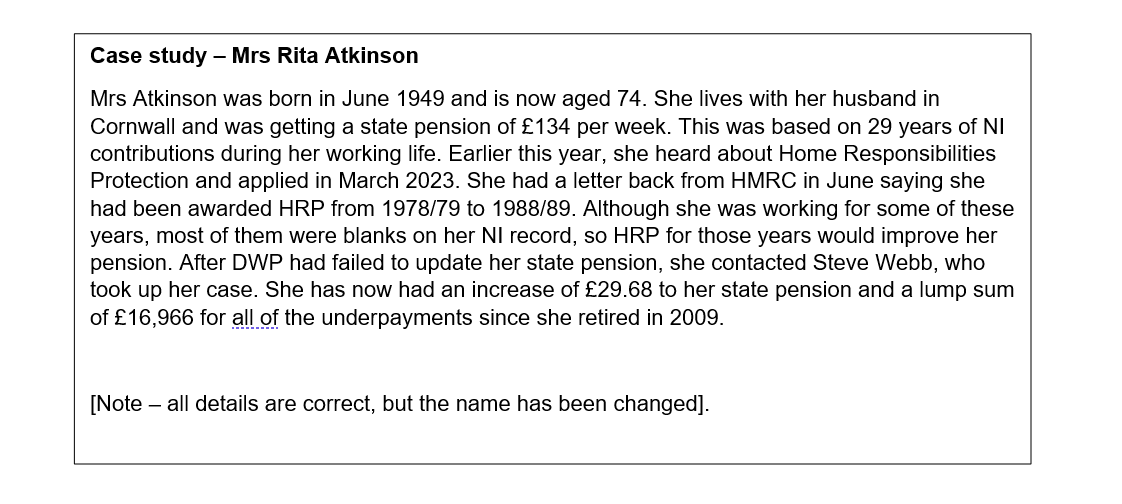

In its 2022/23 Annual Report, DWP published its first estimates of the scale of errors on state pensions arising from failure to record time at home with children on National Insurance records. The system known at the time as ‘Home Responsibilities Protection’ (HRP) boosted the state pension position of parents, mostly mothers who received child benefits and were not in paid work. But in over 200,000 cases, the government admits that this information is missing, particularly for those in receipt of Child Benefit before the year 2000. DWP estimates that they may have to spend over £1 billion in paying state pension arrears by the time they have sorted out the problem. Many of the mothers affected are now over state pension age.

In terms of the scale of the problem, the DWP annual report says:

- The total amount underpaid could be £1.3 billion, with 210,000 people affected; of these, 150,000 are still alive, and around 60,000 are now deceased (and hence were never paid the correct pension).

- DWP thinks it is likely to reach about 90% of cases where the person underpaid is still alive and 75% where the person has died; on this basis, it has set aside £1 billion in its annual accounts and expects to track down around 187,000 people (or their heirs).

- The typical state pension arrears payment in these cases will be around £2,000, but because some people will be owed far more than this, the ‘mean’ payment will be around £5,350 (£1 billion divided by 187,000).

A big problem, however, is that HMRC does not know whose NI records are incorrect because data on child benefit receipt has not been retained. It is, therefore, planning a two-pronged strategy with a mixture of writing to those it has identified as ‘most likely’ to be affected, as well as general publicity to encourage people to come forward.

With regard to the letter-writing campaign, civil servants giving evidence to the Public Administration Committee on Monday (18th September) told MPs that they expected the process of contacting potentially affected parents would start this month, with letters being sent out over an 18-month period. Those over pension age will be the first to be contacted. Those receiving letters will be invited to put in a claim for HRP if they meet the relevant criteria. The main rules which apply from when the system was introduced in 1978/79 are:

- You were receiving child benefits in your own name (not that of a spouse or partner).

- Your child was under 16 for the whole of the financial year in question.

- You were not paying the married woman’s ‘reduced stamp’.

However, because HMRC is having to make an educated guess as to which groups of people are most likely to be affected, it seems very likely that not all of those who are being underpaid will receive a letter. They will, therefore, be dependent on seeing general publicity and proactively putting in a claim. This may be particularly true where the person who was underpaid has since died, and it is their heirs who would need to make a claim.

Commenting, Steve Webb, Partner at LCP who has campaigned on this issue for over a decade, said:

‘It is truly shocking that so many people have been underpaid because of errors on their National Insurance record for time at home with children. It is even worse that tens of thousands of people, mostly mothers, died without ever receiving the correct state pension. It is vitally important that HMRC and DWP are open and transparent about this whole process and that every effort is made to track down all those who may be entitled’.