Investment in new energy start-ups and scale-ups quadruples, with the UK, Germany, the Netherlands, and Sweden leading in Europe

This content is AI generated, click here to find out more about Transpose™.

For terms of use click here.

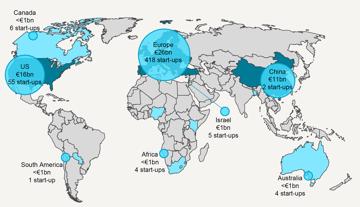

Investment in energy start-up and scale-up companies has risen sharply, according to LCP Delta’s Follow the Money Dashboard.

The dashboard shows that funding grew from €10 billion in the four years leading up to 2020 to over €40 billion between 2021 and 2024.

Leveraging data from Dealroom.co, LCP Delta’s interactive tool offers insights into the growth and funding of 500 new energy start-up and scale-up companies.

For one, EVs and solar are popular with investors, securing significant funding. Although only nine EV car manufacturers are in the database, they account for 30% of the total funding. Solar companies are also increasingly receiving large debt deals to support installations.

In terms of emerging areas, heating and flexibility have traditionally attracted less investment, but both are showing signs of growth. In 2024, heat pump start-ups secured two major debt financing deals. While the flexibility sector is still in its early stages, new companies continue to emerge, with 60% of start-ups in the database launched in the past year focused on flexibility.

Despite overall growth, some areas remain ‘untapped’ such as energy supply, which includes various company types, makes up 10% of the companies but only receives 2% of the funding. Some company types within the energy supply sector, such as digital-first energy suppliers, specialised back-office software providers, and platforms facilitating peer-to-peer energy trading, have greater potential for success than others.

Building energy management is similar, accounting for 8% of companies but only 1% of funding. Despite being a long-established sector that may not be considered the most innovative, several large funding rounds in recent years indicate investor interest is there.

In Europe, four key countries stand out for their presence in the new energy start-up ecosystem:

- The UK leads the database with 109 companies headquartered here, collectively securing €9 billion in funding. The start-up landscape is dominated by companies focused on EV charging, flexibility, and energy supply.

- Germany is home to 59 companies — around 12% of the database — and has attracted approximately €7 billion in investment, accounting for 13% of the total recorded. The market is dominated by EV charging and energy supply companies.

- The Netherlands follows closely with 44 start-ups in the database, securing nearly €3 billion in funding. EV charging companies are the most common, followed by energy efficiency and storage start-ups.

- Sweden, despite only having 18 companies in the database, has collectively received €2 billion, with many focused on solar, energy insights, and flexibility solutions.

LCP Delta’s Follow the Money Dashboard

As investment in new energy grows, some sectors attract significant interest while others remain underexplored. To stay competitive, it’s vital to reassess not just the heavily funded areas but also those receiving less attention, as they may offer untapped opportunities.

Nigel Timperley Research Manager, New Energy Strategies & Energy Insights+