LCP highlights the importance of schemes carefully managing their moves to buy-out and wind-up, with insurers and administrators working hard to overcome industry-wide resource challenges

Pensions & benefits Post-transaction and wind-up support Pension risk transfer Risk

There is an increasing need for dedicated, experienced practitioners to help insurers and pension schemes battle with resource and data challenges when moving schemes from buy-in, to buy-out and wind-up. Schemes need to plan ahead to avoid delays during the home stretch of their risk transfer journeys.

Insurers’ buy-out pipelines are seeing exponential growth

LCP’s recent insurer survey reveals that twice as many schemes are moving to buy-out this year than in 2022. The future pipeline also looks busy, with the number of schemes aiming to make this transition likely to double again in 2025 and beyond.

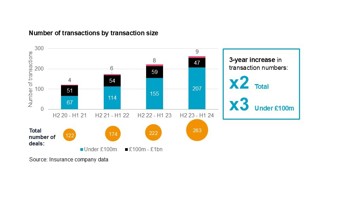

The key drivers are the significant increase in buy-in activity (see chart), including a three-fold increase in the number of deals under £100m over the last three years, coupled with a trend towards schemes completing full buy-ins. Full buy-ins now represent over 95% of all transactions and involve significantly more implementation work than pensioner-only buy-ins.

This has led to a huge growth in workloads for insurers’ post-transaction implementation teams and scheme administrators alike. And with LCP estimating that 50% of schemes are now fully funded or within 5 years of being fully funded on buy-out, this is certainly an area for longer-term focus and investment.

Significant work is needed after completing a full buy-in, to prepare to buy-out and wind-up a scheme.

Post-transaction work involves multiple workstreams and decisions requiring input from insurers, administrators, legal advisers, actuarial teams, trustees and sponsors, in addition to effective member communication. The first step after a full buy-in is to complete a full data cleanse, which often involves completing outstanding GMP projects and resolving any benefit and legal uncertainties (eg issues like the Virgin Media case).

A subsequent move to buy-out and wind-up involves further work – eg in relation to AVCs, DC accrual, historic annuities, settling small benefits etc – as well as ensuring a smooth handover of administration and payroll to the insurer. There may also be surplus assets to manage. This is a complex process that can take years to complete. Any delays can mean a scheme losing their position in the insurer’s implementation queue, putting the overall timetable at risk, and creating tension between different parties.

The industry is facing a number of key challenges in this area

- Insurers are working hard to build up their teams with the right skills and experience to cope with the queue of schemes that want to transition to buy-out and then wind-up.

- More schemes present more challenges as every scheme is unique. The exact route to buy-out will be different for each of them and bespoke solutions will be needed for scheme-specific challenges.

- Missing data cleanse deadlines agreed with insurers can put the whole project timetable at risk. There is heavy reliance on administrators for data cleanse work alongside other demanding projects (including Pensions Dashboards) as well as day-to-day administration.

LCP is urging trustees and sponsors to ensure that their buy-out and wind-up is carefully managed and that experienced, specialist support is brought in to help schemes navigate bespoke challenges, common pitfalls and resource bottlenecks.

Rachel Banham, Head of Post-Transaction services and Partner at LCP, commented: “The busyness of the market and accompanying resource constraints mean that specialist, experienced support is essential after schemes complete a full-buy-in.

“The pressures created by the sheer volumes of schemes looking to move to buy-out and wind-up are likely to become significantly more pronounced over the next few years given the rapid projected growth in insurer implementation pipelines. Trustees and sponsors should make sure their buy-out and wind up is carefully managed if they want to complete their process within their expected timescales and budgets.”

Alex Stobbart, Senior Consultant at LCP, added: “We are seeing insurers and other providers building up their teams and investing in enhancing automated processes which will help to ease some of the pressures. However, the bottom line is that schemes need to be proactive to make sure the post-transaction phase runs smoothly and member service is maintained, with thorough preparation and the right support in place.”

You can read more about LCP's post-transaction and wind-up support here