M&G re-entry will help ease building pressure as record volumes of schemes seek insurer quotations

Pensions & benefits Pension risk transfer DB pensions Economy

M&G has today announced two new DB pension scheme transactions marking its re-entry to the bulk annuity market. M&G was formed from the de-merger of Prudential PLC in 2019 with the UK insurance business becoming part of M&G plc. The UK insurance business operated in the UK bulk annuity market between 1997 and 2016 under the Prudential brand.

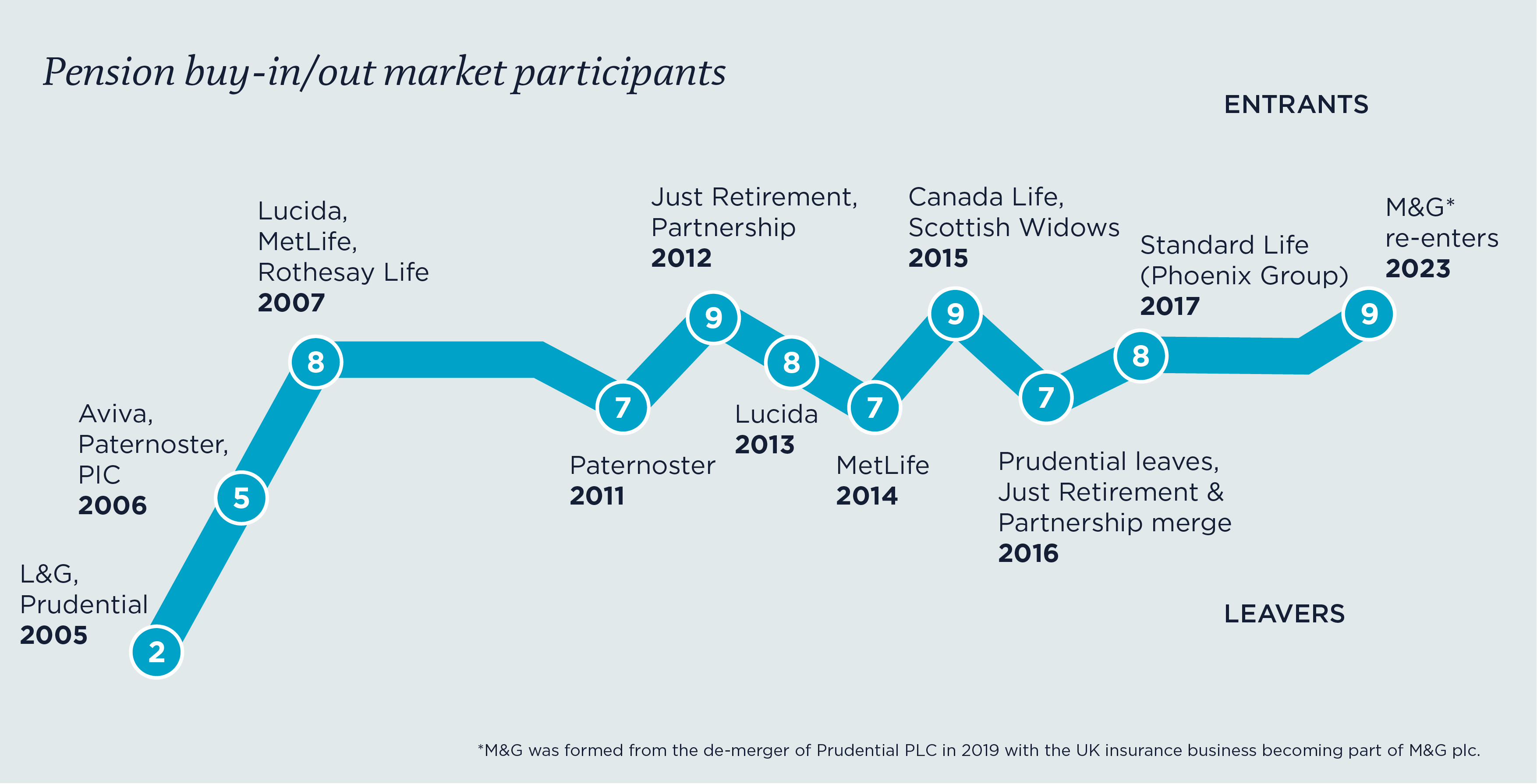

LCP made five predictions at the start of 2023 including that we would see an additional insurer enter the market this year, taking the total participants to nine. The last entrant was Standard Life (part of Phoenix Group) in 2017. The below chart shows the history of entrants and leavers in the market since it first expanded over 15 years ago.

Charlie Finch, partner at LCP, commented:

“We predicted at the start of the year that we would see an additional insurer enter the bulk annuity market this year. This transaction today marks M&G’s re-entry to the market after a near seven year absence, and represents their first transaction as M&G (prior to 2016 they wrote transactions under the Prudential brand).

“It will be welcome news for many pension schemes as the additional capacity M&G brings will help ease the building pressure as a record volume of schemes seek quotations from insurers. Scheme funding levels have continued to improve this year due to further rises in long-term interest rates and continued attractive pricing from insurers. 2023 remains on track to hit a record £45bn of buy-in/out volumes, and we project that as much as £600bn of pension liabilities could transfer to insurers over the next decade. We are in discussions with a number of other insurers that are planning to enter the market over the next year, seeking to tap into the market’s growing potential.”