New website tool launched to help public navigate ‘labyrinth’ of boosting their state pension, as 2022/23 forecast to be ‘record year’ for top-ups – Steve Webb, LCP

Pensions & benefits Policy & regulation Personal finance

A new online tool has been created by consultants LCP to help members of the public work out if they can benefit by topping up the new state pension by paying voluntary National Insurance Contributions.

A previous LCP website to enable people to check for errors in their state pension has now been visited over 800,000 times. The new tool is especially timely as there is a deadline at the end of the current financial year for paying back historic missing years for years between 2006 and 2016.

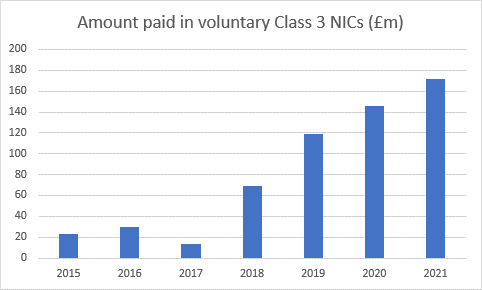

Since the creation of the new state pension in 2016, the potential for improving state pensions through voluntary contributions has increased considerably. This is reflected in the chart below which shows that over half a billion pounds has been paid by the public in voluntary NICs in the last four years alone. LCP partner Steve Webb is predicting that this year is likely to be another record, especially with the added impetus of the deadline at the end of this year for filling historic gaps.

Tens of thousands of people are topping up their state pension each year, but many more could do so if they knew what to do. At present people may be confused as to whether they can top up at all, how this would affect their state pension and which years to top up first.

Source: Government Actuary’s Department, National Insurance Fund accounts (various years)

At best topping up your state pension can be a highly cost-effective way of securing a higher income in retirement. For example, one year of voluntary NICs typically costs £824.20 at current rates for Class 3 contributions. In many cases this will boost state pension entitlement by 1/35th of the standard rate, or around £275 per year. This means that someone who tops up by one year will get their money back within four years of drawing their pension, even allowing for basic rate tax. Someone who draws a state pension for twenty years will get back £4,400 (net of basic rate tax) for their initial outlay of £824.20.

However, people considering topping up need to take a range of factors into account. For example:

- Some years can be ‘cheaper’ to top up than others; for example, people who have worked part-year and have paid some NI may be able to complete that year more cheaply than buying a completely blank year;

- Filling blanks for certain years (particularly those before 2016/17) can sometimes have no impact on your state pension. This is particularly relevant for people who have already paid in 30 years by April 2016 and who were long-term members of a ‘contracted out’ pension arrangement.

- People who expect to be on benefit in retirement may find that some or all of any improvement in their state pension may be clawed back in reduced pension credit or housing benefit;

- People who were self-employed can save money by paying voluntary Class 2 contributions (currently £163.80 per year) rather than Class 3 contributions (£824.20 per year);

- Before paying voluntary NICs, individuals should see if they can claim NI credits for a particular year. For example, those looking after grandchildren may be able to claim credits transferred from the child’s parent, and this could be a cost-free way of boosting their state pension.

The Government’s ‘check your state pension’ website (Check your State Pension forecast - GOV.UK (www.gov.uk)) provides useful information but crucially does not help people to decide which years, if any, they should top up. The new LCP website helps to plug that gap.

Two groups for whom top-ups may be of particular interest are:

- Early-retired public servants, who have been members of a ‘contracted out’ occupational pension scheme; the period of contracting out is likely to reduce their state pension below the maximum amount, and their early retirement is likely to mean they have ‘gaps’ in their NI record which can be filled; the case study below gives an example;

- The self-employed, who may have gaps in their NI record and may be able to go back to any year since 2006/07 to top it up; this group is less likely to be affected by complications around ‘contracting out’;

Commenting, LCP Partner Steve Webb said: “I regularly hear from people who would be interested in boosting their state pension but are confused about whether they can do so and how to go about it. At its best, topping up your state pension can generate a tremendous rate of return, far better than almost any other way of using spare capital. But there are many pitfalls to avoid, and we hope that our new website will help people to navigate the labyrinth of boosting their state pension”.

** ENDS **

Note to editors:

- The new LCP website can be found at www.lcp.uk.com/statepensionboost . The site asks users first to obtain information about their personal NI record from the gov.uk site, and the LCP site then interprets that information to explain to users what their options are. Users are however reminded that they should always check with DWP that topping up the years in question will definitely boost their state pension before paying any money.

- In general there is a six year deadline for filling historic gaps in NI records. A temporary extension allows people to fill gaps back to 2006/07. But this extension expires on 5th April 2023. See: Voluntary National Insurance: How and when to pay - GOV.UK (www.gov.uk)

- The LCP website is for those who come under the ‘new’ state pension system, those who reached state pension age on or after 6th April 2016. This is men born on or after 6th April 1951 and women born on or after 6th April 1953.

- The previous LCP site to help people check their state pension entitlement is at www.lcp.uk.com/underpaid