"Over half a million more pensioners set to be dragged into income tax net by second large state pension rise” – Steve Webb, LCP

Pensions & benefits Personal finance

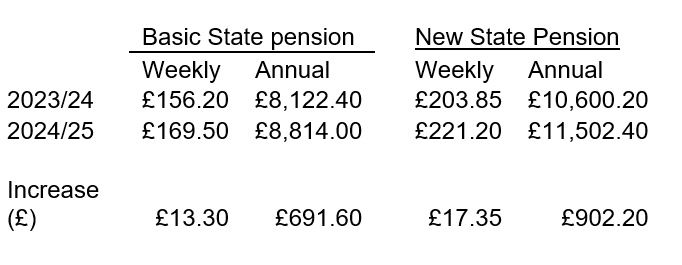

With today’s average earnings figures showing a rise of 8.5% on a year earlier, state pensions are set to enjoy a substantial cash increase in April 2024, with the new state pension set to rise just over £900 per year to just over £11,500.

The Table shows the current rate of ‘basic’ state pension for those who reached pension age before 6th April 2016 and the ‘new’ flat rate state pension for those reaching pension age after this date. It also shows the new figures based on an uprating in line with average earnings, which is expected to be the highest of the three elements of the ‘triple lock’ formula.

Table: Current and expected rates of a) basic state pension and b) new state pension per week/year in 2023/24 and 2024/25

Pensioners and tax

With the personal tax threshold due to be frozen again at £12,570 next year, a large pension rise, coming on top of last year’s 10.1% rise, will drag many more pensioners into paying income tax. Between 2022/23 and 2023/24, HMRC figures suggest that the number of those aged 65+ who pay income tax rose by roughly three quarters of a million from 7.73m to 8.5m off the back of the April 2023 state pension increase. Today’s figures, leading to a further rise of 8.5%, would be expected to increase the number of taxpaying pensioners to 9.15 m, an increase of around 650,000, according to LCP.

Will the triple lock hold this year?

There has been some speculation that the government might prefer to use a lower figure for the April 2024/25 uprating. For example, the current inflation figure (for the year to July) is 6.8%. Even if this were to rise slightly by the time of the September figure (published in October), it would probably still be lower than the earnings growth figure.

Despite the cost pressures on the government, according to LCP partner Steve Webb, there are several reasons why the government is likely to stick with the earnings growth figure in line with the ‘triple lock’ policy:

- The Triple Lock was a Conservative manifesto commitment in 2019 and has already been broken once – in April 2022 – when benefits increased by the 3.1% rate of inflation rather than the 8.6% rate of earnings growth. Breaking the commitment twice in three years could be highly politically damaging.

- With only a relatively small gap between earnings growth and inflation, the savings from breaking the triple lock would be relatively modest compared with the political challenge.

- The law states that the state pension must rise at least in line with average earnings; breaking that link would therefore require legislation, and the government might struggle to get such legislation through, especially in the final uprating before an expected Autumn 2024 General Election;

- Older voters are most likely to turn out to vote, and at present, they have the highest likelihood of voting Conservative of any age group; with Conservative support already at a relatively low level, a policy seen as hostile to older voters could further undermine that support;

At the time of the March 2023 Budget, the OBR forecast an increase of 6.2% for the April 2024 uprating (see Table A.3, Economic and Fiscal Outlook). As a rough guide, each 1% on the basic/new state pension costs around £1 billion in pension payouts, so today’s figure means the Chancellor will have to find roughly an extra £2.3 billion to keep his triple lock promise.

Commenting, Steve Webb, partner at LCP, said:

“Today’s figures for earnings growth are likely to mean a second successive significant cash increase in the value of the state pension, following on from this year’s 10.1% increase. Alongside a continued freeze of the tax-free personal allowance, this is likely to drag well over half a million more pensioners into the income tax net. Once again, ‘stealth’ taxation proves a convenient revenue raiser for the Chancellor.

In terms of the triple lock policy, with a General Election in the offing, it seems quite inconceivable that the government would choose to break the triple lock promise for a second time in three years. Such a decision would be like aiming a laser-guided missile at the core of Conservative support and could fatally undermine the party’s electoral prospects.”

Looking to the party manifestos, Steve Webb added:

“What is far less clear is what each party will do when it comes to their manifesto. In 2017, Theresa May removed the triple lock from her manifesto but was forced to reinstate the policy as part of her post-election deal with the Democratic Unionists. In 2019, Boris Johnson decided it was preferable to reinstate the policy. There is no doubt that the present government and opposition would both like to drop the policy in order to make savings to be spent elsewhere. But both want to avoid a situation where they have moved first by dropping the triple lock only to find that the other party has retained it”.

Commenting, Steve Webb, partner at LCP, said:

“Today’s figures for earnings growth are likely to mean a second successive significant cash increase in the value of the state pension, following on from this year’s 10.1% increase. Alongside a continued freeze of the tax-free personal allowance, this is likely to drag well over half a million more pensioners into the income tax net. Once again, ‘stealth’ taxation proves a convenient revenue raiser for the Chancellor.

In terms of the triple lock policy, with a General Election in the offing, it seems quite inconceivable that the government would choose to break the triple lock promise for a second time in three years. Such a decision would be like aiming a laser-guided missile at the core of Conservative support and could fatally undermine the party’s electoral prospects.”

Looking to the party manifestos, Steve Webb added:

“What is far less clear is what each party will do when it comes to their manifesto. In 2017, Theresa May removed the triple lock from her manifesto but was forced to reinstate the policy as part of her post-election deal with the Democratic Unionists. In 2019, Boris Johnson decided it was preferable to reinstate the policy. There is no doubt that the present government and opposition would both like to drop the policy in order to make savings to be spent elsewhere. But both want to avoid a situation where they have moved first by dropping the triple lock only to find that the other party has retained it.”