Smaller buy-ins drive record transaction numbers in H1 2024, with a flurry of giant transactions set to dominate H2

Pensions & benefits Pension risk transfer DB pensions Risk

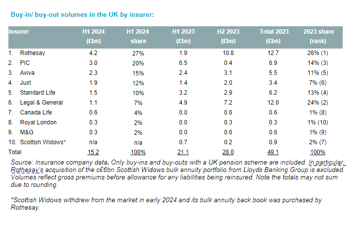

Analysis of insurers’ half-year 2024 results by Lane Clark & Peacock (LCP) shows that buy-in/out volumes by UK pension schemes are set to accelerate over H2 2024 with total buy-ins/outs predicted to exceed £40bn for the year. With Rothesay’s H1 2024 results released today, full data is now available on UK buy-ins and buy-outs over the first half of the year. LCP’s full analysis of the data is set out at the end of the release, but key findings include:

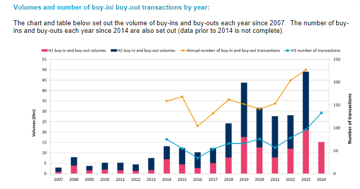

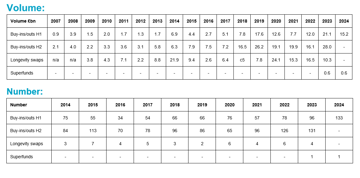

- Activity levels over the first half of the year hit record levels, as 133 buy-in/out transactions were completed by UK pension schemes. This is up by almost 40% on H1 2023 (96 transactions) and 70% on H1 2022 (78 transactions), driven by smaller transactions under £100m which accounted for over 80% of H1 2024 transactions by number (compared to c70% for FY 2022 and 2023).

- Despite record activity, buy-in/out volumes in H1 2024 were only the third highest H1 volumes on record at £15.2bn, down from the record £21.1bn in H1 2023. This reflected that there were only two £1bn+ transactions in H1 2024, compared to five over the same period last year which included the largest ever single buy-in transaction by RSA Insurance at £6.5bn. The largest named transaction in H1 2024 was the£1.2bn buy-in by TotalEnergies with PIC.

- Rothesay wrote the largest buy-in/out volumes in H1 2024 with £4.2bn (27% market share), in addition to agreeing to acquire the c£6bn Scottish Widows bulk annuity portfolio from Lloyds Banking Group following Scottish Widow’s buy-in/out market exit earlier this year. Aviva, L&G, PIC and Standard Life have all disclosed that they have exceeded £4bn of new business including deals post half-year end and those in exclusivity.

- We expect volumes to accelerate over H2 2024 driven by a flurry of giant transactions over £1bn. Insurers have disclosed that they have already written, or are exclusive on, a further c£10bn of buy-ins/outs since the half-year point. We expect £1bn+ transactions to reach double figures over the course of the year, putting 2024 on par with the record twelve £1bn+ deals completed last year. Two further £1bn+ transactions have already been announced: a £1.1bn full buy-in by SCA with L&G and a £1.3bn full buy-in by Coats with PIC.

- Two insurers, Just and Aviva, together wrote over 70% of the H1 2024 transactions by number (up from c50% and c60% for FY 2022 and 2023 respectively) and demonstrating the effectiveness of insurer streamlined processes in accommodating increasing numbers of smaller transactions.

- New entrants continued to take their first steps in the market. M&G and Royal London each wrote a further c£0.3bn transaction in H1, with Royal London since confirming completion of their first deal with an external scheme in July. Utmost now has Board approval to write deals and, if reports of Brookfield’s planned entry are correct, this will take the UK buy-in/out market to a record 11 insurers, in line with LCP’s prediction in June.

- After completing the UK’s first superfund transfer in November 2023, Clara Pensions agreed a second £600m superfund transfer from the Debenhams scheme in March 2024, rescuing the scheme following its sponsor’s insolvency in 2019 and allowing benefits to be paid in full. With the new UK Government committing to table formal regulations for superfunds, this is an area of the market that we expect to continue to expand.

- Over 2024 to date, LCP has been lead adviser on over £10bn of buy-ins/outs across 30 transactions. This includes six £1bn+ deals, including those for TotalEnergies, SCA and Coats.

Charlie Finch, Partner at LCP, commented: “2024 has seen a staggering number of transactions in the first half of the year as we continue to see strong appetite from UK sponsors to remove DB pension risk. Total disclosed buy-in/out volumes already exceed £25bn for 2024 and we expect the full year to reach over £40bn, which would make 2024 one of the biggest years on record.

The insurers have responded strongly to the continued high demand, growing both their transaction capacity and target volumes. This additional capacity has led to aggressive insurer price competition on transactions over the summer with some of the best non-pensioner pricing ever. LCP has led transactions for a record number of schemes so far in 2024 including six over £1bn which have benefited from these competitive dynamics.”

Ruth Ward, Principal at LCP, commented: “Most of the insurers quoting for smaller schemes now have highly efficient streamlined processes which has supported the record transaction numbers in the first half of the year. With five insurers each reporting over £4bn of buy-ins secured to date, this is a healthy and competitive market.

Looking ahead, we are optimistic for the outlook for the risk transfer market. The new insurers are now establishing themselves which is bringing further capacity and a record level of competition. We expect them to make their presence felt next year. The superfund market is expanding steadily, offering new options for schemes where buy-out is not affordable. Whatever a scheme’s ultimate endgame, there are effective and proven risk transfer options that they can make use of should they choose.”