Twenty million adults could be in line for ‘state pension age reprieve’ as life expectancy improvements ‘collapse’ even before the Pandemic

Pensions & benefits Personal finance

New analysis of population projections by consultants LCP has found that the government’s current plans to raise state pension age to 67 by 2028 and age 68 by 2039 have been ‘blown out of the water’ because expected improvements in life expectancy have largely failed to materialise.

If the government sticks to its policy of linking state pension age to life expectancy (as projected by the Office for National Statistics), there would now be no case for raising pension age from 66 to 67 until 2051 – twenty three years later than currently planned. This change alone would deprive the Treasury of at least £195 billion in planned savings on state pension expenditure but could give a state pension age ‘reprieve’ to more than twenty million people born in the 1960s, 1970s and early 1980s.

A link between state pension age and longevity was established in government policy in 2013. The first review of state pension ages (undertaken by Sir John Cridland) said:

“In 2013 the Government stated that on average people should spend up to one third of their adult life in retirement, and that the State Pension age should reflect this longevity link so long as ten years notice of changes was given. The 2014 Act put in place the requirement for independent reviews to consider this”. (p21)

The first review undertaken on that basis was published in 2017 and used population estimates prepared by the Office for National Statistics (ONS) as at 2014. These projections assumed that life expectancies would continue to improve over the coming decades. On that basis, the Government Actuary’s Department calculated that state pension age would need to rise to 68 by 2041 to make sure no-one spent more than one third of their adult life in retirement. Responding to the report, the DWP indicated that it planned a slightly tougher schedule, reaching 68 by 2039, though it did not change the law at that stage. This is seven years ahead of the schedule currently set out in legislation.

However, since the last review was undertaken, ONS has published population estimates as at 2016 and 2018, which reveal lower life expectancies than previously thought. For example, the 2014-based projections suggested that a 66 year-old woman today could expect to live, on average, to around 89 (based on significant continued improvements in life expectancy) whereas the 2018-based projections now expect the same woman only to live to around 87.

LCP have taken these latest projections and re-run the Government Actuary’s calculations to see what they imply for state pension age. The dramatic conclusions are:

- Any move from 67 to 68 would not be needed until the mid 2060s, rather than the mid 2040s as per current legislation, and certainly not by the late 2030s as planned by the government;

- The move from 66 to 67, which is currently scheduled to be phased in over a two year period between 2026 and 2028, could be put back twenty three years to 2049-51.

Putting back the increase from 66 to 67 until 2051 would have a massive impact on the public finances. If this happened, the people who would enjoy a pension age of 66 rather than 67 (or above) would be those born between 1961 (who would otherwise have faced a pension age of 67 in 2028) and 1984 (after which pension age will rise to 67). Latest UK population figures suggest that there are 20.975m people in this age bracket. Based on the current state pension rate of £9,339 per year, the total cost to the Treasury from this revised timetable would be around £195 billion, ignoring ‘second round’ effects on tax revenues, benefits spending and the wider economy.

Even if the government does not slavishly stick to the ‘less than one third’ principle, and delay the move to 67 by more than twenty years, it would still find it very hard to justify the rapid increase to 67 due to begin in less than five years’ time.

To add to the Government’s problems, a new round of ONS projections for 2020 is expected to be published early in the New Year, and this will be the first to reflect any potential long-term impact from Covid-19. If ONS conclude that the Pandemic could have a lasting negative impact on life expectancy, this could imply even further delay in state pension age increases and could intensify the political pressure to ditch the forthcoming move to age 67.

Commenting, Steve Webb, partner at LCP said:

“The Government’s plans for rapid increases in state pension age have been blown out of the water by this new analysis. Even before the Pandemic hit, the improvements in life expectancy which we had seen over the last century had almost ground to a halt. But the schedule for state pension age increases has not caught up with this new world. This analysis shows that current plans to increase the state pension age to 67 by 2028 need to be revisited as a matter of urgency. Pension ages for men and women reached 66 only last year, and there is now no case for yet another increase so soon”.

Notes to editors:

- Under the terms of the 2014 Pensions Act, there has to be a state pension age review at least every six years. The first review was undertaken in 2017 by Sir John Cridland (State Pension age independent review: final report - GOV.UK (www.gov.uk). A second review has just been commissioned by the Government and will be headed by Baroness Neville Rolfe (Second State Pension Age Review launches - GOV.UK (www.gov.uk).

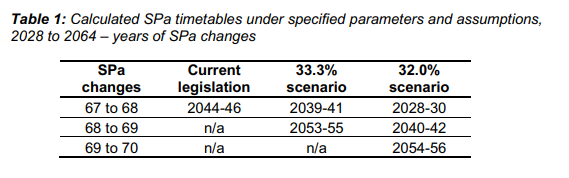

- Under current legislation the state pension age will be phased up from 66 to 67 between April 2026 and April 2028. The table below (from the Cridland Review) shows the current legislated timetable to move from 67 to 68, what it would have to be to make sure people spent no more than 33.3% of their adult life in retirement, and what it would have to be to make sure people spent no more than 32% of their adult life in retirement.

In response to this report, DWP opted for a timetable somewhere between the 33.3% and 32.0% scenario and indicated that its plan was to move to 68 between 2037-39. (Proposed new timetable for State Pension age increases - GOV.UK (www.gov.uk). - Alongside the state pension age review, the Government Actuary is commissioned to undertake calculations as to how state pension age would need to change based on the latest population projections. The 2017 GAD report (which generated the figures shown in Table 1 above) is at: Periodic review of rules about State Pension age, Report by the Government Actuary (publishing.service.gov.uk)