A Match Made in Heaven? – New Research Reveals the Potential for Pension Schemes To Make a ‘Step Change’ in Data Quality

Pensions & benefits Pensions data services Pensions dashboards

A new report published today reveals the potential for pension schemes to use data matching techniques to make dramatic improvements in the quality of their member data and calls on schemes to use the delay in the rollout of pension dashboards to get their data ‘dashboard-ready’.

To conduct the research, consultants LCP teamed up with:

- Digidentity, a certified Identity Service Provider under the UK’s Digital Identity and Attributes Trust Framework (DIATF). Digidentity is the current provider of digital identity services to the Pensions Dashboards Programme.

- TransUnion, a global information and insights company and one of the UK’s leading credit reference agencies, to analyse the member data of a large Defined Benefit (DB) pension scheme with around 17,000 non-pensioner members.

Selected information about members was shared with TransUnion and compared with their databases to check the accuracy of names, addresses and other personal data. Accurate name and address data will be crucial to the success of the pensions dashboard project, as these will be two of the three ‘verified’ data fields which will be sent to pension schemes for data matching.

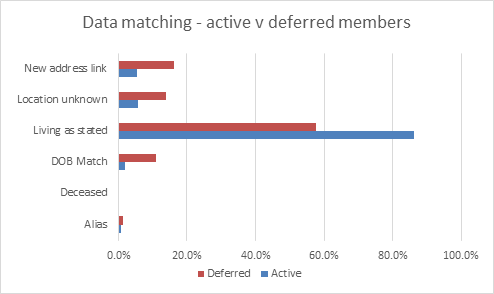

TransUnion identified whether member data was 100% accurate (‘living as stated’) or whether there were discrepancies (e.g. someone now at a new address, a member who had changed their name etc.). The chart below shows the results, separately for active and deferred members of the scheme.

Across the sample as a whole, TransUnion found that member data was accurate for about five out of six active members, but only just over half (58%) of deferred members.

The biggest category of discrepancy was on address information, in particular where the address held by the DB scheme appeared to be out of date and where a new address was available. Not surprisingly, a higher percentage of deferred members than active members had incorrect address data (16% vs 5% respectively), but even amongst active members, around one in 20 had moved house and not notified the scheme.

The research also found that around one in 10 deferred members had no address match but could be matched (generally uniquely) purely on the basis of name and date of birth against a person showing on TransUnion’s records.

The data matching exercise also showed a large number of smaller discrepancies in address data held by the scheme, including around 200 members with missing postcodes, which could be added, and a further 200 where postcodes were held by not correct. Given the importance of addresses for data matching with pension dashboards, even small ‘tidying up’ like this could greatly reduce the number of partial matches between user data and scheme data which would require further work to resolve.

Commenting, Steve Webb, Partner at LCP, said:

“The process of preparing for pensions dashboards could have a huge spin-off benefit by leading to a step change in the quality of pension scheme data. Both DB schemes and DC schemes will have data issues, sometimes relating to the lack of regular contact with members, but also because of inaccuracies in data supplied by employers. This research shows that even a relatively simple one-off exercise can lead to a major improvement in scheme data with a wide range of benefits for pension schemes and providers as well as members”.

Jonathan Evans, Senior Business Development Manager at Digidentity, said:

“The work to develop pensions dashboards has highlighted the importance of digital identities in an increasingly online world. Where schemes can get their data in shape, they will find that the process of data matching will work far more smoothly when dashboards go live. Time spent now getting data cleansed and kept up to date will reap dividends when dashboards go live”.

Adam Gillott, Director of Diversified Markets at TransUnion in the UK, added:

“This research affirms the importance of using robust and actionable data and insights to support evolution within the pensions sector and ensure consumers can fully benefit from the new Pensions Dashboard Programme once it is available.

“Harnessing credit data from information providers like TransUnion makes it possible to create a single customer view, by tracing the same identity across multiple policies, even where circumstances such as name or address have changed over time. This aligns with the aim of the new dashboards, so that it’s possible to consolidate various pension schemes in one easy-to-use place.”