Boosting employee wellbeing through financial education: an HR imperative

Pensions & benefits DB member engagement and communication DC member engagement and communication Financial wellbeing

In today's fast-paced and competitive corporate landscape, the importance of employee wellbeing cannot be overstated.

HR professionals have a responsibility to foster a supportive and empowering environment for employees. One often overlooked aspect of employee wellbeing is financial wellness.

By providing comprehensive financial education programs, organisations can equip their workforce with the knowledge and tools to make informed financial decisions. In this blog, we will explore how financial education can support employee wellbeing, enhance productivity, and contribute to the overall success of the organisation.

Reducing financial stress

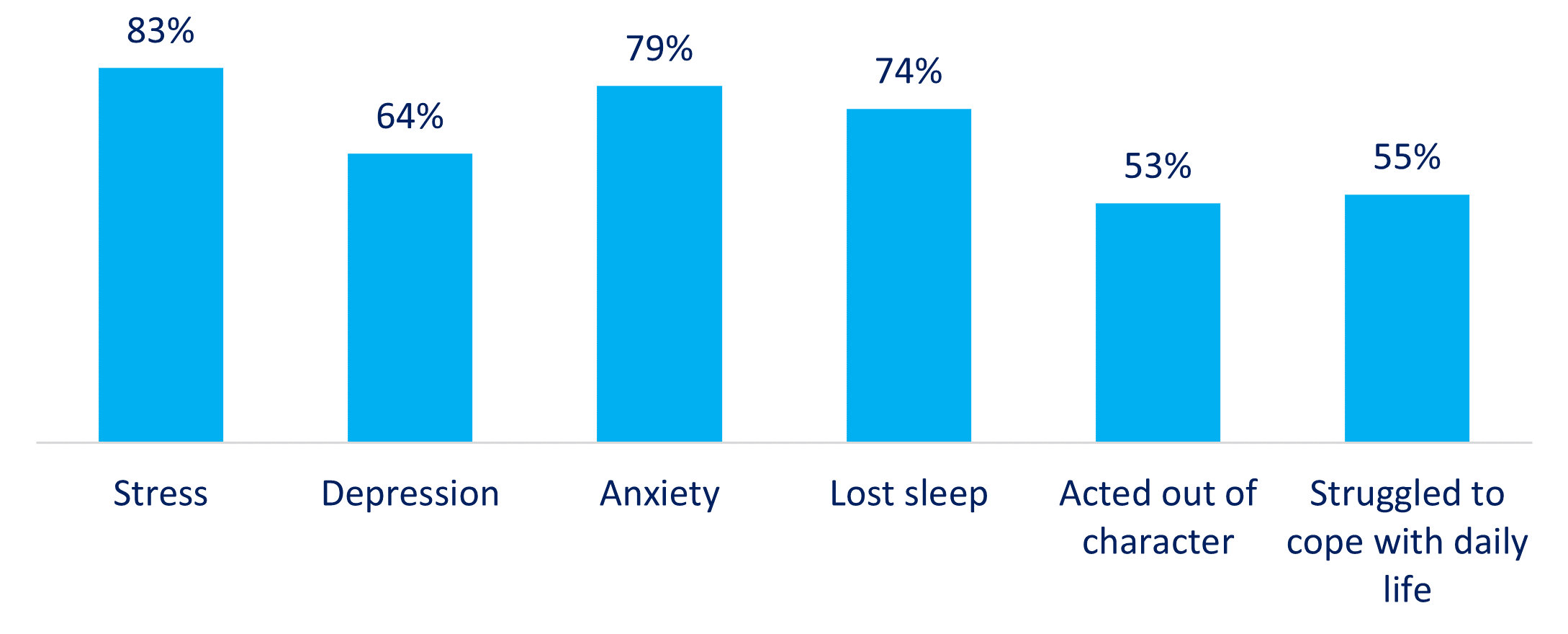

Financial stress has a significant impact on an individual's overall wellbeing and job performance. Employees coping with financial worries may struggle to concentrate, experience decreased job satisfaction, and face higher levels of absenteeism as well as see impacts on their wider mental health as our latest study shows.  Source: Employee wellbeing: supporting good financial futures – LCP 2023

Source: Employee wellbeing: supporting good financial futures – LCP 2023

By implementing financial education initiatives, organisations can empower their employees with practical skills to manage their personal finances effectively. Budgeting, debt management, and retirement planning are areas where employees often seek guidance. By addressing these concerns through financial education programs, employers can help to reduce financial stress and anxiety, allowing employees to focus on their work and improve their overall wellbeing.

Encouraging responsible financial behaviours

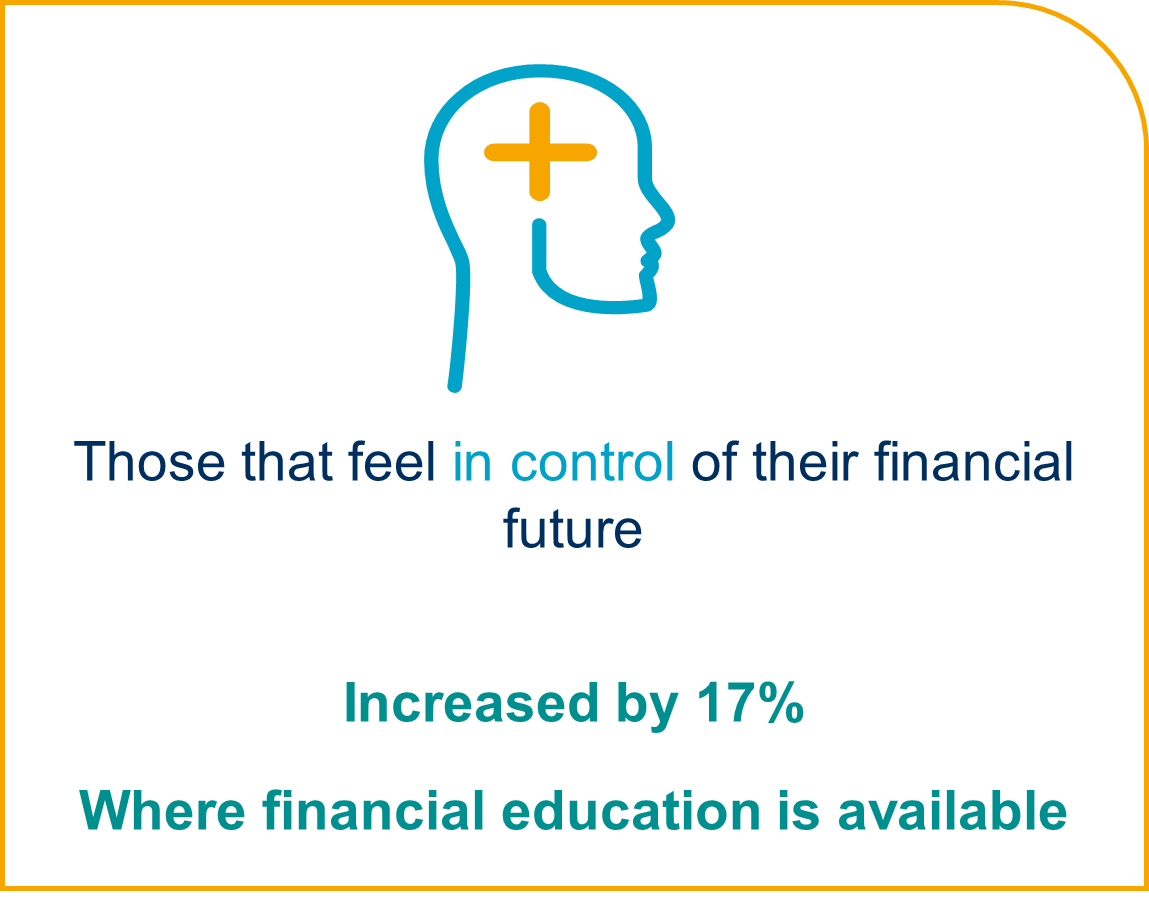

Financial education not only equips employees with knowledge but also fosters responsible financial behaviours. Understanding the importance of saving, budgeting, and investing can lead to improved financial habits, which can benefit employees in both their personal and professional lives. By promoting positive financial behaviours, organisations can help employees establish a solid financial foundation which will build their confidence, capability and ultimately their financial resilience. This, in turn, cultivates a sense of loyalty and commitment to the organisation, as employees feel valued and supported.

Empowering employees for long-term financial security

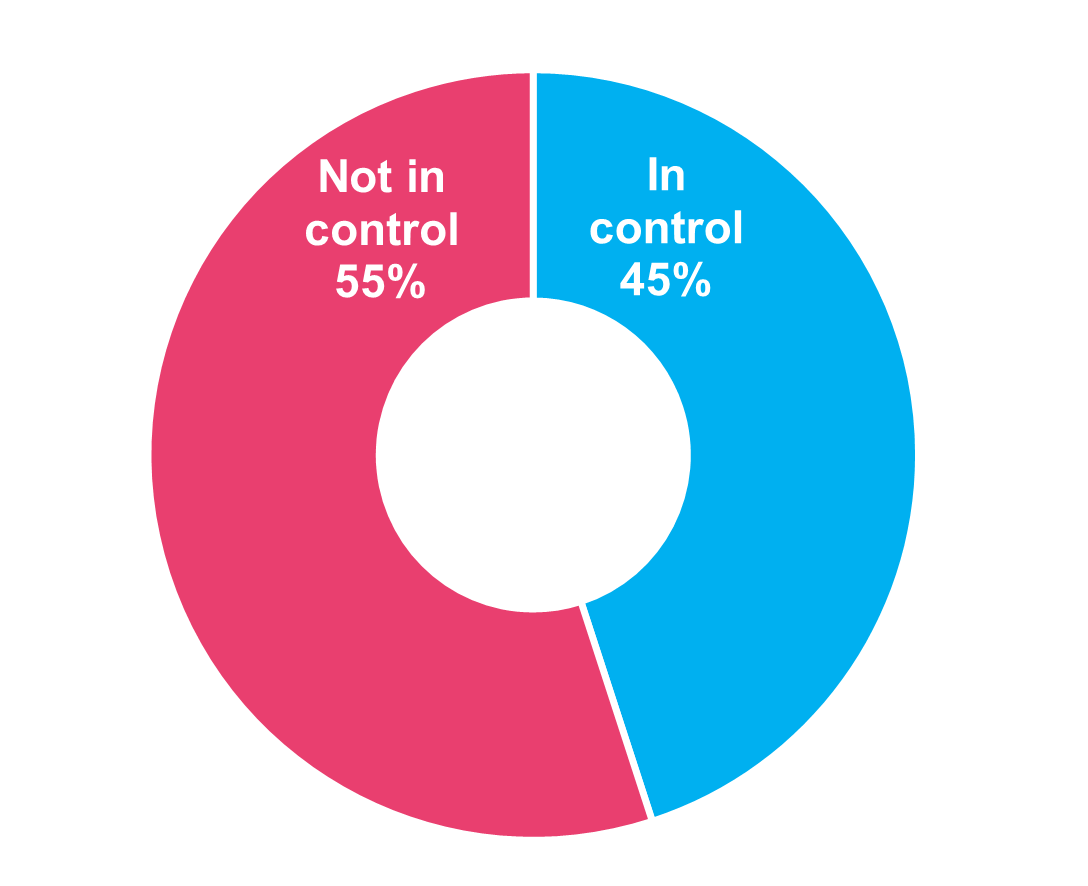

Preparing for the future and later life is a critical aspect of financial planning that often receives limited attention. Many employees are uncertain about their retirement goals, investment options, and the overall financial implications of retirement.

How do you feel about your financial future?

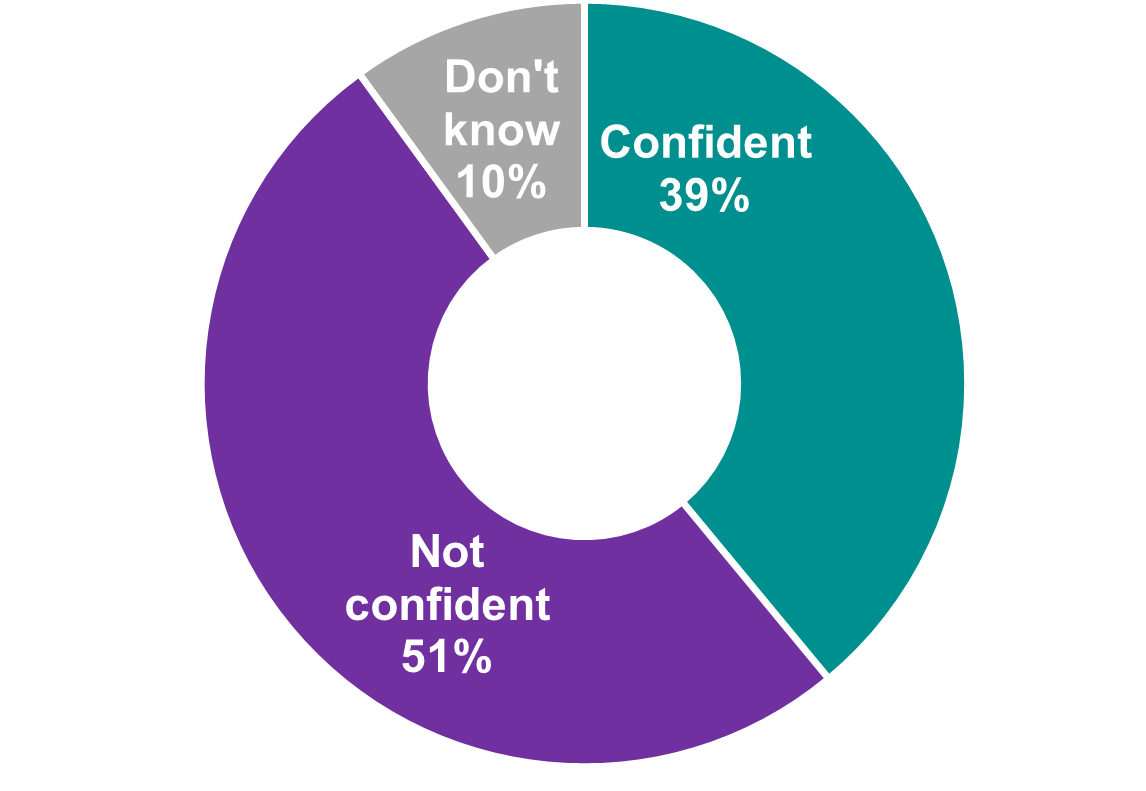

How confident are you in being able to achieve your desired retirement?

Source: Employee wellbeing: supporting good financial futures – LCP 2023

By offering financial education programs that cover future finances and retirement planning, organisations can empower employees to make informed decisions for their long-term financial security. By helping employees plan for their futures, organisations demonstrate their commitment to the holistic wellbeing of their workforce.

Enhancing employee engagement and productivity

Financial worries can be a significant distraction in the workplace, leading to decreased engagement and productivity. Employees who are preoccupied with financial concerns may spend valuable work hours dealing with personal financial matters or engaging in second jobs to make ends meet as we have seen above. By offering financial education, organisations can equip employees with the knowledge and resources to overcome financial challenges, allowing them to focus on their work and perform at their best. Engaged and financially secure employees are more likely to contribute to the success of the organisation, fostering a positive and productive work culture.

Strengthening employer-employee relationships

Providing financial education demonstrates an organisation's commitment to its employees' overall wellbeing, beyond their professional roles. When employers invest in the financial education of their workforce, it creates a sense of trust and loyalty. Employees feel valued and supported, leading to stronger employer-employee relationships. This, in turn, can improve retention rates, attract top talent, and enhance the organisation’s reputation as an employer of choice.

In conclusion

Financial education is a powerful tool that can significantly impact employee wellbeing, engagement, and productivity. By recognising the importance of financial wellness and implementing comprehensive financial education programs, organisations can create a supportive environment that empowers employees to make informed financial decisions.

Investing in financial education demonstrates a commitment to the holistic wellbeing of employees and can yield long-term benefits for both individuals and the organisation as a whole. As HR and benefits professionals, it is our responsibility to advocate for financial education initiatives and drive positive change in our organisations. Together, let us pave the way for a financially secure and thriving workforce.