A few weeks ago, the Capacity Market (CM) Delivery Body released the first CM register for the upcoming auctions; including the T-4 auction for delivery in 2027/28. On first glance, we only have a maximum of 2.5GW of prequalified capacity above the target. Last year, we saw record high clearing prices when there was over 5GW at this stage. Is the lack of competition in the CM an issue for this and forthcoming auctions? Here at LCP Delta, we can see a situation where the next few CM clearing prices are as high, if not higher, than last year’s record-breaking auction.

So, what is the big picture?

Against a demand target of 43GW, total prequalified derated capacity stands at only 45.5GW for next year’s auction. Whilst there are a few drivers, such as lower derating factors for batteries, what is perhaps a clear trend is that given the impending power sector decarbonisation deadline, fewer new-build gas units are participating. Despite the success of the Eggborough CCGT last year, this is the first T-4 auction that does not have a large new-build CCGT participating. Instead, the biggest new build gas units we see are some sizeable gas turbines, such as Killingholme, at 430MW – a far cry from the new build CCGT units well over 1GW that we are used to seeing in the CM.

Economists around the world will tell you that competition will drive better customer results, so, with not much headroom, there could be significant concerns on the upcoming Capacity Market clearing price outturn. We use the Residual Supply Index (RSI), a concentration metric, to get a better view of the liquidity. We have found that this has once again dipped below the traditional threshold of 100, to an even lower value than last year – this may lead to high clearing prices.

And… given this is only prequalification, things could change further. We run the rule over a few factors which could swing this ahead of the auction.

A) What factors may decrease competition further?

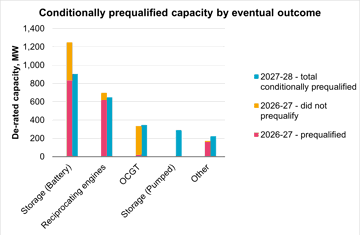

This is only conditionally prequalified capacity: Not all prequalified capacity reaches the auction. Last year, demand rose to 43.9GW and supply dropped to 46GW as conditionally prequalified units were finalised by the time of the auction – meaning that the next auction could get even less competitive. As in previous years, about 5% of capacity is conditionally prequalified – in previous auctions with plenty of participating capacity, this didn’t use to affect auction liquidity. Since last year, as auctions have started to tighten heading into the late 2020s, conditional prequalification is getting more attention when considering liquidity. If last year’s prequalification behaviour repeats, this year’s final prequalified capacity heading into the auction could be as low as 44.5GW, although no CCGT has prequalified conditionally.

B) What factors could improve liquidity?

Drax units availability may lead to ESO reducing its demand target: There was some surprise around the four Drax biomass units opting out of the Capacity Market. The units are currently under renewable support contracts, which are set to end in 2027 – their total 2.3GW would be sorely missed in the late 2020s GB power market. Since the release of the CM registers, Drax has publicly stated that the Department for Energy Security and Net Zero (DESNZ) is set to launch a consultation early next year about a special, dedicated support mechanism for their units. While this new mechanism remains unconfirmed, the ESO might feel confident enough about it to reduce the demand target – assuming that the Drax units will deliver outside of the CM and therefore somewhat alleviating the tight margin.

The return of mothballed units

As the CM margins are decreasing, there is more incentive for older plants to come back online, helped by the CM rule changes on easing the return of mothballed plants. The new T-4 auction sees the return of two large CCGTs that were mothballed in 2020 (total of 1.5GW derated), terminating their CM agreements at the time. Both Severn Power and Sutton Bridge have entered as refurbishing units – with Severn Power combining their two units into one and aiming for a 15-year contract, implying capital intensive changes. In the late 2020s, these fully refurbished units could help provide some relief to security of supply.

In the short-term ahead of their refurbishment, the two power stations are also aiming to participate in the T-1 auction for delivery in 2024/25, so all three units have recently started recommissioning.

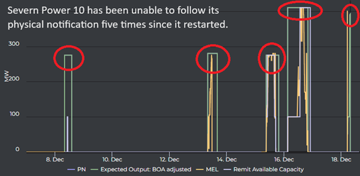

Given these units have been unavailable for 3 years, this could take a while, as evidenced by the behaviour of one of the Severn Power units over the past couple of weeks. Severn Power 10 has struggled to deliver its physical notification 5 times since it restarted – unsurprisingly, given the length of time it has been out of action. The ownership of these units is understood to not be finalised yet and this could lead to the current owners not being confident in entering these plants into the auction. ESO may also choose to increase the demand target to avoid the risk of non-delivery, increasing the risks to security of supply in the short term.

LCP Delta looks ahead to next year

There is a clear risk of the T-4 clearing price being as high as last year, increasing the costs of maintaining security of supply further in future years. This isn’t even considering the increasing costs to operate, maintain and develop capacity.

The Capacity Market has historically been a relatively cheap government scheme. Many large existing power stations have provided an increased margin and together with the declining electricity demand this has meant that annual costs of maintaining security of supply have been less than £1 billion, much lower than originally expected.

As the transport and heat sectors are starting to decarbonise, electricity demand will be increasing – exactly at the same time as many existing power stations are coming to the end of their lifetime. This will drive up the costs of procurement through the Capacity Market, with the OBR forecasting annual costs to be above £3 billion by the second half of the decade.

The Capacity Market’s long-term structural issues

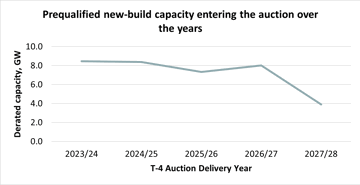

But we are facing another potential problem in future auctions that may affect the ability of the CM to procure enough capacity at all – the participation of new build units is falling. We are observing a big drop in their volume to less than 4GW compared to the 8GW seen in the last four auctions, as building conventional capacity providers is becoming riskier. The Capacity Market is naturally expected to become a less liquid market. To resolve this issue and avoid a late 2020s crunch in security of supply ahead of the development of abated gas generation and hydrogen-to-power, the government needs to make a clear statement on how they aim to achieve robust, cost-effective security of electricity supply during the net zero transition.

Please get in touch if you need any support in developing your bidding strategy for the upcoming T-4 auction. Please also contact us for any advice on how the future of security of supply will look like as the GB power sector decarbonises.