What is timberland investing?

Timberland investing involves buying and operating commercial forestry, managing an established forest or planting new trees. It’s an area that continues to grow and is currently estimated to be a market between $300-$400 billion USD.

Key forestry regions include North America, Australia, New Zealand, and parts of Latin America and Europe.

Most timberland funds target total returns between 6% to 10% pa nominal, after fees, with management fees of around 1% pa.

The returns are lowly correlated with other major asset classes, so we think timber is an attractive asset class, which also provides other positive environmental benefits. Demand for timber is growing as the global population continues to increase and is further enhanced by GDP growth as well as increasing urbanisation in emerging economies. Changes in consumer preferences and behaviour due to people’s increased awareness of environmental issues could also drive demand further.

Where do the investment returns come from?

Appreciation: The increase in the price of timber over time and quantity of timber, as trees grow, is the main driver of returns. There is also a small component from appreciation of the land itself.

Depending on the geographic focus of the fund, returns from capital appreciation range from 3-8% pa.

- Timber pricing is the most uncertain return component and is influenced by factors such as: the stage of the economic cycle, supply/demand dynamics, environmental/political climate policies.

- Timber biological growth is predictable.

- Land value is related to local demand and supply.

Timber harvests: The sale of timber generates income for the investor of around 1-3% pa.

There are also additional sources of returns:

Active forest management activities: such as thinning, pruning, and fertilization can increase the growth and value of the timber.

Carbon credits provide additional returns for some funds – difficult to estimate as several years are needed for credits to be verified and pricing and regulation in these markets is uncertain.

Carbon credit returns are expected to contribute 1-4% pa to overall fund returns once realised – however there is significant price volatility and regulatory uncertainty especially in voluntary markets.

Illiquidity premium: Timber is an illiquid asset, most funds have lock in periods of around 7-12 years. Therefore, it’s appropriate for investors that have long-term investment horizons.

What is the NCREIF Timberland Property Index?

The NCREIF Timberland Index comprises 443 US investment-grade timber properties, collectively valued at around $27bn as at end 2023.

However, a significant limitation of using this data is its regional focus, which may not accurately reflect global timberland performance.

What have historic returns been?

The chart below compares the risk and returns for the NCREIF Timberland Index in USD (Timber USD) and the NCREIF returns converted to GBP (Timber GBP) against other traditional asset classes.

Timberland has generated strong returns with low volatility, relative to traditional asset classes, accepting that the index has a regional bias

Source: Bloomberg, NCREIF Timberland Property Index. Data shown is before fees to 30 June 2024. Past performance is not a reliable indicator for future performance. Timber (GBP) and Global Equities (GBP) refer to unhedged returns. Timber (USD), Global Corporate Bonds (USD) and Global Equities (local) refer to hedged returns for a GBP investor.

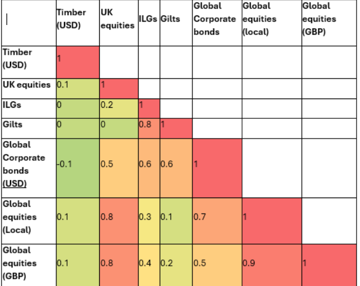

Does timberland improve diversification within a portfolio?

Including timberland in an investment portfolio can enhance diversification and reduce overall portfolio risk.

Over a longer period (10 years +), the correlation of timberland with other more traditional asset classes has been low.

Correlations (10 years to 30 June 2024)

Source: Bloomberg, NCREIF Timberland Property Index. Data shown is before fees to 30 June 2024. Past performance is not a reliable indicator for future performance. Timber (US) is the equivalent of hedged returns for a GBP investor.

How can you gain exposure to timber?

There are several ways to gain exposure to timberland:

- Invest via a pooled fund with a professional Timberland manager. The manager purchases and manages the forest so the investor owns the physical underlying asset through the fund.

- Own forests directly through a segregated mandate, managed by a professional Timberland manager.

- Invest in timberland REITS - listed companies that invest and own other timberland companies. Offer greater liquidity, however performance is closely tied to the broad equity market.

- Timber ETFs track the price of a basket of timber related stocks and REITs. These are highly liquid, but closely correlated with equity markets.

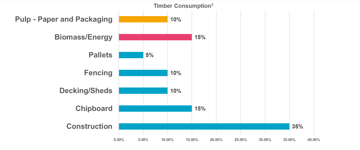

What is timber used for?

- Housing construction: Residential construction, including wood framing, flooring.

- Energy and biomass: Wood is utilised as a source of energy and biomass. Firewood and pellets are used for heating and cooking purposes. The biomass industry utilises wood chips, sawdust, and other wood residues to generate electricity, heat buildings, or produce biofuels.

- Consumer goods: Furniture, flooring, doors, paper and packaging contain wood or wood-based materials.

- Infrastructure development: Timber is used in infrastructure projects such as timber bridges, playgrounds, parking garages, bus stations.

Source: Gresham House Asset Management – Global Timber Outlook 2020. Timber consumption based on the UK sawmill and wood processing industry as a representative guide to commercial temperate forest Timber uses.

ESG considerations

Carbon sequestration

Trees remove carbon dioxide from the atmosphere – called carbon sequestration. Timberland investing involves afforestation, reforestation and improved forestry management which increase carbon sequestration. However, processing of timber products can release pollutants into the air and water. The preferred outcome is for the overall output to result in carbon capture, however it can be difficult to measure precisely as it is also dependent on the end use of timber. For instance, some products, such as a wooden table, lock up carbon, whereas burning the wood would release CO2 into the atmosphere.

The UK’s ambitious plans to achieve net zero by 2050, should provide additional demand for timberland, and support pricing longer term.

Another positive benefit is the cooling effect that planting trees can have. Medellin, a city in Colombia, reduced its temperature by 2°C in three years by creating green corridors.

Biodiversity and ecosystems

Repurposing of ‘natural’ forests into commercial forests and can result in loss of habitat and biodiversity. Overharvesting can lead to deforestation and impact soil quality. However, good forestry management (robust planting and harvesting techniques) can help to protect habitats at risk such as wetlands and riparian areas from degradation and destruction.

Social

Timberland investing can provide employment opportunities for local communities, both directly and indirectly through the support of related industries. However, there are cases where it can result in displacement of local communities. Land rights and relationships with local communities should be managed appropriately by good timber managers.

Governance

Well-governed timberland should involve stakeholder engagement, open communication, and adherence to environmental and social standards. Illegal logging, which can be driven by corruption and lack of government oversight, can result in significant environmental and social harm, as well as undermine the sustainability of timberland investments.

Timberland management that prioritises robust labour practices can help ensure fair treatment of workers.

Certification standards

There are certification standards such as the Forest Stewardship Council (FSC), the Programme for the Endorsement of Forest Certification (PEFC) and the Sustainable Forestry Initiative (SFI) that are dedicated to promoting sustainable forestry management and long-term forestry growth – we prefer funds that are certified.

The value of carbon capture

Some funds generate carbon credits.

Carbon credit: either permits the emission of a 1 tonne of CO₂, or gives assurance that the originating party has captured or reduced emissions by 1 tonne of CO₂.

Types of carbon credit

Regulated emissions allowances: “Certified emission reduction” (CER) credits, are verified by a regulator, required by regulated entities to emit.

“Voluntary emission reduction” (VER) credits are certificates that a company, or other entity, has undertaken an emission reduction or CO₂-capture project. These may be sold on to individuals or other companies. Investors may be eligible (depending on the fund) to do any of the following with their forest carbon credits:

- Monetise the carbon credits by allowing the manager to sell them on their behalf.

- Hold the credits for sale at a later date.

- Retire the credits for insetting purposes.

An ‘offset’ is when a company or individual buys and then retires a carbon credit offset some or all of their own carbon emissions. Controversial due to the difficulty of verifying that emissions have actually been reduced and because they may disincentivise companies from reducing their own emissions.

Compliance/certified credits pricing is more certain (California and New Zealand accept forestry) however most forestry regions use voluntary credits.

What other risks are there?

Natural risk: this includes forest fires, wind damage, weather damage, pests and disease. These natural factors are uncorrelated to financial markets, and historically the impact is typically small, from 0.1%-0.5%.

The impact of fire on timberland returns may be managed through tools and models assessing wildfire risk, considering factors like geographic concentration, forest health, and proximity to firefighting resources. Well managed forests recovering more effectively.

Timber insurance is available, however it is largely avoided due to cost considerations, with diversification and active forest management playing a key role.

Political/regulatory risk: expropriation and regulatory changes can affect returns. These risks can be mitigated by avoiding countries with weak governance and ownership rights and concentrating on well-established regions.

Reputational risk: this risk could be reduced by investing in forests (and funds) that are certified as sustainable.

Conclusion

Overall, we believe that forestry investments provide attractive returns, diversification and inflation hedging properties, while also having important positive ESG characteristics.

In the UK the PPF has been a long-term investor in forestry and the Nest pension scheme has also invested. The asset class is popular with charities, endowments and pension schemes with longer-term investment horizons.

Subscribe to our thinking

Get relevant insights, leading perspectives and event invitations delivered right to your inbox.

Get started to select your preferences.