LCP Delta are expecting significant change in forthcoming CfD auctions

Energy transition Energy consultancy Power marketsUtilising our in-house modelling expertise, we've constructed an Allocation Round 5 (AR5) Contract for Differences (CfD) auction supply curve to predict outcomes. Despite a £22million AR5 budget increase (August 3, 2022), the persistently low Administrative Strike Price (ASP) for offshore wind suggests limited successful bids. Budget constraints, pricing restrictions, and economic volatility are poised to discourage investor participation, hindering the government's 50GW offshore wind target by 2030. Additionally, offshore wind project results will determine the fate of other ventures, as those exceeding its bid threshold may struggle to secure CfD contracts.

Renewable developers find themselves facing a very different investment landscape in the UK than previous CfD (contract for differences) auction years. The era of cheap capital looks to be over as high inflation and high interest rates seem unlikely to come back down to historic levels in the short term – directly impacting the cost of renewable projects. Adding to these challenges is the effect of the US Inflation Reduction Act and the EU’s Green Deal Industrial Plan that will both increase the competition for capital globally.

It is likely that more and more investors will ask themselves whether the UK is still an attractive proposition for investment, or perhaps if there are greener pastures elsewhere.

The recent inflation, supply chain disruptions, and energy crises, have all played a part in pushing up the cost of building solar, onshore and offshore wind plants. Offshore wind in particular faces significantly higher upfront cost on procuring materials such as steel, specialist personnel to construct them in the sea, and to lay the under-sea cable to connect them. We believe that it is these cost pressures that have meant that offshore wind developers require a strike price that exceeds the Administrative Strike Price (ASP) set for the AR5.

We are nearing the bid submission window for the AR5. Last week, the government has announced an increase of £22million to the overall budget (£20million for Pot 1 and £2million for Pot 2). The aim of this budget increase is to clear more projects in the auction. However, how material is this budget increase, and more importantly how will this year’s Allocation Round play out for developers (especially for offshore wind) is uncertain.

At LCP Delta, we have analysed 500 eligible projects for AR5 and, using our in-house modelling capability, we have simulated the upcoming auction and calculated the strike price that each project will bid.

What is new in this year’s allocation round (AR5)?

This years auction will be different from previous rounds for two significant reasons:

- There have been some major changes that the Department for Energy Security and Net Zero (DESNZ) has introduced to the CfD scheme, and

- the changing global investment environment.

Major policy changes

CfD auctions are now held annually rather than biannually which offers more flexibility for developers. Developers can take the option to phase the total capacity of their project across subsequent auctions, or if they are unsuccessful, they can participate in the next auction.

Carrying out annual auctions, in contrast to 2-yearly auctions, will reduce the uncertainty of obtaining stable funding for investors and make it easier to invest in the renewables market. However, there are concerns that the change also means that the annual budget that DESNZ sets for each Allocation Round will likely be lower going forward to spread out the investment and funding requirements. This will increase competition between developers in each auction round.

Another change is that offshore wind no longer has its own funding pot, and it must now compete directly against solar and onshore wind projects. By including all three technology types in a single pot with a single budget will bring different bidding dynamics.

Offshore wind developers have expressed particular concerns that the Administrative Strike Price (ASP) for offshore wind projects is significantly lower than previous years and could drive them out of bidding in AR5. In fact, Vattenfall has called off development of the Norfolk Boreas offshore wind project due to rises in cost of up to 40%. As a likely response to these industry signals, the government has increased the budget by £22million (3rd of August 2022) but crucially not increased the ASP.

Global investment environment

Since the CfD was launched, we have seen continual falls in offshore wind prices as capex costs have decreased and finance has been cheap. However, these factors have changed substantially over the past year. Supply chain costs have increased with inflation, coupled with the action of Central Banks around the world who have reacted to inflation pressures and raised interest rates – significantly increasing costs for developers.

Due to these factors putting pressure on costs for developers, we expect the clearing prices will increase in both AR5 and AR6.

Modelling AR5 to calculate the strike price and clearing capacity

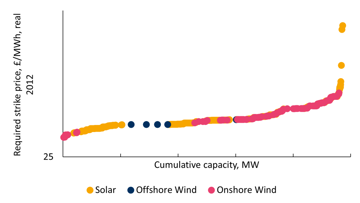

We take a bottom-up approach, at LCP Delta to modelling the CfD auction and, using our in-house modelling capability, we can calculate the strike price that each project will bid in the auction and project the auction results. This is what we observed:

1. Due to the budget this year and the combined competition with other technologies, we expect that offshore wind projects will likely struggle to win a CfD contract.

2. Offshore wind projects will have a defining impact on the likelihood of success for all other projects due to their large size on a project-by-project basis and load factor.

3. Offshore wind projects will be the king maker in this auction – with any bid above offshore wind struggling to clear the auction.

4. Increasing the budget does improve the level of capacity that is procured, by clearing an extra 10% capacity than under the original budget. However, this budget increase provides little improvement for offshore wind due to the unchanged ASP, which is lower than the required strike price needed for developers to have a financially viable project.

Supply curve constructed from LCP Delta’s CfD model.

What does this mean for CfDs in the GB market?

Offshore wind projects will struggle to clear the auction in AR5. As we have highlighted, this is due to auction budget and the ASP being too low compared to the significant rise in costs. If offshore wind projects do clear the auction, we expect it will likely take up a significant portion of the Pot 1 budget leaving little funding for any onshore wind or solar project – particularly for any bid that is above offshore wind bids. Although, the recent increase in the budget will help to alleviate this disadvantage it may not be enough. If AR5 auction struggles to clear significant amount offshore wind projects, then it jeopardises delivering UK’s target of reaching 50GWs of offshore wind by 2030.

A potential recourse for unsuccessful renewable developers is that they will no longer have to wait two more years to try again – they will get another chance the following year. However, depending on how the yearly auction clears, the parameters for the next allocation round could change significantly and perhaps not in their favour. This may act as a double-edged sword, where even though developers have another chance to participate, they may face auction parameters that are still disadvantageous to their project.

An unfavourable auction outcome, one that unfairly burdens renewable developers and fails to procure enough capacity will put UK in bad standing among global investors. The UK Government must be mindful of the increasing competition for global capital. If they want to attract investors, then they will need to increase the support available to rival the US and EU. The government has promised a response to the US and EU measures in autumn 2023 but warned investors not to expect the same scale of intervention. Whether it is enough we will have to wait and see.