What should all good post-retirement solutions include in their design?

Pensions & benefits DC trustee consulting DC pensions

The King’s speech re-enforced the importance of our industry building and supplying adequate post-retirement solutions to DC savers.

This focus is both welcome and overdue. It is a mystery to me why so much regulation and industry focus has been spent ensuring DC pension pots accrue adequately pre-retirement. However, at the point when the individual has to make one of the biggest financial decisions of their lifetime, the industry has largely left matters to private wealth houses targeting the wealthy.

Yes – it is difficult. No – we can’t provide a ‘fully default’ solution that adequately captures everyone's specific needs (health, other wealth, attitude to risk, spouse’s income etc). But we do have a duty to offer more.

This is why I think the King’s speech was particularly interesting in focusing on a solution that is ‘guided’; a clear indication that rather than individuals having to put together a collection of building blocks, there should be a pre-packaged ‘default’ solution available.

Post-retirement is also topical for providers. We are currently seeing many launching new solutions or changing them to reflect developments in their thinking in this space. This is needed, but there is a clear reward. As DC becomes the primary pension solution, providers have a vested interest in keeping those assets they have on their books beyond retirement.

As consultants, it will fall to LCP to help guide providers, Trust-based Schemes and Master Trusts in either developing solutions or selecting them. What will I be looking for those solutions to incorporate?

‘Guided’ with a ‘set and forget’ mindset

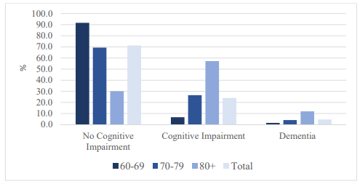

In post-retirement there is an interesting juxtaposition. The solution needs to accommodate engagement and flexibility for those that want it. It also needs to cater for members that either don’t feel confident making changes or, sadly, aren’t able to make them. c25% of 70–79-year-olds and almost 60% of those 80+ experience cognitive impairment, therefore impacting their ability to make rational financial decisions at this crucial time.

English Longitudinal study on ageing (ELSA)

In my mind this needs to be addressed in two ways:

- ‘Guided’ to reflect member needs in different stages of retirement. Members who are 66 have different needs to 90-year-olds. This should be reflected in the solution. Any strategy should be structured similar to pre-retirement solutions, with a clear ‘de-risking’ both of decision making but also investment risk.

- ‘Set and forget’ mindset – i.e. all key decisions should be taken at retirement, with an ‘opt out’ option for those who wish and are able to make changes. This could mean opting into a deferred annuity to secure later life income for example.

A defined ‘end point’ for active retirement - With a role for an annuity in later life

A post-retirement default is much harder to design because there are many unknowns. Will my housing needs change? Will I need money for healthcare or alternatively, will I remain healthy for longer? Finally (and sadly!) when will I die? Clearly any solution needs to tailor for the full distributions of outcomes. For me this solution:

- Has an ‘active’ retirement phase – income drawdown in the early phase of retirement makes sense to me. It is flexible (individuals can change drawdown amounts based on differing needs), but it can also be a prudent static amount in a ‘set and forget mindset’. It also allows for any surplus pension to be included in inheritance estates in the event of an untimely death.

- Uses annuity to cover later life needs – provides the saver with:

- a guaranteed income

- no necessity for decisions in the event of cognitive decline

- a hedge against living beyond the median life expectancy.

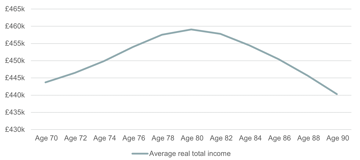

We believe the most ‘efficient’ point at which to annuitise, in order to maximise retirement income in retirement, is at c80 (as evidenced in the chart below). This is also supported by a paper produced by LCP colleagues back in September 2022 called ‘fix first, flex later’.

Average real total income throughout retirement

Chart shows average real total income at each annuitisation age, assuming the individual retires at 66 with a £100k pot, using LCP market assumptions and assumes the individual is entitled to a full state pension each year of c£11.5k.

Should the solution be nominal or real?

Broadly, members retiring around state pension age are expected to live for about 20 years. This is a long time to plan for, especially if there is no inflationary uplift. However, our analysis suggests that a solution should be designed on a nominal basis (ie without factoring in inflation). The reasons for this are:

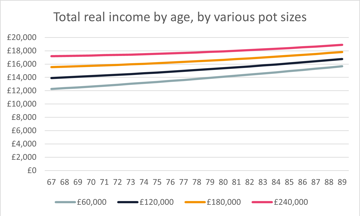

- The state pension already provides a more-than-inflationary protection on a material proportion of total pension. The current state pension keeps pace with average earnings (typically higher than inflation) and current policy applies a 2.5% underpin as part of the ‘triple lock’. Members eligible for a full state pension should therefore see a steady growth in their real living standard through retirement – even with a frozen nominal DC private pension. The chart below shows a combination of an (earnings-indexed) state pension and (level) DC income, giving a real total income over time for different pot sizes. The pot sizes are before any tax free lump sum.

Assumptions: Full new state pension (£11,500 from April 2024) per year, rising in line with average earnings. Inflation 2%, real earnings growth 1.5%.

Even the £240,000 DC pot, where the proportional contribution by the nominal DC income is c30%, supports a modestly increasing real standard of living year on year.

- Simplicity – it is much easier to understand a solution that provides, as a default, the same £ amount of income each month.

Where possible there should be some ‘advice’ element

The industry is eagerly awaiting the final position from the FCA on its advice/guidance boundary review. Post-retirement solutions are complex and any form of 'personalised guidance' that is ‘built in’, maybe in the form of personas i.e. ‘people like you did this’ would be a hugely welcome addition to any solution.

Initial screening questions

Consumer duty obligations require the product to be designed with the target audience clearly identified. This requires a reasonably detailed initial screening process to ensure individuals are indeed appropriate. Some considerations I believe should be factored in include:

- Those pension pots where the sophistication and monitoring requirements are not justified financially

- Other wealth

- Individuals experiencing cognitive decline and vulnerable customers

- Those receiving means-tested benefits in retirement who may be at risk of losing some or all of these benefits. For example, those with disabilities entitled to additional ‘premiums’ on top of their basic benefit level and private renters whose housing benefit, even with income well above state pension levels, would be detrimentally impacted by taking out a post-retirement solution.

The post-retirement solutions being developed currently tackle my ‘non-negotiables’ list in different ways. I embrace this difference – it is a recognition that the problem being addressed is complex. Over time it may be that solutions converge to a more industry-accepted solution, but at present I am encouraged that baby-steps towards offering credible post-retirement options are beginning to be made in earnest.