Pensions & benefits

Provider research and selection

Our provider research team drives LCP’s thorough and detailed knowledge of the provider market, which we pass on to you in a clear and straightforward way through our advice.

We don’t have our own products which means providers are willing to share details about their propositions and developments in an open manner.

We are able to influence the development of the provider’s offerings for the benefit of the end user - the workplace pension saver. We can give many examples where we’ve effected change for our clients and the good of the industry.

We don’t outsource this key area to third parties. Our dedicated team is 14 people strong and conducts over 5,000 hours of market research each year.

All this means we can add real value to your workplace pension offering.

We undertake ongoing research of workplace pension offerings using our research database, including the whole master trust market. Schemes and providers complete and maintain the LCP database on an ongoing basis.

LCP database key facts

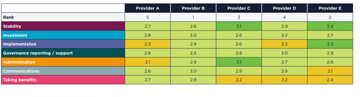

There are typically seven high-level categories we analyse solutions against.

Under each area there is a range of preferred features we look for in the detailed analysis of providers’ offerings.

We also hold regular research meetings and site visits covering investment / non-investment propositional offerings and our assessment views are updated following these meetings.

Providers are analysed against market best practice and feedback is given in terms of areas they could improve. Because we do not offer a master trust (or other pension products), providers are prepared to share details of their proposition in detail.

-

350+Question areas

-

60+Sample documents

-

7000Question updates pa

Example assessment scoring

What this means for you is that we have robust inhouse research underpinning our advice to you, saving you time and money. When we make a recommendation to you, you will understand the basis for the advice and this means full transparency and reduced risk, supporting your own stakeholder sign off processes. Let us help you get the best solutions for your workplace pension savers.

Get in touch

If you would like to know more about our services and how we can help you with pensions and benefits.