Why health is the next investment megatrend

This content is AI generated, click here to find out more about Transpose™.

For terms of use click here.

“Nothing is certain in life except death and taxes”. This quote by Benjamin D Franklin could arguably include a third element – healthcare. It is an almost certainty that at some point we will all visit a GP, stay in hospital or take medication. Healthcare is a critical sector, needing to operate and meet demand regardless of the economic context.

Despite this, it’s been somewhat overlooked by investors. Healthcare as an investment opportunity is complex, with numerous sub-sectors requiring specialist knowledge to understand growth drivers and long-term outlook. However, things are changing. This is largely thanks to advanced analytics helping investors understand where they can get the best risk adjusted returns. There is also better understanding of the long-term impact investing in healthcare could offer societal prosperity.

Investing in healthcare is not new

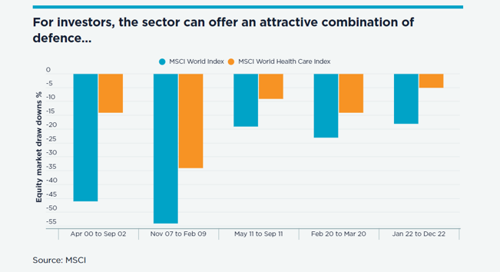

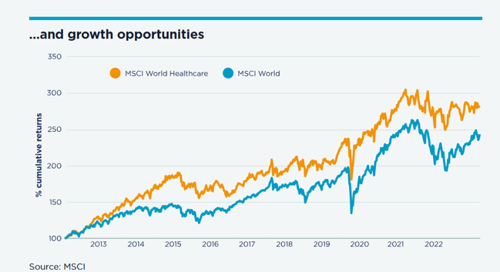

Specialist investors have been active for some time, recognising the importance that healthcare has to global GDP. The World Bank estimates that global healthcare expenditure is about 11% of global GDP. This has been increasing recently, fuelled by the growth in expenditure in population heavy middle-income countries such as China, India and Brazil. For investors, healthcare offers attractive opportunities, historically outperforming the wider market during draw downs, whilst also offering significant growth opportunities driven by innovation as well as increase in demand.

What makes up the investment healthcare sector?

Healthcare as an investment sector is made up of different opportunities, amenable to a variety of strategies. Depending on risk appetite, different sub-sectors are often more attractive to investors.

Biotech is an area where many breakthrough technologies in healthcare originate. The potential for upside is huge; in 2018, Moderna recorded the largest biotech IPO driven by their impressive pipeline. However, developing a new medicine is notoriously challenging, with less than 10% of drugs entering phase I of clinical trials ultimately making it to patients and the long-term impacts of new treatments often remain unknown.

Big pharma tends to have a steadier return profile and lower risks but even this sub-sector can be dynamic. In recent months Novo Nordisk, the manufacturer of the anti-obesity medication Wegovy and Ozempic, became the most valuable company in Europe. Demand has soared since clinical trials showed it could help patients lose weight as well as significantly reduce the risk of cardiovascular disease. With more than half the global population projected to be living with overweight or obesity within the next 12 years, current sales are only scratching the surface of growth of this market.

Growth opportunities: Demand and innovation

This dynamism speaks to underlying trends in health. Demand is increasing, largely driven by demographic shifts related to ageing populations and increased multi-morbidity. Today more and more people are living well into their 80s but often develop long-term conditions, such as diabetes, requiring complex and intensive care. This shift, combined with short-term spikes from Covid-19 backlogs is creating significant supply challenges; in the UK our NHS waiting lists currently stand at over 7 million people and is rising.

Yet advanced technologies are unlocking new opportunities for targeting and intervening on previously untreatable diseases. Precision medicine is one such area where information can now be used on a person’s genes, proteins and environment to select a treatment most suited to their disease characteristics. This is impacting cancer patients where therapies are now developed that target specific tumour cells meaning treatment becomes more effective and adverse-effects avoided.

Why invest in healthcare now?

The answer is analytics. More data are becoming available around population health; this can be translated into meaningful insights that allow investors to make better decisions. For example:

Tackling supply challenges

At LCP Health Analytics, we work with healthcare system leaders spotting capacity challenges and modelling future demand to help target resource effectively. Similarly, sovereign wealth funds with specific mandates to invest in local infrastructure and projects could benefit from analysis that helps identify where within healthcare their money is best spent and associated risks.

Optimising growth opportunities

Real-world evidence not only allows better understanding of chronic diseases but also provides granularity to understand how these diseases are impacting patients differently. This can help investors forecast trends, such as the increasing prevalence of obesity, and where they should be allocating their funding to capitalise on growing markets.

Leveraging omics data and novel methodologies to predict the effects of drug targets

Genes code for proteins, which make up most drug targets. It follows that, at a population level, naturally occurring genetic variation in the genes coding for these proteins can be used to study the effects of medicines targeting them. As genetic variants are randomly allocated, this variation can be leveraged to study the causal effects of drug targets, predicting their efficacy for certain diseases, as well as adverse effects and repurposing potential. This will enable more cost-effective clinical trials as well as biotech investors to prioritise their investment decisions.

A moral imperative too?

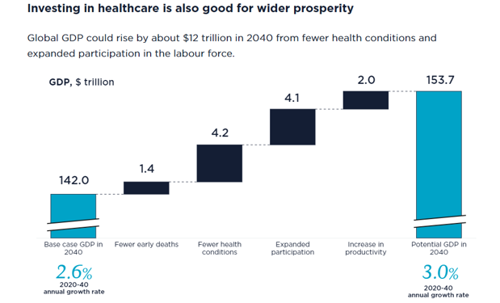

We continue to face challenges when it comes to our health; populations are living longer but less healthy lives and external threats such as future pandemics are real. Investors could, and arguably should, play a more significant role in driving better health outcomes for populations by being intentional about investing in what will make a positive difference to health. This will be good for patients and broader prosperity; research has shown that global GDP could rise by about $12 trillion in 2040 from people living with fewer health conditions coupled with expanded workforce participation and increased productivity.

Source: Prioritising health: A prescription for prosperity | McKinsey

Now is the time for all of us in the investment community to tap into this megatrend. If it’s a certainty in life that everyone will need healthcare at some point, why wouldn’t we?