Progress has been made in Demand-Side Flexibility, but urgent acceleration is needed to keep up with challenges ahead – LCP Delta & smartEn

This content is AI generated, click here to find out more about Transpose™.

For terms of use click here.

The sixth edition of the joint LCP Delta and smartEn Market Monitor for Demand Side Flexibility (DSF), released today, highlights progress in DSF but warns that market accessibility to enable a shift to smart, flexible electrification is not happening fast enough to meet future challenges.

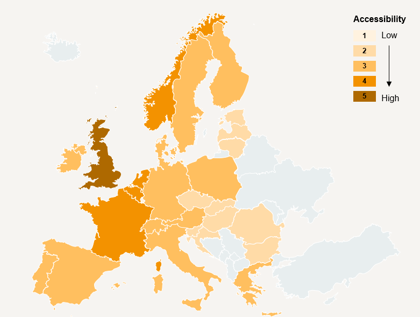

While countries like the UK and France lead in DSF among the 30 European markets analysed, there is still a growing need to maximise the participation and value of DSF assets across multiple value streams. Despite the reform of the Electricity Market Design entering into force in 2024, many of the requirements of the Electricity Regulations and Electricity Directive from the 2019 Clear Energy Package have yet to be implemented. More needs to be done to create a cost-effective and consumer-centric electricity system.

In 2024, residential assets saw a significant increase in participation in ancillary services, particularly in Sweden and France, despite existing barriers. There was also widespread adoption of wholesale reflective dynamic tariffs, encouraging greater flexibility among residential consumers. Norway and Finland led the way, with over 90% of households using day-ahead dynamic tariffs, while Sweden had a higher share of monthly variable tariffs.

While this progress is promising, more action and collaboration are needed to support consumers and the sector as a whole. The report highlights the rise of asset-specific tariffs, mainly for heat pumps and electric vehicles, which offer lower costs for customers while helping energy retailers and asset providers better manage electricity demand.

At the same time, large renewable targets—led by France, Germany, and Italy—along with a rapid increase in residential assets, particularly in Germany, are driving future DSF development. In the coming years, LCP Delta and smartEn expect more service providers to combine both implicit and explicit flexibility to create most value for customers.

Wholesale energy markets are mostly inaccessible to independent flexibility service providers, which limits their ability to profit from DSF. France and Great Britain are the only countries where residential assets can take part in these markets without needing approval from their Balance Responsible Parties (BRP).

LCP Delta and smartEn are calling for:

- Opening all markets to distributed energy resources

- Transparent price signals to help consumers manage costs

- Encouraging System Operators to buy clean, affordable flexibility sources

Today, the need for electricity system flexibility is more urgent than ever. While demand for flexibility grows with the electrification of our economy, progress has been too slow. To keep up, we need independent access for trading flexibility in wholesale markets, with better coordination between retailers and aggregators.

Jon Ferris Head of Flexibility at LCP Delta