Have you established your ultimate objective and timescales?

Pensions & benefits Strategic journey planning

We recently published LCP GEARS – our Strategic Journey Planning Frameworks which sets out how we at LCP help our clients to achieve a successful journey to their ultimate goals, capturing opportunities and managing risks effectively on the way. In this blog series we look at each step in turn, and what it means in practice.

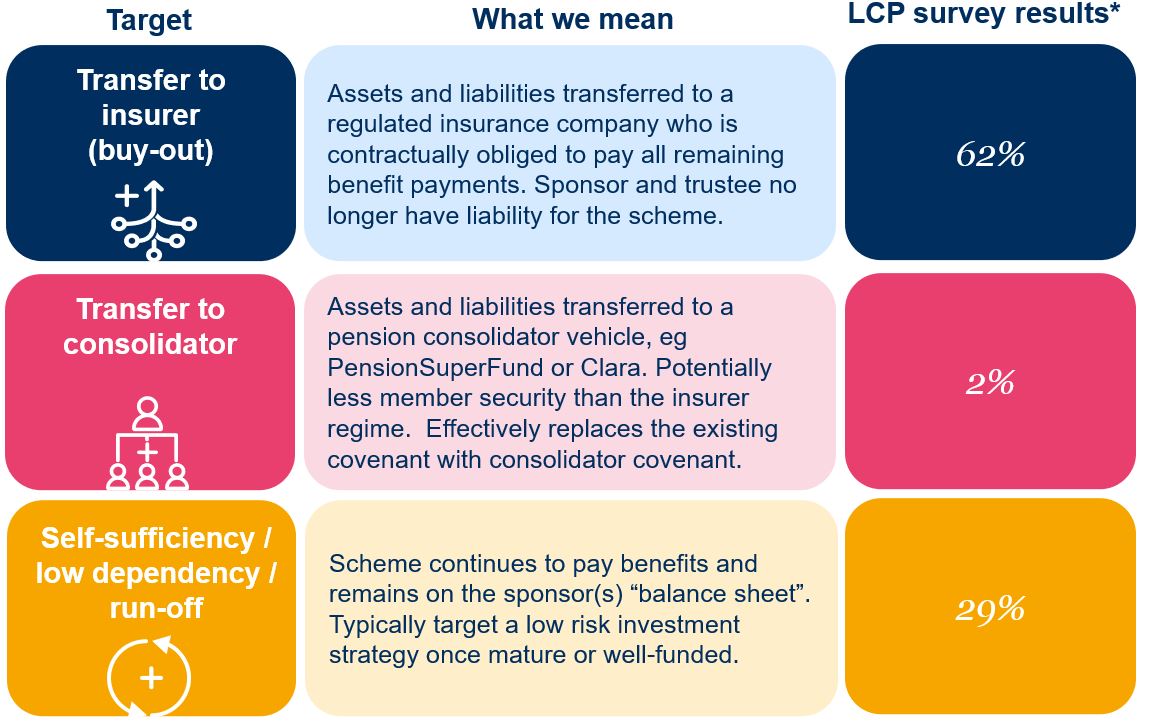

Let’s start with some jargon busting:

- Ultimate Objective: where you want to be when the job is done. Typical ultimate objectives are buy-out, self-sufficiency/run-off or consolidator (more below).

- Long Term Objective (LTO, also called low-dependency / long-term funding target): a position where you’re not expecting to rely on the scheme’s sponsor for more money, because you are fully funded on a strong basis and you don’t need to take much risk in your investment strategy. Referred to as low dependency in the recently published draft funding and investment regulations. Sometimes might be the same as your ultimate objective, or might be used as a stepping-stone to it.

- Strategic Journey Plan: a framework agreed between trustees and sponsor to turn your objectives into a reality. We sometimes hear “journey plan” used to describe the LTO only, but we think Strategic Journey Planning is much wider than this – it’s about the whole plan.

What should your ultimate objective be?

It’s important to consider the full range of options and their relative pros and cons, taking into account all relevant factors, starting of course with the strength of the sponsor covenant.

For most schemes buyout remains the gold standard. But many schemes, especially larger schemes that can achieve efficiencies of scale, target self-sufficiency and run-off. And in certain situations, superfunds / consolidators may be right for you – where buyout in the near term is not a realistic possibility. Read about the spectrum of de-risking options here, but we’ve summarised the headline three choices below. We’ve also confirmed the proportion of respondents to our recent Chart your own course survey currently aiming for each objective.

*7% of our survey respondents had not yet determined their ultimate objective.

Why consider all options, when you might have an idea on where you’d like to get to? Because it’s important to be realistic, because your constraints might have changed, and because the relative cost of different solutions isn’t static over time. The Pensions Regulator expects schemes to reach an LTO by the time the pension scheme is “significantly mature” (defined in the regulations – generally when your scheme is mostly pensioners), but covenant trumps maturity, and could drive you to seek safe harbour (potentially via an intermediate LTO) in a shorter time frame.

Residual risks are also often forgotten, with the mindset that hitting your objective is “job done” – well this might be the case if you’ve secured benefits via a transaction to an insurer or consolidator, but if the scheme remains ongoing, the sponsor is still on the hook. Risks such as climate change should be considered carefully in the context of long-term covenant strength, when making your decisions on where you are headed and timescales to get there.

You may be closer than you think

Our experience shows that once schemes allow for more realistic projections of their funding position, they may be much closer to their objective than they think.

This doesn’t just mean allowing for best estimate investment returns and any future contributions – it means allowing for other factors too. The key factors we often see being missed are member driven:

- For example, it is currently around 5% cheaper to secure pensioner members via insurance solutions than non-pensioners (because there are far fewer unknowns). For the 62% of schemes targeting buy-out, the maturing of membership will directly translate into increasingly attractive buy-out pricing over time.

- Member option terms are often set at best estimate levels, which means when members take transfers, or commute pension, or retire early, the scheme will see a gain in funding position versus a prudent LTO. These gains can be extremely significant and can drive expected timescales to the LTO much closer: for example one scheme saw their expected timeframe to buy-out shrink by more than 50%.

And if you are targeting an insurance transaction, you could find yourself even closer still: we have recently been seeing excellent insurer pricing for those schemes who have taken the right actions to get transaction ready.

All the more reason to take a closer look at your timescales, plan ahead and perhaps get started on any actions – to avoid the risk of missing opportunities to secure member benefits.

Reaching agreement

Of course, the right timescales for your scheme will likely be influenced by more than just your best guess of when they will be achievable, or when regulation expects things to happen. Sponsors and trustees could have conflicting views and objectives on the timescales and LTO, and even on the ultimate objective for the scheme.

In our experience it’s better for both sides to be upfront about their aims so they can work together to achieve them – and in most cases there are ways to square the circle, but that’s something for another blog!

It’s also important to know that what you agree now as being right for your scheme may not always play out in practice - we all know things are never quite that simple! So look out for our next blog on how to Analyse what could change your journey, to give you comfort your long-term objectives are robust and to help you establish a strategic plan to get there.

Other blogs in the LCP GEARS series:

G - Is governance a part of your journey plan?

E - Have you established your ultimate objective and timescales?

A - Analyse what could change your journey

R - Refine the steps you plan to take