Navigating the 2024 gilt yield conundrum: a tale of two markets

Investment Pensions & benefits DB pensions

As the curtain falls on 2023, a superficial glance at the UK bond market landscape might suggest it’s “déjà vu” from last year. Nominal gilt yields hold steady at 4.1%, while real yields have seen a small rise from 0.4% to 0.6%, reflecting slightly lower inflation expectations (all of these observations are at the 15 year point typically used by long-term investors like pension schemes).

However, beneath this veneer of stability lies, firstly, significant volatility in these yields over 2023, and, secondly, a very interesting distortion in the gilt yield that is something of a conundrum! I was curious about what was going on, so I’ve been putting my grey matter to work and, coupled with over 30 years’ experience of analysing long-bond yields, I have set out below my hypothesis for what I think the market is telling us.

The gilts market anomaly

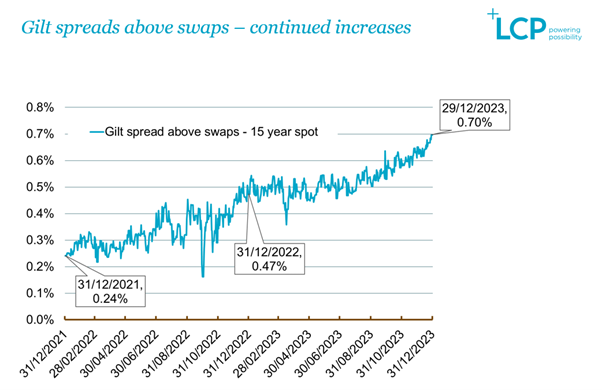

In my opinion, the peculiar current situation of the gilts market is one for the history books. The AA corporate bond spread (the extra yield you get from investing in high quality companies rather than the UK Government) is hovering at a meagre 0.4% pa - which is low by historical standards and represents a halving over 2023. At the same time, the gilt-swap spread (the yield on Government debt over the swap derivative market) has ballooned to a staggering 0.7% pa - a 50% increase over 2023 and a leap of 200% since the start of 2022. (A 'swap' here is a financial agreement where two parties exchange different types of interest payments - it's a common tool used by investors to manage interest rate risks.) The chart below sets out the incredible movement over the last two years in the gap between the gilt yield and the swap yield. Whilst not unprecedented, this trend definitely deserves further attention.

Source: LCP Analysis (2/1/2024)

Undoubtedly a number of factors are at play, in both the UK market and internationally; for example, there seems to be increasing confidence in the economic outlook as inflation may be under control and we may yet see a “soft landing” for the world economy. Some similar patterns are seen overseas too, to some extent. However, there also appears to be some “UK effect” in the numbers.

A single source of strangeness

However, in my view this isn't a case of two independent oddities but rather a single explanation can rationalise the conundrum. The crux of the matter lies in the long gilt yield – which is unusually high and discordant with both the robust swaps market and the typically more lucrative corporate bond market. My hypothesis? A plus 0.5% pa distortion, say, in long gilt yield relative to these other markets would entirely explain the current situation.

Beyond the risk of default

I accept that it’s unlikely that gilt yields are being pushed up by major market fears of a UK Government default. With a track record that’s essentially unblemished since 1672, the risk of default is essentially non-existent for UK Government bonds that are held to the end of their life (known as “redemption”). Yet, in my opinion it's the "market risk" of resale before redemption that is steering market sentiments, overshadowing the negligible default risk.

The real risk: market sentiment and pension schemes

My hypothesis here is that the market is bracing for a considerable offload of gilts by their principal holders – UK pension schemes and the Bank of England. The anticipated sell-off would naturally drive down gilt prices and hence elevate yields, potentially accounting for the observed circa 0.5% pa discrepancy relative to other markets.

Rethinking the 'risk-free' rate

For investors and pension schemes with a strategy to hold their gilt portfolio to maturity, the gilt yield arguably remains a reliable indicator of the 'risk-free' rate that they can expect to receive. However, the billion-pound question remains: Will pension schemes stay the course to redemption? If market sentiment indicates a shift, the gilt yield's reputation in the pensions industry as the de facto benchmark for the long-term 'risk-free' rate could well be due for a reassessment.

As we step into the new year, it's clear that, while the UK Government's commitment to honouring gilt coupons is not in question, the market participants' commitment to holding these instruments might well be. It's a pivotal moment for pension schemes to take stock – the gilt yield indicator is more than just a number; it's a narrative of market anticipation and pension strategy stability.

Let's stay curious and interpret what the market is telling us with deeper insight than simply taking the year-end numbers for granted.