PRA sets out specific details of further divergence from EU rules

On 29 June 2023 the PRA published CP12/23, which sets out significant proposed reforms to the Solvency II regime as it will apply in the UK. The consultation paper, which is open to industry responses over the summer, gives the clearest indication yet of how Solvency UK will operate, and how it will diverge from EU rules. The PRA expects to transition to the new regime on 31 December 2024.

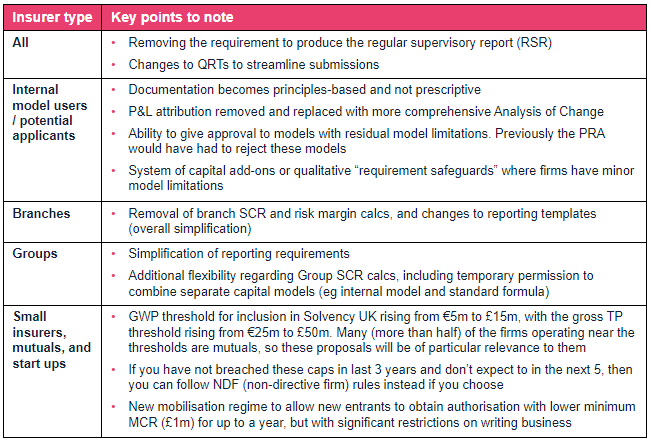

Key points: This paper summarises the key points for general insurers to consider from the consultation. We have not covered every change (eg we have not commented on administrative changes, or TMTP rules that are only relevant to life insurers). To some extent, the focus areas will differ by “type” of general insurance (GI) firm. The table below sets out the key considerations for a range of GI firms.

Internal model changes

Non-binary model approvals

The PRA wants to remove the cliff-edge where previously models were either only approved or rejected. This meant insurers spent disproportionate resources addressing non-material limitations. The new approach will be principles-based, and allow the PRA to approve sound models even if they have residual limitations, provided appropriate safeguards are in place. These may include capital add-ons; or restrictions on model use or on the business the firm can write.

Principles-based documentation

The current model documentation rules are very prescriptive, with specific requirements that are set out in legislation (eg around data directories and data appropriateness). The PRA wants to move to a principles-based approach, with detailed guidelines to be set out in a future policy statement. These changes will give firms more flexibility in documenting internal models, allowing for more focus on the key areas.

P&L attribution removed and replaced with Analysis of Change

The PRA wants to drop P&L attribution, requiring insurers to instead submit a new template with supporting narrative with a more detailed Analysis of Change (AoC). This template will be relatively flexible, allowing insurers to provide AoC results in the manner they find most useful. Most insurers already produce detailed AoCs, so this change is effectively a simplification.

More flexibility for group internal models

The PRA plans to introduce more flexibility into Group models including;

- Allowing groups to (temporarily – for up to 2 years) calculate consolidated SCRs by adding up solo SCRs calculated using different approaches (eg internal model + standard formula).

- Extending the “method 2” group calculation rules to apply to overseas sub-groups under specific conditions.

The PRA expects this additional flexibility to simplify consolidated group calculations, and make the UK a more attractive regime for insurance groups.

Threshold changes

The PRA wants to significantly raise the thresholds at which Solvency UK becomes mandatory:

- GWP threshold: from €5m to £15m.

- Gross TP threshold: from €25m to £50m.

Firms can de-scope and follow the PRA’s non-directive rules if they:

- have not exceeded the threshold in the past 3 years, and

- do not expect to in the next 5 years.

New mobilisation regime

The PRA plans to introduce a discretionary mobilisation regime to help new firms establish themselves without meeting the PRA’s usual minimum requirements.

- Mobilisation will last up to 12 months with a £1m minimum MCR floor during the period.

- Aimed at firms nearly fulfilling regulatory requirements (eg just needing to appoint senior managers, raise capital etc).

- Firms would have significant restrictions on writing business. In practice the PRA does not expect firms to write a material amount of business whilst in mobilisation.

- After a year, firms will either join the main regime if they meet the regulatory requirements, or exit the market.

Simplification of reporting requirements

Regular supervisory reports scrapped

The PRA intends to remove the requirement for firms to produce RSRs. This will benefit all firms.

Branch reporting streamlined

The PRA plans to remove redundant reporting requirements linked to branch SCRs, risk margins and asset localisation. This is a significant reduction with 20+ templates being dropped. Instead, branches will provide a 3-yearly report on their parent’s resolution plans. Branches previously submitted this via the RSR.

Group SCR calculation streamlined

The PRA intends to move to a single template for group SCR reporting. Currently there are three, depending on the calculation method. These changes would also capture the additional internal model flexibility that the PRA intends to grant groups.

QRT in-template changes

The PRA is making changes to a range of other QRTs to simplify its own data ingestion, and to align with other proposed regulatory changes. Insurers will need to ensure that their submission processes are adapted to cover the new forms.

Third-country branch requirements

The PRA wants to scrap branch SCRs, and the consequent localisation requirements, and risk margins. This reflects the fact that branches cannot fail independently and is a significant streamlining of requirements. More emphasis will be placed on the initial approval process and on monitoring / reporting and disclosures from parent entities.

Our perspective

The PRA has set out some sensible proposals to streamline the Solvency UK regime and take advantage of its freedom to flex the rules to work better within a UK environment, and in particular to avoid duplication of governance in areas that are already subject to routine PRA supervision. The simplifications are proportionate and should ease regulatory burdens for insurers in key areas and maintain a similar level of policyholder protection. They should also maintain broad equivalence with the EU’s Solvency II rules, minimising transitional costs or dual‐regulatory costs for firms that also have an EU presence.

Particular positives

- Principles-based documentation: We welcome the move to make model documentation principles-based, allowing firms more leeway to produce internal model documentation in a form most useful for them.

- IMAP simplification: Similarly, we welcome changes to the internal model approval process. These should allow firms to obtain permission to use new models (or to make major changes) more efficiently. In particular, we think they will help avoid protracted wrangling over non-material aspects of compliance, particularly where firms have demonstrated that the model is, overall, a good representation of the risk profile despite having minor limitations.

- Flexibility for new and smaller firms: Finally, we support the PRA’s objective of reducing the regulatory burden on new and smaller insurers. The new mobilisation regime and raising of thresholds at which Solvency UK compliance becomes mandatory should help deliver this objective.

Other comments

- Reporting requirements: Many of the simplifications around reporting relate to groups or branches. We would have liked the PRA to have gone further in considering reductions in reporting requirements for smaller insurers, whilst noting that these firms can already apply for waivers to reduce the frequency of reporting.

- Mobilisation regime: We welcome the PRA’s efforts to make the market more accessible to new entrants. However, the 1‐year mobilisation period may be too short for many start-ups to take advantage of, and material restrictions around issuing business during this period may make this mobilisation route unappealing to new firms.

Please note that this paper is a summary of the changes we expect to be of most immediate interest to general insurers, rather than an exhaustive list of all the proposed changes. For further details, please see the underlying document: CP12/23.