Executing a successful transaction

Pensions & benefits Pension risk transfer Strategic journey planning

We recently published LCP Gears – our Strategic Journey Planning Framework which sets out how we at LCP help our clients to achieve a successful journey to their ultimate goals, capturing opportunities and managing risks effectively on the way. In this blog series we look at each step in turn, and what it means in practice.

In this edition, Ruth Ward shares her thoughts on step 6: Transact successfully at the right time.

I pick up today where my colleagues, Chris Potts and Stephan Kemp, left off – having successfully implemented the LCP GEARS framework and steered your journey dynamically through the challenges and opportunities of the last few years, your strategic end-goal is at last in sight! Whether it’s been an arduous climb with many bumps in the road, or a helter-skelter descent to arrive at (or even shoot past) your destination as yields have risen sharply, it’s time to switch your focus to executing a successful transaction without letting your current position slip away.

My blog is aimed at schemes targeting full insurance (i.e. a bulk annuity ‘buy in’) followed, at the right time, by buy-out and scheme wind-up. Similar considerations will apply for other third-party solutions (eg transfers to DB superfunds). If your strategic end-goal is run-off, then your priorities instead will be around robust internal governance and risk management of your scheme over the long-term – my colleague, Andy Linz, has shared his thoughts on building a strategy for long-term run-off here.

So, how to successfully transact a buy-in? Those of you who have done your homework will be well aware that, despite a competitive and well-functioning bulk annuity marketplace, demand from defined benefit schemes over the next 2-3 years is set to severely test insurers’ appetites and operational capacity. In practice this means you need to work harder than ever to get strong insurer engagement and secure the deal that is right for you.

How do I stand out to insurers in a record-busy marketplace?

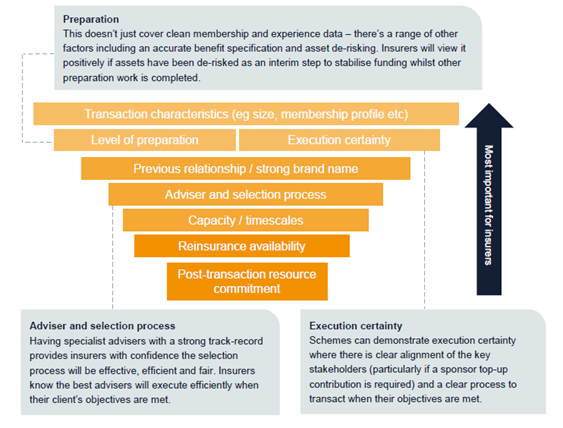

In my ‘beat the triage’ article I encourage you to put yourself in an insurer’s shoes when deciding how to make the strongest case for insurers to quote for your scheme, and to make sure you will be positively assessed on the following important ‘triage’ criteria:

- How likely is this deal to transact?

- How likely am I (the insurer) to win this deal?

- How much work will this deal involve?

In practice there are many factors that insurers will consider when answering the above questions during triage, ranked by them in our recent (H2 2022) survey as follows. Read more practical hints and tips from our longevity de-risking team on how to score well against these three triage criteria.

How do I make sure I’m getting the price and terms I want?

Depth and breadth of adviser experience are essential here. Your adviser needs to fully understand the market and the art of the possible (for different deal types/sizes), have strong relationships with all relevant insurance counterparties and, ideally, recent experience from other similar transactions that you can benefit from. A full scheme buy-in (or even a series of phased buy-ins) is the biggest investment decision your scheme will ever take, and it’s usual to bring in specialist de-risking advisers (both broking and, sometimes, legal) for such a large and important project.

Your de-risking adviser will help you:

- Establish a clear set of deal criteria and an effective governance structure to enable efficient decision making

- Carefully design a broking process to maximise insurer engagement and best achieve your objectives – this will vary considerably by deal and in response to market conditions

- Articulate clearly upfront to insurers the terms you are seeking and, where appropriate, a price target – different advisers have quite different approaches here, with our preference being to set out a comprehensive set of requested best practice and scheme-specific contractual terms (the former already reflected in pre-agreed enhanced contracts for smaller, streamlined cases we advise)

- Weigh up the merits of introducing additional requirements for larger deals – e.g. surrender rights, collateral, residual risks cover – and the best approach to negotiating these

- Review your scheme member data and advise on quick wins to improve quality and/or source missing items (i.e. where insurers would otherwise make prudent pricing assumptions)

- Ensure you have clearly set out the scheme benefits and taken advice on the approach insurers should take on discretions

- Work through any scheme-specific issues, e.g. illiquid asset holdings, to find a solution that works for you.

How do I avoid pitfalls and manage a smooth transaction?

Preparation and careful planning are essential. Don’t get caught out by:

- Your funding position slipping away from you – take advice early on repositioning your investments (if necessary) into a ‘buy-in ready’ strategy

- A key stakeholder raising a material concern late in the day – trustees should engage early with the scheme sponsor (or vice versa), understand and agree the proposed transaction, set up an effective governance and decision-making structure (e.g. joint working group) and work through corporate accounting impacts at an early stage

- Late discovery of data or benefit issues, requiring material repricing or rendering a deal unaffordable – a legal review of the scheme benefit specification and interrogation of critical member data before approaching the market can avoid nasty surprises (e.g. unclosed Barber windows!)

Of course, even with the best laid plans, unexpected issues can arise – as before, having an experienced de-risking adviser in place will ensure a solution can be found with minimum fuss and loss of insurer engagement to keep your transaction on track.

In conclusion

Transacting successfully at the right time requires careful planning, clear deal criteria, good governance and process, and a strong case to put to the insurers, all supported by expert advisers who can help you successfully avoid potholes, gear slippage and burst tyres! So, buckle on your helmet and realise the adventure you’ve been striving so long for.

Our next blog takes you through the final miles of completing wind-up efficiently.

Other blogs in the LCP GEARS series:

G - Is governance a part of your journey plan?

E - Have you established your ultimate objective and timescales?

A - Analyse what could change your journey